Introduction

Jet fuel is a crucial component of the aviation industry, powering aircraft engines and enabling air travel. However, the industry is experiencing a transformative shift with the emergence of sustainable aviation fuel (SAF). SAF is derived from renewable resources like used cooking oils and animal fat waste, setting it apart from conventional jet fuel sourced from crude oil.

Delta Air Lines, a pioneer in aviation innovation, has committed to replacing 10% of its jet fuel with SAF by 2030 and reducing fuel consumption year over year. This practical and available solution is compatible with existing aircraft engines and fuel infrastructure, paving the way for a greener future in aviation. LanzaJet's ethanol-to-SAF production plant and the joint venture between Virgin Atlantic and Delta Air Lines further demonstrate the industry's dedication to decarbonization.

With the aviation sector aiming for net-zero carbon emissions by 2050, SAF plays a pivotal role in achieving this goal. As the industry explores new horizons of sustainability, education and awareness are key to advancing the use of SAF. With only 0.1% of flights currently powered by SAF, it is crucial for industry leaders and consumers to understand its benefits and potential.

Through continued investment, innovation, and collaboration, the aviation industry is steadily navigating towards a greener, more sustainable future.

What is Airplane Fuel and Its Importance

Jet fuel is integral to the aviation industry, providing the necessary power for aircraft engines. Beyond its traditional form, the industry is witnessing a transformative era with the advent of sustainable aviation fuel (SAF). SAF is derived from renewable resources such as used cooking oils and animal fat waste, distinguishing itself from conventional jet fuel which is based on crude oil.

Delta Air Lines, a trailblazer in aviation innovation, has committed to replacing 10% of its annual 4 billion gallons of jet fuel with SAF by 2030. Additionally, Delta aims to reduce its fuel consumption by 10 million gallons year over year through the end of the decade. Saf's compatibility with existing aircraft engines and fuel infrastructure makes it a practical and available 'drop-in' solution.

In a landmark event, LanzaJet inaugurated the world's first ethanol-to-SAF production plant, pioneering a new direction for decarbonized aviation. This achievement signifies a major step towards the aviation industry's goal of net-zero carbon emissions. Virgin Atlantic, another prominent airline, has been recognized for its customer service and innovation.

It is part of a transatlantic joint venture with Delta Air Lines, offering extensive connectivity and championing eco-friendly initiatives.

The industry's shift towards SAF is imperative as it accounts for approximately 90% of its carbon emissions. Despite the challenges, the aviation sector remains committed to a net-zero future by 2050, with SAF playing a pivotal role. Last year, a transatlantic flight successfully operated on a blend of fat and sugar-based fuel, offering a glimpse into the future of air travel powered by alternative, renewable energy sources.

As the sector explores new horizons of fuel efficiency and sustainability, it is evident that education and awareness are key to advancing the use of SAF. With only 0.1% of flights currently powered by SAF, it is crucial for industry leaders and consumers alike to understand its benefits and potential. Through continued investment, innovation, and collaboration, the aviation industry is steadily navigating towards a greener, more sustainable future.

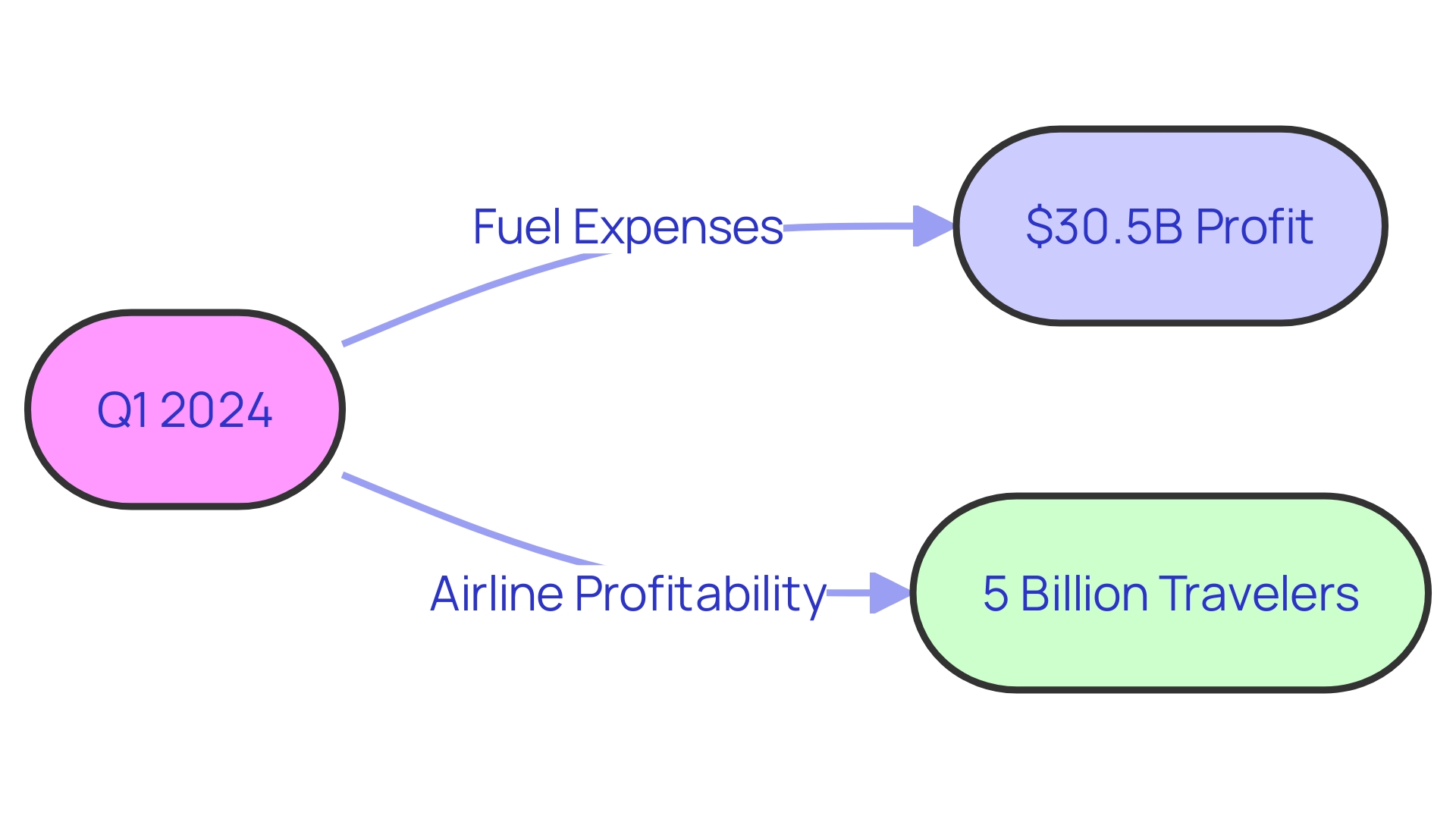

Impact of Airplane Fuel Prices on Airlines

Airline operations are inextricably linked to the costs of aviation fuel, with these expenses often being one of the heftiest line items on the balance sheet. The precarious dance between fuel expenses and airline profitability is a familiar one; the slightest surge in per-gallon prices can quickly erode profit margins. Given the volatile nature of oil markets, the airline industry remains particularly susceptible to shifts in oil production and pricing.

A notable example occurred in the wake of production adjustments by key oil-producing nations, which sent oil prices climbing towards the $100 mark per barrel. This uptick poses a direct challenge to airlines, as the competition for oil intensifies amidst a global economy poised to grow by 2.9% in 2023. With the United States consuming around 20 million barrels daily, and the top ten oil-consuming countries vying for over 73% of global production, the impact of the market dynamics on airlines is both immediate and significant.

These trends underscore the critical nature of astute fuel price management for airlines to safeguard their competitive edge.

Factors Influencing Airplane Fuel Prices

The cost of airplane fuel is a complex interplay of global factors, with crude oil prices being the most significant driver. This vital component of airplane fuel, derived through refining processes, is susceptible to volatility due to geopolitical events, supply-demand imbalances, and market speculation. For instance, recent production cuts by major oil-producing nations like Saudi Arabia and Russia, nearly three million barrels per day, have had a material impact, pushing the likelihood of oil reaching $100 a barrel.

These cuts influence the West Texas Intermediate Crude (WTIC), a key benchmark for U.S. oil prices, and consequently, the NYSE Arca Airline Index (XAL), which tracks the airline industry's performance.

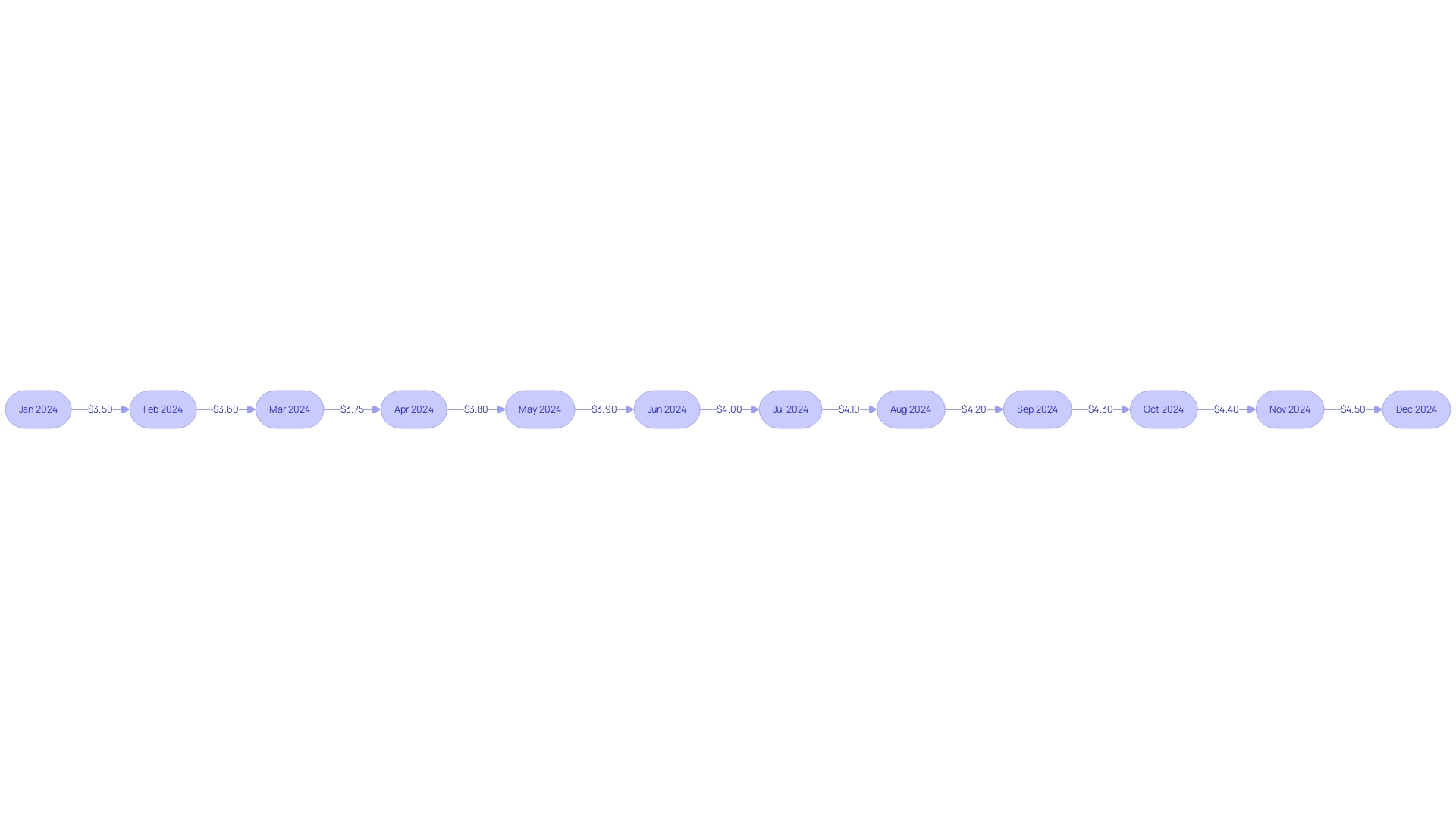

Fluctuations in oil prices are felt across various sectors, as seen with airline companies experiencing shifting fuel costs. During the first half of the year, airlines such as JetBlue and Southwest reaped the benefits of lower fuel expenses. However, costs have been climbing; Brent International and West Texas Intermediate saw significant price increases following extended production cuts and export reductions by Saudi Arabia and Russia.

These changes underscore the sensitivity of airplane fuel prices to underlying oil market trends.

Refining costs, taxes, transportation expenses, and regional market dynamics also play a role in determining airplane fuel costs. Refineries, for instance, may face operational challenges such as extreme temperatures or hurricanes that can reduce their capacity, further influencing fuel availability and prices. Weather-related disruptions demonstrate that even localized conditions can have broader implications for fuel costs in the air travel industry.

Overall, the cost of airplane fuel is tied to the ever-changing landscape of the oil market, with numerous factors contributing to its price per gallon. Understanding these elements is crucial for stakeholders who navigate the intricacies of fuel procurement and management within the airline industry.

Analyzing Airplane Fuel Costs and Prices per Gallon

Airlines are constantly navigating the complexities of fuel costs, which are influenced by a myriad of factors, including oil production levels and global economic activities. Recent production cuts by major oil producers, such as the 300,000 barrels per day reduction by Russia and additional OPEC+ reductions, have led to a significant 25% increase in oil prices since June. This surge has pushed Brent International up to $90.04 per barrel, while West Texas Intermediate futures have reached $86.69 per barrel, highlighting the material impact these changes have on the airline industry.

Given the sensitivity of airlines to oil price fluctuations, operators are leveraging advanced fuel management systems not only to monitor fuel usage but also to evaluate and enhance fuel efficiency. Through a careful analysis of historical data and market forecasts, airlines can devise strategies to soften the blow of these volatile prices.

The broader economic context is equally important, as the global economy is projected to grow by 2.9% in 2023, escalating the demand for oil. With the top ten oil-consuming countries vying for over 73% of the global oil output, the competition for this resource is intense. Coupled with the rise in travel demand, as evidenced by the record revenue performance during the Labor Day weekend, airlines are under pressure to optimize their operations.

This optimization includes not only cost management but also exploring sustainable fuel options. For instance, Airbus aims to make its fleet 100% sustainable aviation fuel (SAF) capable by 2030, and Emirates' recent SAF demonstration flight, powered by Engine Alliance, underscores the industry's commitment to sustainability.

Amid these challenges, Virgin Atlantic's continuous growth and the launch of new routes to the US signify the adaptability and resilience of airlines. The balance between managing operational expenses, such as aircraft efficiency and route planning, and the pursuit of innovative solutions like SAF, is essential for airlines to maintain their competitiveness and contribute to a more sustainable future for aviation.

Conclusion

The aviation industry is undergoing a transformative shift with the emergence of sustainable aviation fuel (SAF). Delta Air Lines has committed to replacing 10% of its jet fuel with SAF by 2030, setting an example for the industry. SAF's compatibility with existing infrastructure makes it a practical solution for a greener future in aviation.

LanzaJet's ethanol-to-SAF production plant and the joint venture between Virgin Atlantic and Delta Air Lines demonstrate the industry's dedication to decarbonization. SAF plays a pivotal role in achieving the sector's goal of net-zero carbon emissions by 2050. However, education and awareness are crucial, as only 0.1% of flights currently use SAF.

The cost of airplane fuel is influenced by various factors, primarily driven by crude oil prices. Understanding these elements is crucial for stakeholders in the airline industry to navigate fuel procurement and management.

Airlines are constantly managing the complexities of fuel costs, affected by oil production levels and global economic activities. To mitigate fluctuations, airlines leverage advanced fuel management systems and explore sustainable fuel options to enhance efficiency and reduce costs.

Airlines must balance cost management with pursuing innovative solutions like SAF. By optimizing operational expenses and embracing sustainable fuel options, airlines can contribute to a more sustainable future for aviation.

Through continued investment, innovation, and collaboration, the aviation industry is steadily navigating towards a greener, more sustainable future. Education and awareness are key to driving the widespread adoption of SAF. As the sector explores new horizons of fuel efficiency and sustainability, the aviation industry is poised to achieve its goal of net-zero carbon emissions by 2050.