Introduction

Understanding the factors that contribute to the cost of avgas per gallon is crucial for businesses and consumers in the renewable fuels industry. This article delves into the various components that impact avgas pricing, including crude oil prices, refining and distribution costs, taxes and regulations, market demand and competition, seasonal and regional variations, price volatility and forecasting, strategies for cost optimization, fuel efficiency measures, bulk purchasing and supply chain optimization, fuel hedging and price contracts, and the exploration of alternative fuels. By exploring these topics, readers will gain valuable insights into the complex ecosystem of the renewable fuels industry and how to navigate the challenges and opportunities it presents.

I. Avgas Cost Components

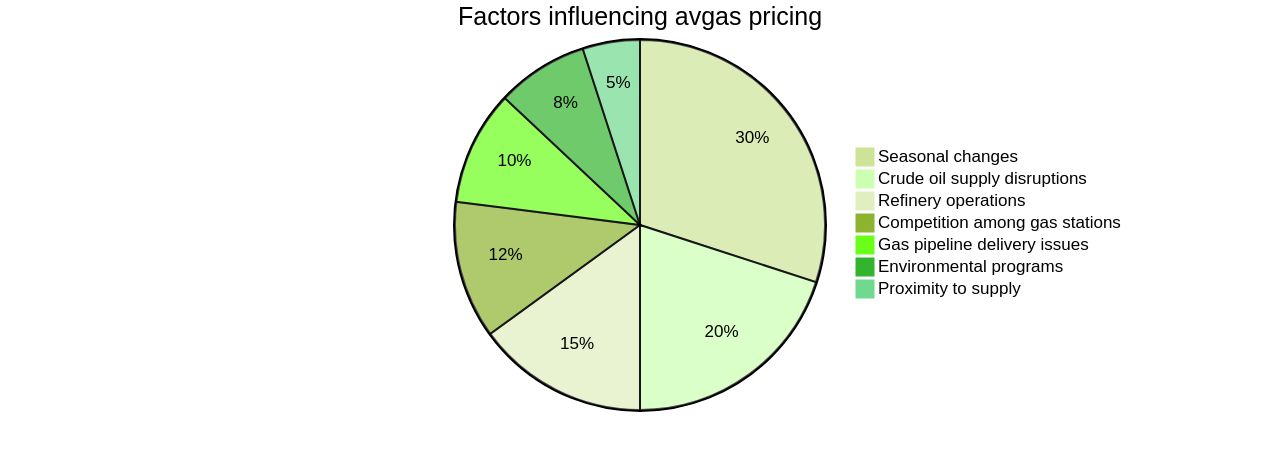

Understanding the pricing of avgas per gallon pivots on multiple factors. Crude oil supply disruptions, refinery operations, or gas pipeline delivery issues can lead to fluctuating fuel costs. Proximity to supply, competition among gas stations, and environmental programs also play significant roles in determining gas prices.

For instance, the farther the gasoline needs to be transported, the higher the price. Similarly, the fewer gas stations in a certain area, the higher the price. Some gasoline needs to be reformulated to meet a state’s environmental standards, making production and distribution more expensive.

It's noteworthy that gas prices also tend to change seasonally; as more people travel during the spring and summer, the cost of fuel increases to meet the higher demand. Refining impacts the cost of fuel as well. Some facilities closed in 2020 and did not return to normal operations after the global health crisis ended.

However, their absence has been covered by other industry players, ensuring US refining is not significantly affected. On the other hand, the cost of charging electric cars, in comparison to fueling them with gas, depends on the segment and price. Trucks cost about the same to fuel and charge, while entry- and mid-level cars and SUVs cost more to charge at home and in public than they do to fuel at a gas station.

II. Crude Oil Prices

The cost per gallon of avgas is influenced by a myriad of factors, with the price of crude oil playing a crucial role due to avgas being petroleum-derived. An increase in crude oil prices directly affects the final price of avgas. However, other elements also come into play.

For instance, the switch to more expensive summer-grade gasoline every year contributes to a rise in price, as noted by Patrick De Haan, head of petroleum analysis at GasBuddy. Additionally, operational issues at refineries can significantly impact gasoline prices. As seen in California, if multiple refineries experience issues simultaneously, the delay in getting supplies from other refineries can lead to substantial price increases.

Moreover, geopolitical factors, weather conditions, and market sentiments of financial investors can sway oil prices on commodity markets, thereby affecting gas prices. Lastly, programs aimed at reducing greenhouse gas emissions, such as the one in California that adds 30 cents per gallon, can also inflate the cost of avgas. This cost is set to increase dramatically by 2025, further impacting the final price of avgas.

III. Refining and Distribution Costs

The process of converting crude oil into aviation fuel, also known as avgas, involves multiple expenses including refining, transportation, and distribution costs. The average cost of avgas can fluctuate based on several factors, including the geographical position of the refinery and the distance to distribution points. However, it's worth noting that the refining industry has found increasing the capacity of existing refineries to be more cost-effective than constructing new ones, leading to a rise in overall U.S. refinery capacity despite a decrease in the total number of operating refineries.

The viability of capacity increase is determined by the size of the refineries, with the cost of avgas playing a crucial role. Larger refineries benefit from economies of scale, whereas smaller ones struggle with cost competitiveness due to their limited capacity to upgrade, resulting in higher avgas cost. This has led to a shift in strategy for owners of less competitive refineries who are now exploring the conversion to renewable fuel production.

The profitability of sustainable fuel production is greatly influenced by the proximity of the refinery to the feedstock source, which includes considering the average cost of aviation fuel (avgas). Refineries that are situated close to sources of soybean oil, distillers corn oil from ethanol production, canola oil, or beef tallow and white grease from beef or pork processing plants tend to have an advantage in terms of avgas cost. Furthermore, the availability of feedstock is largely contingent on geographical location and climate.

When used in aircraft, electrofuel, an alternative to fossil fuel, has shown significant potential in reducing carbon dioxide emissions. Additionally, it can also contribute to reducing avgas cost. The production of electrofuel, which is a sustainable aviation fuel (SAF), involves the use of fossil-free electricity, water, and recycled carbon dioxide, resulting in a fuel with lower avgas cost. Various partner companies are conducting in-depth analyses with the goal to commission a new production facility for electrofuel by 2030.

IV. Taxes and Regulations

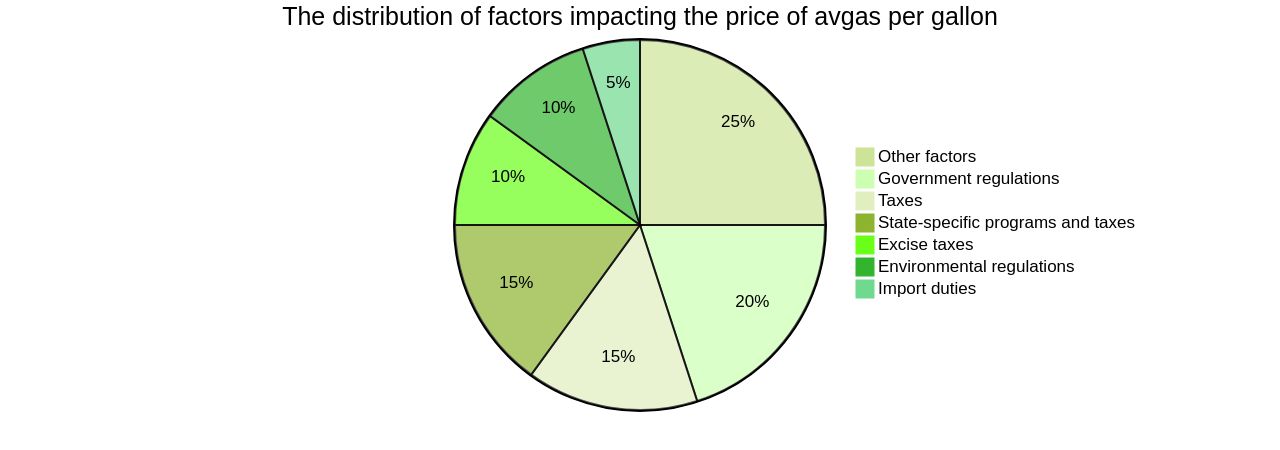

Government regulations and taxes significantly impact the price of avgas per gallon. For instance, excise taxes, import duties, and environmental regulations can inflate the cost.

The Energy Information Administration (EIA) offers a detailed analysis of this, indicating that household electric heating could be 77% more expensive than natural gas on average, with even steeper discrepancies in the Northeast. Furthermore, state-specific programs and taxes, such as those in California, can lead to higher gasoline prices.

The state's stringent reformulated gasoline program and high gasoline tax, coupled with the need for its refineries to operate at near-full capacity, can cause substantial price increases when multiple refineries experience concurrent operational issues. Moreover, the state's avgas price is exacerbated by high taxes, making it one of the highest in the nation. It's worth noting that the price of gasoline is more affordable in the US compared to other countries, primarily due to less government subsidy in those regions. However, recent legislation in California aims to mitigate price gouging and promote industry transparency, which could potentially lead to more stable and lower gasoline prices in the future.

V. Market Demand and Competition

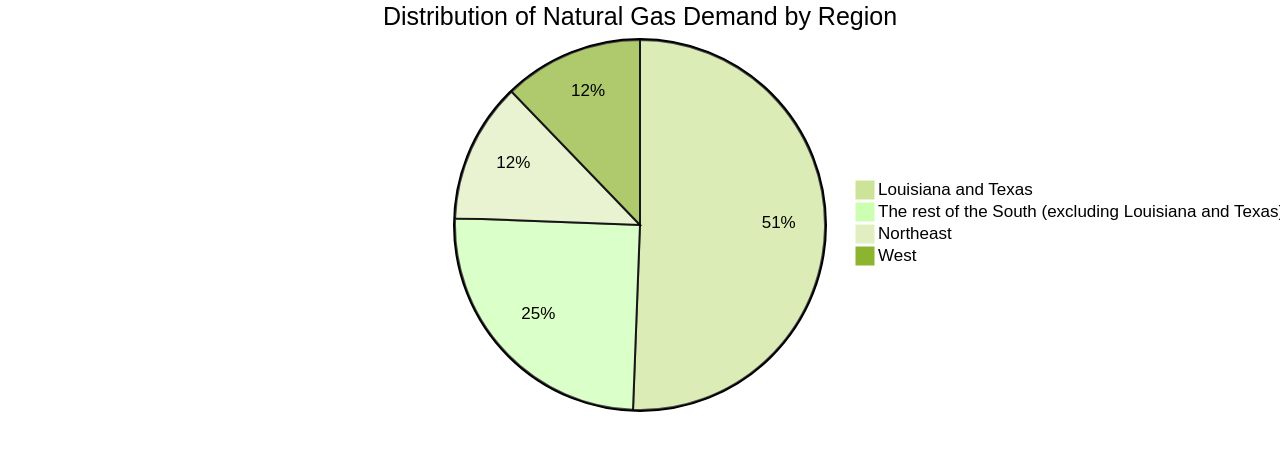

The fuel market dynamics are influenced by a multitude of factors, including but not limited to demand, competition, and global events. From 2022 to 2026, the average growth rate of the overall demand for natural gas, for instance, is expected to slow down to 1.6% per year, compared to the average growth rate of 2.5% per year from 2017 to 2021. However, it is important to consider the impact of avgas cost on this growth.

The slowdown in consumption in mature markets such as Asia Pacific, Europe, and North America can be attributed to the average cost of avgas. This downward trend is being driven by factors such as the rollout of renewable energy sources and improved energy efficiency, which also includes the reduction in avgas cost.

Recent geopolitical events in Europe have led to a significant impact on gas supplies, prompting governments to seek alternative energy solutions due to the increased avgas cost. The increased prices and insecure supply of avgas cost have led to a decrease in industrial gas demand, with many buyers reducing their gas usage.

However, when it comes to the industrial sector, China is predicted to be the fastest-growing market in the near future in Asia-Pacific, especially in terms of avgas cost. The growth is significantly driven by the rapid urbanization, which has increased the size of the industrial sector. The average cost of avgas is a key driver of this growth. Fluctuations in fuel prices, including avgas cost, can occur due to market dynamics, supply disruptions, competition, geographical proximity, and environmental regulations. As of July 24, 2023, the avgas cost per gallon of gasoline nationwide increased by 1.2% over the past week. In summary, the fuel market is a complex ecosystem influenced by a myriad of factors, and understanding these can provide valuable insights for businesses and consumers alike.

VI. Seasonal and Regional Variations

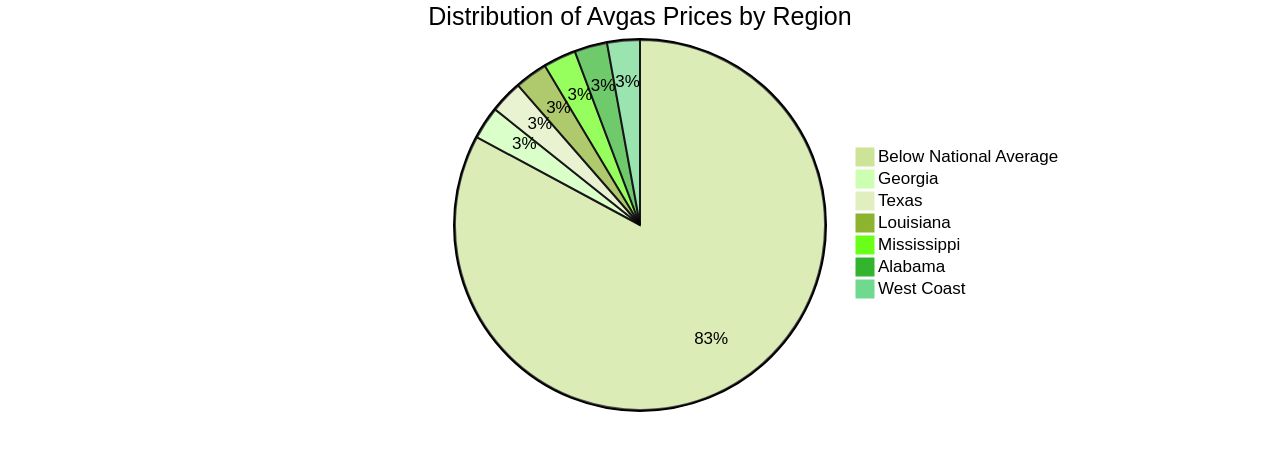

The dynamics of Avgas prices are influenced by a multitude of factors, both seasonal and regional. During peak flying seasons, demand surges, triggering price adjustments. Similarly, regional disparities in supply and demand also play a significant role in shaping the cost per gallon.

For instance, as AAA reports, as of October 25, 2023, the national average price of regular unleaded gas was $3.54 per gallon, with 29 states registering prices below this average. Interestingly, proximity to refineries significantly impacts prices, with states like Texas, Louisiana, Mississippi, and Alabama often benefitting from lower prices due to their geographical advantage. On the other end of the spectrum, West Coast states, burdened with high local taxes and a unique gasoline blend designed to reduce emissions, often grapple with higher gas prices.

Notably, retail gasoline prices, despite being lower than a year ago, are still higher than the 2019-2021 period, largely due to fluctuations in crude oil prices, a key component of retail gasoline prices. Additionally, disruptions in crude oil supplies, refinery operations, gas pipeline deliveries, and environmental programs can cause fuel costs to fluctuate. As we move forward, predicting a definitive trend in gas prices remains a challenge, with various factors at play in this complex market.

VII. Price Volatility and Forecasting

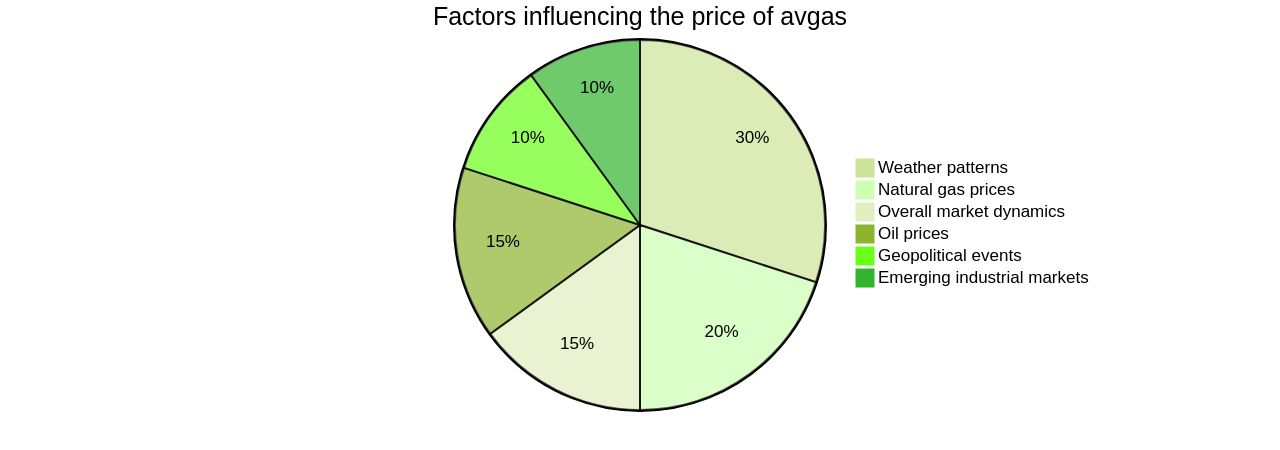

The price trajectory of avgas, like many other commodities, is influenced by a myriad of factors. Notably, it is sensitive to geopolitical events, weather patterns, and overall market dynamics.

For instance, a warmer weather outlook can significantly reduce demand for heating, thereby exerting downward pressure on natural gas prices. This trend has been observed in recent forecasts from NatGasWeather, which predict a substantial decrease in consumption due to milder temperatures.

On the supply front, data indicates a recovery in gas output coupled with a smaller-than-expected withdrawal from storage. This scenario can lead to lower prices, especially during periods of reduced demand.

However, unexpected weather patterns like subzero temperatures can reverse this trend, leading to a surge in heating demand and subsequently, higher natural gas cash prices. The price of oil, a key component of avgas, also plays a significant role.

Decisions made by emerging industrial markets such as China and India can greatly affect oil prices due to their growing energy consumption needs. The limited supply of crude oil and the challenge of finding new reserves further amplify its influence on the price of avgas. Despite these challenges, avgas prices are closely monitored using data such as the Consumer Price Index (CPI). This data, collected monthly from urban areas, aids in tracking the price level of avgas in a particular month. However, it is important to note that average prices are best used to measure the price level in a specific month, not to measure price change over time. For tracking price changes, it is more appropriate to use CPI index values for the particular item categories.

VIII. Strategies for Cost Optimization

As part of the strategic endeavor to diminish avgas costs per gallon, a few potential paths can be considered. A primary approach involves gaining a comprehensive understanding of the capital stock in the airline industry, which consists of durable, long-lasting aircraft.

This knowledge can guide cost-efficient decisions in response to shifts in fuel prices. By adjusting airline operations to focus on fuel conservation, a dual benefit of reduced emissions and cost savings can be realized.

The rise of sustainable aviation fuel (SAF) as a prime method for emissions reduction is another important consideration. This arena presents a variety of fuel types, each with its own carbon intensities, sustainability standards, and associated costs.

It is beneficial for operators to familiarize themselves with the feasible SAF production methods and the potential for scaling to decrease greenhouse gas emissions. Operators also have the opportunity to take advantage of evolving market conditions and strict environmental regulations by transforming existing refineries into producers of renewable diesel and SAF.

These conversions are usually more cost-effective and faster than constructing new renewable fuel production facilities. However, the economics of electricity present a significant challenge. While the costs of renewable energy sources such as wind and solar power are falling, the industry is still wrestling with the timing of electricity generation, not just the quantity. A novel solution to these challenges is flexiforming, a technology offered by Unifuel.tech. Flexiforming allows operators to set their own pace for decarbonization and can be implemented in an idle hydrotreater or reformer, thereby reducing both capex and carbon intensity. It is worth noting that Universal Fuel Technologies, which holds the rights to Unifuel.tech, commits to responding within 24 hours to customer inquiries, a feature that adds an extra layer of support for operators.

IX. Fuel Efficiency Measures

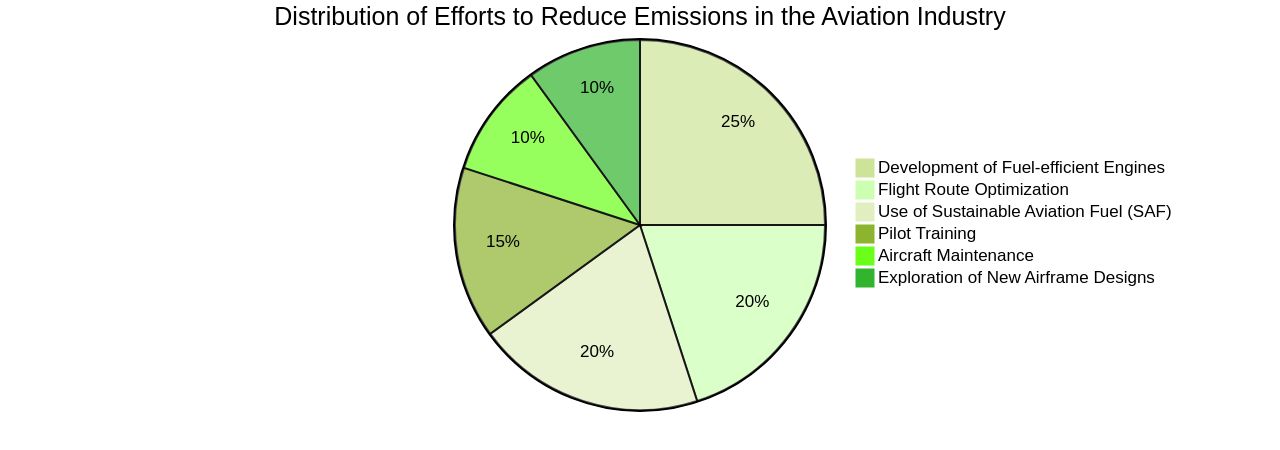

An effective strategy to minimize avgas consumption and reduce costs involves an integrated approach that encompasses aircraft maintenance, pilot training, and flight route optimization. In-depth studies by experts like Jan K. Brueckner, Matthew E. Kahn, and Jerry Nickelsburg reveal that changes in operational strategies can lead to significant fuel conservation and, consequently, lower emissions. For instance, General Electric's partnership with CFM Rise aims to develop a super-efficient 'propfan' engine, projected to offer 20% fuel savings compared to traditional turbojet engines.

This initiative signifies the renewed interest in fuel-efficient technologies due to fluctuating fuel prices and the push for net-zero emissions. Meanwhile, Airbus is committed to making all its aircraft 100% Sustainable Aviation Fuel (SAF) capable by 2030, demonstrating the industry's increasing support for this effective solution to address CO2 emissions. Furthermore, Boeing is exploring new airframe designs that could potentially reduce fuel consumption by 8-10%.

It's clear that the aviation industry is taking substantial strides towards achieving carbon neutrality by 2050, with a focus on innovations beyond just electric vehicles. As Willie Walsh, the director general of the International Air Transport Association, asserts, SAF is the best available tool for reducing emissions, but it requires a concerted industry effort to increase its supply and affordability. The industry's future growth is contingent on demonstrating its commitment to sustainable operations to customers, regulators, and the general public.

X. Bulk Purchasing and Supply Chain Optimization

The complexities and demands of the chemical industry make it a challenging sector when it comes to supply chain management. Given the focus on Cost of Goods Sold (COGS), it is imperative to produce in bulk to achieve economies of scale.

However, this approach introduces logistics challenges such as the handling of hazardous goods requiring special care and regulatory compliance, the use of multiple modes of transportation and intermediaries, and the management of inventory and demand fluctuations due to ever-changing market conditions. Moreover, macroeconomic events, such as the 'post-Covid' era, have caused market imbalance, necessitating the optimization of costs and service levels.

One solution to these challenges lies in outsourcing activities to experienced lead logistics providers like Maersk, which offer integrated coordination or management services. According to a 2020 McKinsey report, this approach could lead to an EBITDA improvement of 8.5 to 16 percentage points along the chemical value chain.

Additionally, the aviation industry's efforts to decarbonize have led to the exploration of sustainable aviation fuels (SAFs), which, although in their infancy, are seen as the primary tool for achieving net zero carbon emissions by 2050. However, the high energy density required for long-haul flights, which contribute the bulk of the industry’s CO2 emissions, poses a challenge. Despite these hurdles, the petroleum industry is increasingly looking to convert existing refineries to produce renewable diesel and Safe by modifying their hydrotreating and separation processes. This is often faster and more cost-effective than constructing new renewable fuel production facilities from scratch.

XI. Fuel Hedging and Price Contracts

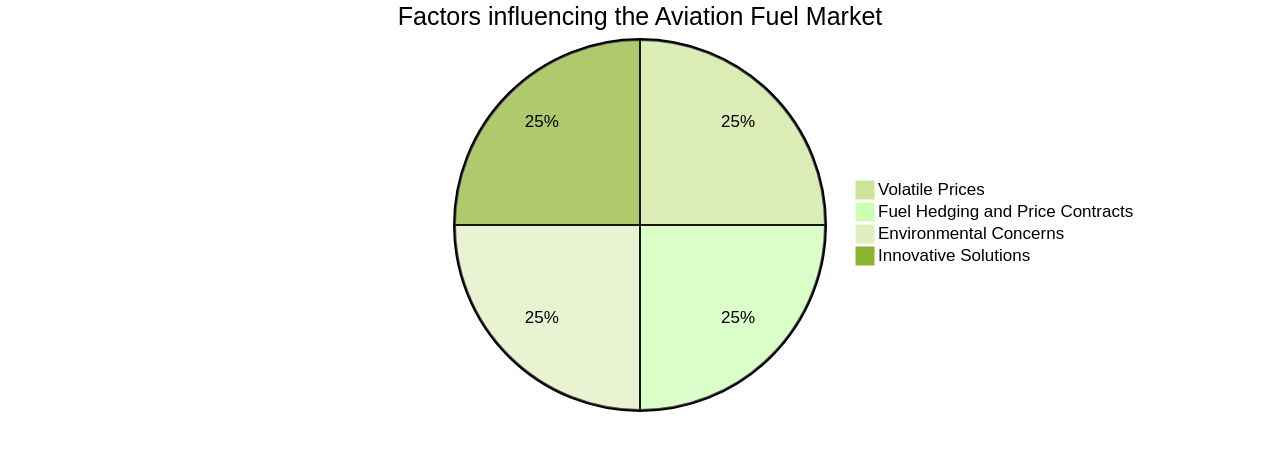

In the face of volatile avgas prices, operators are turning to financial mechanisms such as fuel hedging and price contracts. By locking in prices for future purchases, operators can navigate the uncertainties associated with price fluctuations. For instance, Ryanair, one of the industry's giants, took a proactive approach by hedging 85% of its fuel at $89 per barrel, thereby managing an extra $1 billion on its fuel bill.

However, these strategies are not without their pitfalls. During the pandemic, persistently low oil prices coupled with reduced demand for air travel rendered hedging inefficient for some airlines. This underscores the fact that hedging does not offer guaranteed protection against volatile markets.

Moreover, the aviation industry is also recognizing the environmental implications of fuel consumption. As airlines explore cost-minimizing choices in response to fuel price changes, they are also considering their carbon footprint. For example, Singapore Airlines recently made a historic purchase of 1,000 tons of sustainable aviation fuel, a move that aligns with the International Civil Aviation Organization's goal for the industry to achieve net zero carbon emissions by 2050.

It is clear that the aviation fuel market is a complex ecosystem, influenced by a myriad of factors from fluctuating prices to environmental concerns. While financial instruments like hedging and price contracts offer some level of protection, they are not a panacea. Therefore, operators must continue to explore innovative solutions to ensure sustainable and cost-effective operations.

XII. Exploration of Alternative Fuels

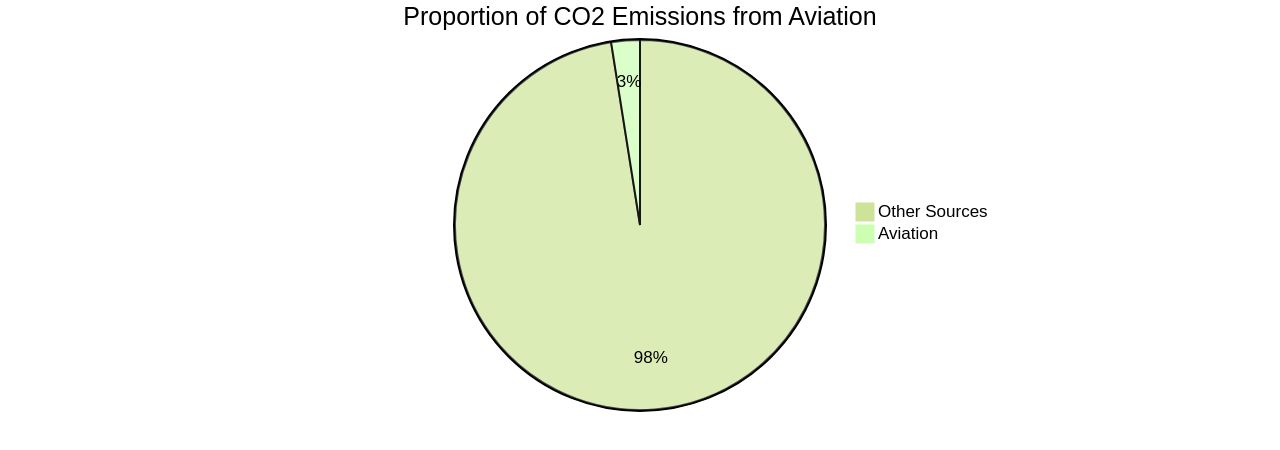

The aviation industry faces a considerable environmental challenge, contributing to approximately 2% to 3% of global carbon dioxide emissions. This seemingly small percentage equates to around 915 million metric tons of annual CO2 emissions. In response to this, the industry is exploring alternative fuels and propulsion systems that could significantly reduce greenhouse gas emissions from air travel.

An important aspect of this exploration is the average cost of aviation fuel (avgas cost), which has emerged as the main method for reducing emissions in the aviation industry. Incorporating fuel options like biofuels or synthetic kerosene, SAF can contribute to a circular energy economy, thereby reducing reliance on traditional aviation gasoline and lowering avgas cost. However, the average cost of avgas remains insufficient, and there are several challenges to overcome, including the scale of the task ahead in such an international and capital-intensive industry.

Despite the challenges, efforts are being made to improve the situation of avgas cost. For example, Airbus, a renowned company in the exploration and utilization of alternative fuels, is addressing the issues of limited supply and high costs, specifically in terms of avgas cost, through various projects. Additionally, the introduction of sustainable aviation fuels, electric and hybrid-electric aircraft, and other green technologies indicate a new era in commercial aviation, which can potentially impact the cost of avgas.

However, if there are no changes in current government policies, the total supply of Sustainable Aviation Fuel (SAF) in 2050 will be limited to approximately 135 million metric tons, which is about 35% of the projected demand for global jet fuel. This limitation is due to the high cost of avgas. Therefore, while the path to net-zero emissions is complex, the industry remains committed to achieving this goal by 2050, despite the challenges posed by the cost of avgas. With the right strategies in place, exploring alternative fuels and technologies can indeed be a long-term strategy for cost optimization and environmental sustainability.

Conclusion

Understanding the factors that impact avgas pricing is crucial for businesses and consumers in the renewable fuels industry. Crude oil prices, refining and distribution costs, taxes and regulations, market demand and competition, seasonal and regional variations, price volatility and forecasting, strategies for cost optimization, fuel efficiency measures, bulk purchasing and supply chain optimization, fuel hedging and price contracts, and the exploration of alternative fuels all play a role in determining the cost of avgas per gallon.

Crude oil prices directly affect avgas pricing, with operational issues at refineries and geopolitical factors also influencing gasoline prices. Taxes and regulations imposed by governments can inflate the cost of avgas.

Market demand, competition, and global events contribute to price fluctuations. Seasonal and regional variations impact avgas prices due to changes in supply and demand.

Price volatility is a challenge in the fuel industry, driven by geopolitical events, weather patterns, and market dynamics. Strategies for cost optimization include understanding the capital stock in the airline industry, embracing sustainable aviation fuel (SAF), exploring renewable fuel production methods, improving fuel efficiency measures through aircraft maintenance and pilot training, optimizing supply chains through outsourcing activities to lead logistics providers, and utilizing financial mechanisms like fuel hedging.

The exploration of alternative fuels such as SAF presents an opportunity for reducing greenhouse gas emissions from air travel. However, challenges like limited supply and high costs need to be addressed. Despite these challenges, advancements in sustainable aviation fuels, electric aircraft technologies, and other green innovations signal a new era in commercial aviation. In conclusion, understanding these factors is essential for navigating the complex renewable fuels industry. By implementing effective strategies for cost optimization and environmental sustainability while considering insights into avgas pricing components, businesses can thrive in this dynamic industry.