Introduction

The rising interest in Sustainable Aviation Fuel (SAF) stems from its potential to significantly reduce carbon emissions compared to traditional jet fuel. However, the economic implications of SAF production require thorough examination.

This article dives into the costs and availability of feedstocks, conversion technologies, economies of scale, and the impact of policy support and incentives on the economic feasibility of SAF production. With a focus on technical insights and analysis, this article provides a comprehensive overview of the factors influencing the cost dynamics of SAF and its potential to revolutionize the aviation industry's decarbonization efforts.

Understanding Sustainable Aviation Fuel (SAF) Costs

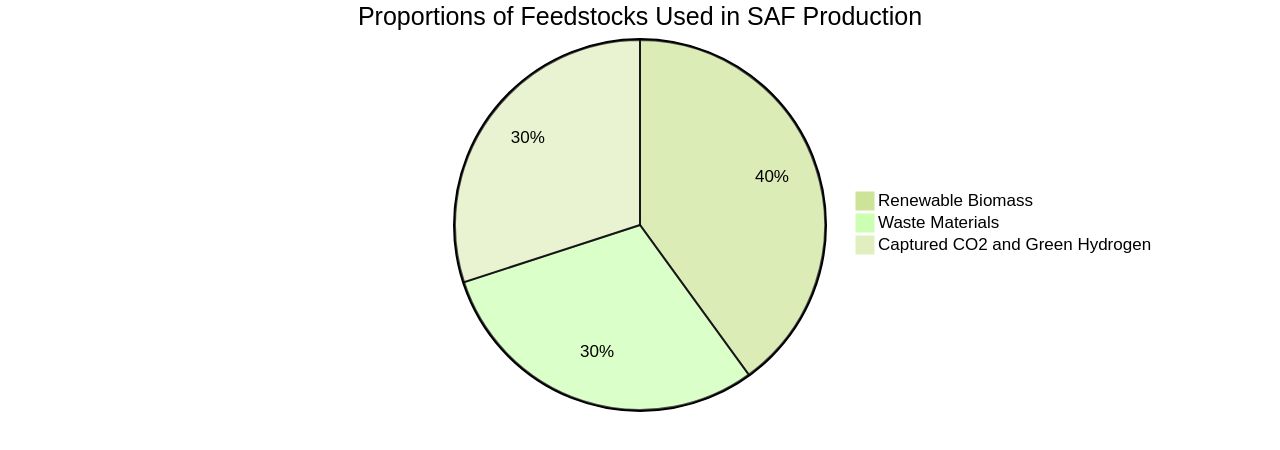

The rising interest in Sustainable Aviation Fuel (SAF) is largely attributed to its potential to significantly mitigate carbon emissions compared to traditional jet fuel. Nonetheless, the economic implications of SAF production warrant thorough inspection. SAF can be produced from a variety of feedstocks including renewable biomass, waste materials, or captured carbon dioxide and green hydrogen.

Regardless of the source, Saf's lifecycle greenhouse gas emissions are markedly lower than conventional jet fuel, due to the carbon sequestration during feedstock growth or the utilization of waste that would otherwise contribute to atmospheric CO2. Despite the technological maturity of most SAF production techniques, the supply is still lacking, primarily due to the capital-intensive nature of the sector. The high costs of SAF, presently 3 to 4 times that of conventional jet fuel, are due to the technology being in its early stages and the challenges associated with mass production.

Overcoming these obstacles necessitates a unified effort from all industry stakeholders. The aviation industry, responsible for 7% of US transportation emissions, is among the fastest-growing contributors to greenhouse gases. Considering commercial aircraft have an operational lifespan of 20 to 30 years, decarbonization through improvements in aircraft design or electrification will be a lengthy process.

Consequently, SAF emerges as a feasible mid-century solution for decarbonizing the sector, particularly in light of the International Civil Aviation Organization's objective for the industry to reach net-zero carbon emissions by 2050. However, to genuinely impact aviation's overall carbon emissions, the extent of SAF production needs to be significantly amplified. This necessitates substantial investments and favorable regulatory frameworks, achievable only with the collective commitment from industry stakeholders and government entities.

In this context, flexiforming technology offered by Unifuel.tech allows operators to dictate their decarbonization pace. This technology can be implemented in an idle hydrotreater or reformer, reducing both capital expenditure and carbon intensity. To optimize flexiforming application, Unifuel.

Tech requires details about the operator's feeds, target products, and existing facilities. They commit to responding within 24 hours after receiving the necessary information. Unifuel.tech, a subset of Universal Fuel Technologies, is a potential game-changer in this field.

Feedstock Costs and Availability

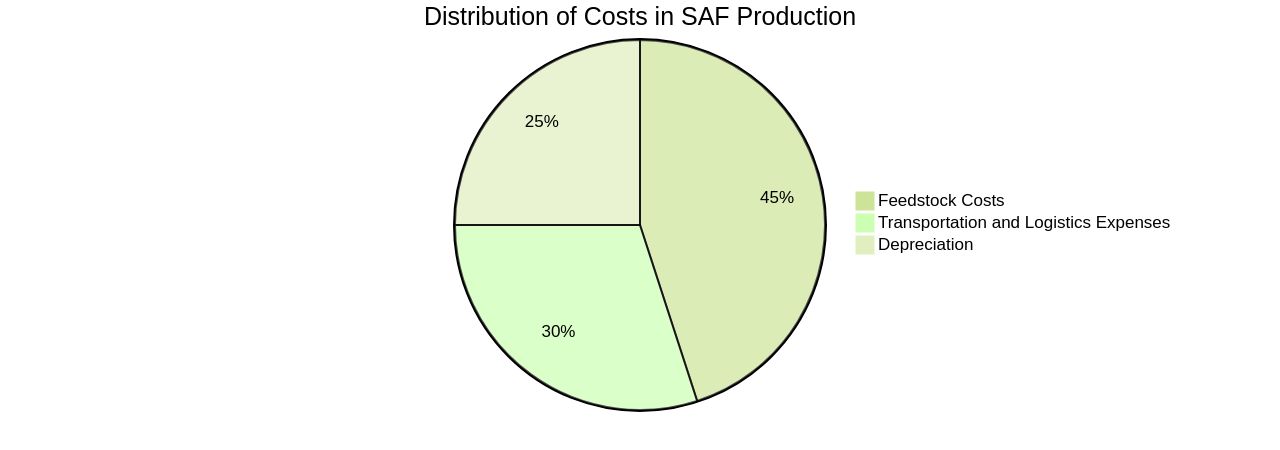

The economic viability of Sustainable Aviation Fuel (SAF) production hinges on multiple factors including feedstock costs, such as those associated with renewable naphtha, used cooking oil, agricultural residues, and algae. Moreover, it also encompasses the expenses related to feedstock transportation and logistics.

In a biorefinery context, depreciation, a time-dependent operating cost, is a notable factor in the operational expenditure, influencing the overall economics of SAF production. The surge in SAF demand, propelled by the aviation industry's emissions reduction commitments, paves the way for large-scale production.

However, this scales up the challenges, especially in capital-intensive sectors. This growth is mirrored in Sweden's planned annual SAF output of 80,000 tons, anticipated to cater to approximately 20% of the nation's SAF requirements by 2030.

Yet, the high cost of SAF, up to five times that of conventional jet fuel, remains a concern. External factors like global and governmental regulations and customer behavior, which are beyond the control of fuel producers, also affect the industry.

Despite these obstacles, the SAF sector persists in expanding, as evidenced by companies like Singapore Airlines investing in 1,000 tonnes of SAF. Innovative solutions like Unifuel.tech's Flexiforming offer a path forward. This product provides the flexibility for operators to determine their decarbonization pace. It can be integrated into an idle hydrotreater or reformer, thereby reducing capital expenditure and carbon intensity. The company's swift response time and data-driven approach to finding optimal Flexiforming applications further contribute to the economic feasibility of SAF production. Therefore, a thorough understanding of feedstock and production process costs, and the impact of external factors is crucial for the economic viability of SAF production.

Conversion Technologies and Process Efficiency

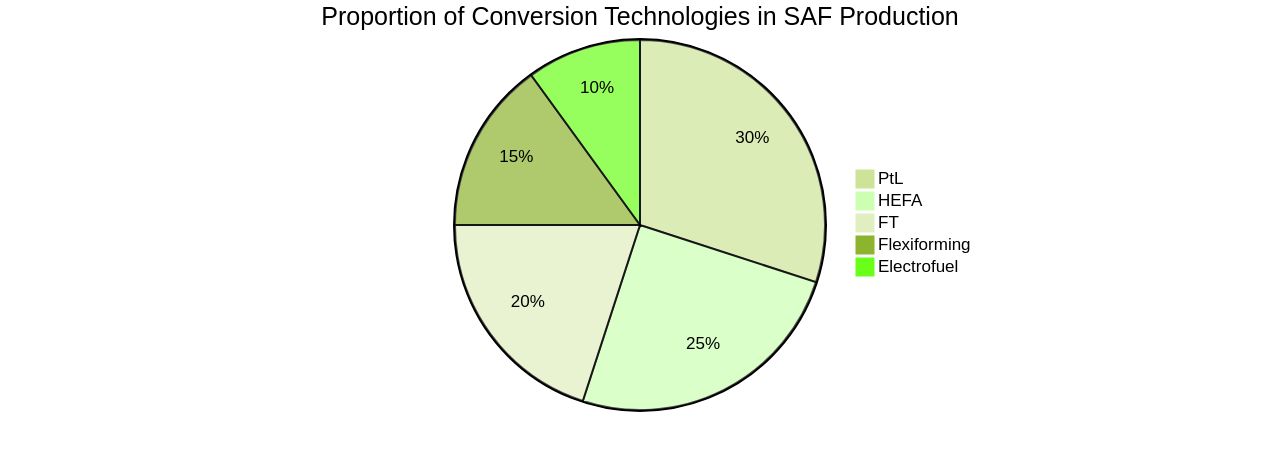

The choice of conversion technology and process efficiency are critical in determining the cost of Sustainable Aviation Fuel (SAF) production. Various pathways, such as Hydroprocessed Esters and Fatty Acids (HEFA) and Fischer-Tropsch (FT) processes, each come with their own set of capital and operating expenses. The efficiency of these processes in converting feedstock into SAF can influence the overall cost per gallon of fuel produced.

However, a promising solution emerges from Unifuel.tech, a company offering a technology called flexiforming. This innovative technology allows operators to select their decarbonization pace and can be installed in an idle hydrotreater or reformer. This results in reduced capital expenditure and carbon intensity, presenting a potentially cost-effective and environmentally friendly alternative for SAF production.

Moreover, the Power-to-Liquid (PtL) and electrofuel processes, both classified as SAF, offer significant CO2 emission savings. PtL, though still in its infancy, offers CO2 emission savings of 89 to 94%, while electrofuel uses fossil-free electricity, water, and recycled carbon dioxide. However, large-scale production challenges persist, and the exact reduction percentage for the electrofuel process remains undefined.

To escalate SAF production and overcome these hurdles, it is crucial to conduct a comprehensive economic analysis of these conversion technologies. This will provide a better understanding of the cost dynamics of SAF. The integration of technologies like flexiforming from Unifuel.tech could be pivotal in this regard, offering economic viability and environmental sustainability in SAF production.

Economies of Scale and Production Volume

The magnitude of production significantly influences the cost-effectiveness of Sustainable Aviation Fuel (SAF). As with other industries, SAF production can reap the benefits of economies of scale, which result in reduced costs per fuel unit produced.

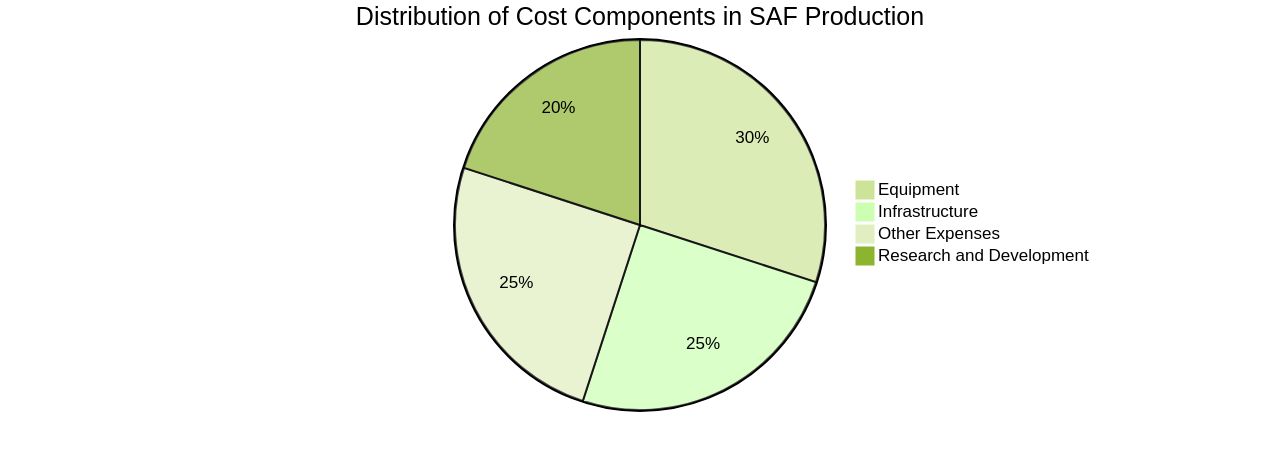

As the volume of production escalates, the fixed costs related to infrastructure, equipment, and research and development are distributed over a larger output, leading to cost reductions. The understanding of this interplay between production volume and cost is crucial in assessing the economic feasibility of SAF production.

The aviation industry, which accounts for 2-3% of global CO2 emissions, views SAF as a key tool for decarbonisation. However, the technology is still nascent and expensive.

The International Civil Aviation Organization aims for the industry to achieve net zero carbon emissions by 2050. SAF's annual planned output of 80,000 tons is roughly 5% of Sweden's current total jet fuel demand and 20% of its SAF requirement in 2030. The use of electrofuel in aircraft, also known as synthetic aviation fuel, results in a significant reduction in carbon dioxide emissions compared to fossil fuel. However, there is currently no exact reduction percentage available. This underlines the importance of understanding the economic aspects of biofuel production at a macroeconomic level, which includes employment, increasing industry production, additional overflow of funds to agriculture, contribution to the development of rural areas, increasing the reserves of foreign currencies, and reducing the dependence of energy parameters on external factors.

Policy Support and Incentives

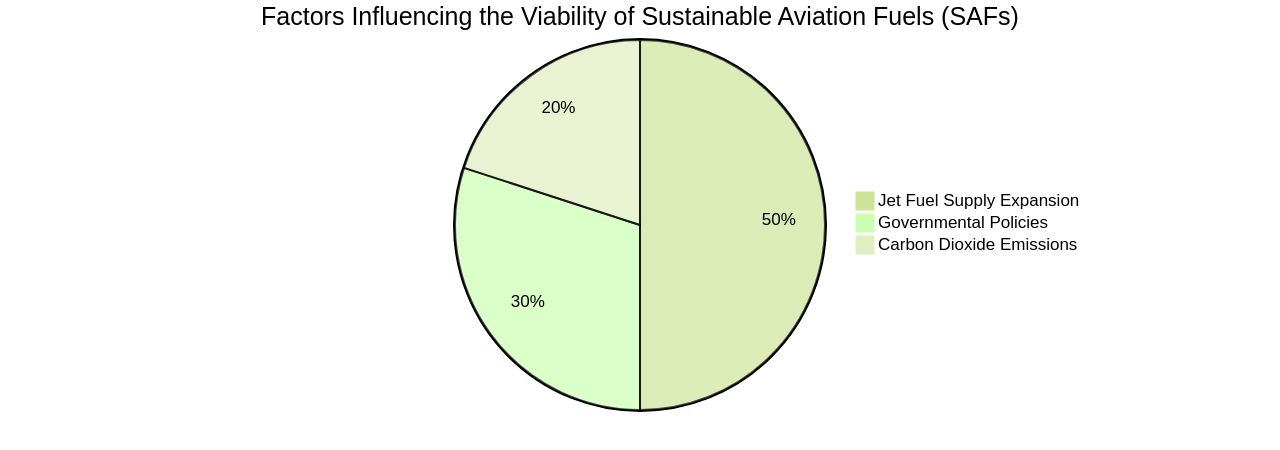

The economic viability of Sustainable Aviation Fuels (SAFs) is significantly influenced by governmental policies, including tax incentives, grants, subsidies, and renewable fuel standards. As SAFs are considered the primary tool for decarbonizing the aviation industry, which contributes 2-3% of global CO2 emissions, these policies are crucial in fostering the development and production of SAFs.

Legislation like the Financing Our Energy Future Act, which extends Master Limited Partnerships to renewable energy projects, provides clean energy sources, including Safe, with access to more extensive and liquid capital sources. This is a key step in promoting the production and use of SAFs.

Furthermore, the Biden administration's recent guidelines for fuel producers, particularly makers of ethanol from corn, aim to increase the supply of Safe and lower the greenhouse gas emissions of air travel. The guidelines provide incentives for farmers to adopt climate-friendly methods for growing crops used in alternative fuels like ethanol.

However, the transition to SAFs is not without challenges. Although SAFs can potentially offset their carbon dioxide emissions depending on their production process, the reality is often far from ideal.

The production process can be linked to carbon dioxide emissions due to the energy required for production or the impact on ecosystems that emit carbon. Furthermore, while SAFs are seen as a drop-in solution for the aviation industry, requiring little adjustment of aircraft and airport infrastructure, they currently make up less than 0.2% of the global jet fuel supply. Therefore, a significant expansion of the supply is required to make SAFs a viable solution for the aviation industry. In conclusion, the impact of policy support and incentives on the cost of SAF production is a critical factor in understanding the overall economics and market viability of Safe. With the right policies and incentives in place, Safe have the potential to revolutionize the aviation industry and contribute significantly to climate progress.

Conclusion

The economic viability of Sustainable Aviation Fuel (SAF) production relies on feedstock costs, conversion technologies, economies of scale, and policy support. Feedstock costs impact the cost dynamics of SAF production, while the choice of conversion technologies and process efficiency influences the cost per gallon of fuel produced. Economies of scale and production volume can lead to cost reductions.

Policy support and incentives are crucial in fostering SAF development. Governmental policies like tax incentives and grants drive the economic feasibility of SAFs. Challenges remain in scaling up SAF production due to high costs and limited supply.

However, with the right policies in place, SAFs have the potential to revolutionize aviation decarbonization efforts. Understanding feedstock costs, conversion technologies, economies of scale, and policy support is crucial for assessing the economics and market viability of SAFs. By addressing these factors collectively, stakeholders can work towards achieving sustainable aviation and making a lasting impact on carbon emissions.