Introduction

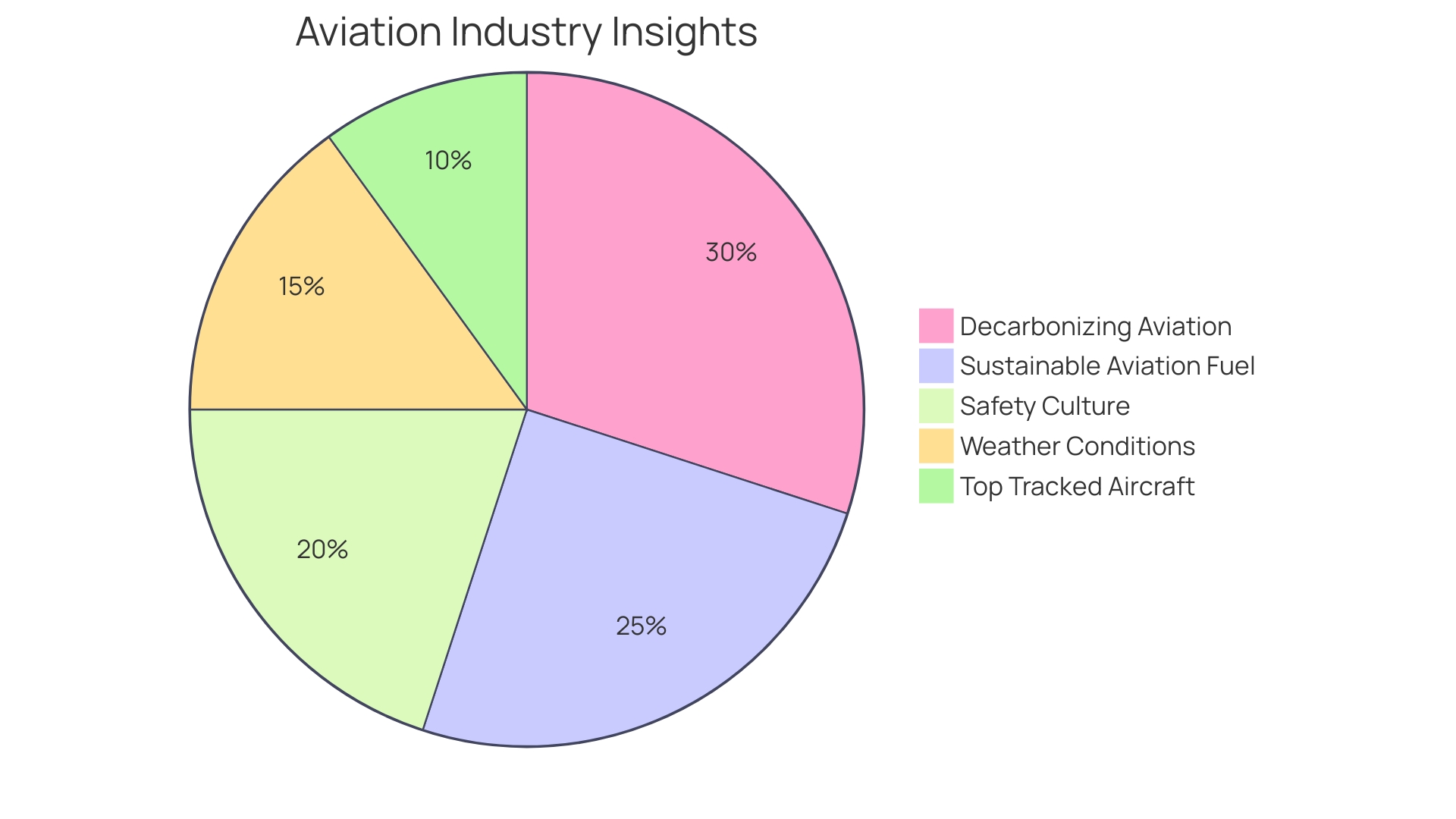

As the aviation industry strives to meet the demands of air travel while addressing environmental responsibility, the focus on sustainable aviation fuel (SAF) has become paramount. Companies like Jetex are pioneering efforts to integrate green technologies and reduce carbon emissions, aligning with IATA's goal of achieving net zero carbon emissions by 2050. This article explores the current market size and growth projections, key drivers of the jet fuel market, challenges facing the industry, opportunities for innovation, technological advancements, regional market analysis, major players in the market, the impact of government regulations and initiatives, and the future outlook and trends.

By delving into these topics, we gain valuable insights into the dynamic landscape of the jet fuel market and the industry's journey towards a more sustainable future.

Current Market Size and Growth Projections

As the aviation industry advances, a key focus has been placed on sustainable aviation fuel (SAF) to meet the rising demands of both air travel and environmental responsibility. Companies like Jetex are pioneering efforts to integrate green technologies and reduce carbon emissions, in line with IATA's ambitious goal of achieving net zero carbon emissions by 2050. These endeavors are crucial for the future of aviation, with a dual aim of addressing climate change and maintaining industry growth.

The evolution of jet fuel is reminiscent of past changes in gasoline and diesel chemistry. Adopting SAF is a pivotal shift as it must be proven to be as reliable as traditional fuels, and compatible with existing jet engine technologies. With a steadfast fuel composition since the 1950s, the aviation industry faces a significant learning curve. Robert McCormick, a senior research fellow at NREL, emphasizes the novelty of designing new jet fuels for an industry accustomed to a long-standing fuel standard.

SAF is not just a theoretical concept but is actively being produced by companies such as Alder Fuels, utilizing patented technology to create high-performance, low-emission renewable jet fuels. These innovative efforts are set to reduce the aviation industry's carbon footprint and meet rigorous standards for a more sustainable future. Similarly, Aemetis Inc. is contributing to the market with renewable fuels and biochemicals aimed at lowering greenhouse gas emissions.

The European biofuel market, featuring major economies like France, the UK, Germany, and Poland, is expected to be the fastest-growing region. Propelled by ethanol, biodiesel, and renewable diesel, Europe's biofuel market is thriving due to supportive policies and initiatives. This growth is indicative of a broader industry trend towards cleaner energy sources and reflects the increasing role of biofuels in the global energy mix.

Market research anticipates the global jet fuel market to expand significantly by 2025, with a compound annual growth rate that underscores the industry's robust trajectory. This growth is propelled by the interplay of economic development, the proliferation of low-cost carriers in emerging markets, and a surge in international tourism. Such forecasts are essential for market participants seeking actionable insights to navigate and capitalize on emerging trends in the fuel procurement landscape.

Key Drivers of the Jet Fuel Market

The jet fuel market is influenced by a multifaceted set of factors that include economic conditions, geopolitical developments, and technological advancements. A robust economy typically stimulates air travel, thereby elevating the demand for jet fuel. Conversely, political stability, trade policies, and international relations can have profound effects on market stability and pricing. Technological progress, particularly in the realm of aircraft engine efficiency, plays a crucial role in fuel consumption rates. For example, Jetex's commitment to IATA's goal of achieving net zero carbon emissions by 2050 underscores the industry's focus on integrating green technologies and enhancing fuel efficiency. Moreover, shifts in the energy market, as depicted by the decrease in UK inflation due to falling energy price inflation, highlight the volatility and interconnectivity of fuel prices. In Europe, the biofuel market, energized by ethanol, biodiesel, and renewable diesel, is expanding rapidly, propelled by supportive EU policies and initiatives. The intricate interplay of these drivers underscores the dynamic nature of the jet fuel market and its susceptibility to a wide array of influences.

Challenges Facing the Jet Fuel Market

The jet fuel market, while poised for growth, confronts multifaceted challenges, primarily stemming from the volatility of crude oil prices, given jet fuel's derivation from crude. This price instability can notably affect the jet fuel market's profitability and pricing structure. Concurrently, intensifying environmental concerns and stringent regulations aimed at curbing carbon emissions are putting pressure on the aviation industry to seek alternatives to traditional jet fuels. These challenges are further exacerbated by geopolitical tensions and potential disruptions in the oil supply chain, affecting jet fuel accessibility and costs.

In response to these challenges, advancements in sustainable aviation fuel (SAF) are gaining traction, driven by both public and private investments. SAF is increasingly seen as a critical solution for the aviation industry's environmental impact, offering compatibility with existing jet engines without compromising safety or reliability. Notably, Saf's properties have remained consistent since the 1950s, which is a testament to its long-standing record of efficacy.

The transition to SAF is underscored by initiatives such as Jetex's environmental strategy, which aims to reduce carbon emissions and integrate green technologies in alignment with IATA's goal of achieving net-zero emissions by 2050. This strategy includes a comprehensive approach involving emission reduction at the source, offsetting, and carbon capture technologies.

In the broader context, oil prices have exhibited fluctuations, with December prices averaging $78/bbl, a decrease from the $94/bbl observed in September. This downward trend is attributed to factors such as subdued global economic activity, record output from the United States, and steady production and exports from Russia. Despite geopolitical tensions and OPEC+'s production cuts, these factors have collectively contributed to the recent price dynamics.

As the industry navigates these challenges, Argus provides valuable insights through blogs, webinars, and podcasts, offering expert analysis and perspectives on energy and commodity markets worldwide. Argus' pricing knowledge, with over 50 years of data collection, is recognized for its accuracy and reliability, serving as a trusted reference for market intelligence.

Ultimately, the jet fuel market's future hinges on its ability to adapt to these challenges through innovation, investment in renewable alternatives like SAF, and informed decision-making supported by expert market analysis.

Opportunities in the Jet Fuel Market

As the aviation industry grapples with reducing its carbon footprint amid rising demand, sustainable aviation fuels (SAFs) are emerging as a pivotal solution. SAFs, encompassing biofuels, hydrogen, and synthetic varieties, are lauded for substantially slashing carbon emissions in comparison to traditional jet fuels. Such innovative fuels are crucial for the industry's ambition to achieve net-zero carbon emissions, a goal underscored by milestones like Virgin Atlantic's eco-friendly flights.

The potential of SAFs extends beyond eco-friendliness; they're products of diverse pathways utilizing biomass sources—waste cooking oil, energy crops, or even human waste—avoiding the environmental pitfalls of deforestation and food supply interference. British firm Firefly's venture into crafting aviation fuel from human waste exemplifies the ingenious methods being explored. Yet, the sustainability of such fuels hinges on the availability of renewable electricity and carbon capture technologies, given the power-to-liquid process they often entail.

As the industry's aircraft fleet is predicted to more than double in the coming decades, the switch to Safe is imperative. The most modern aircraft models boast 15-30% improved fuel efficiency, but with commercial aircraft having a lifespan of 20-30 years, reliance solely on advancements in aircraft design is insufficient. Here, Safe serve as a much-needed accelerant for decarbonization.

The journey towards SAFs is not without hurdles. Public and private sectors must continue to invest and collaborate to scale up SAF production, as echoed by Robert McCormick from the National Renewable Energy Laboratory. Such efforts are crucial for ensuring these fuels can seamlessly integrate with existing jet engines, which have operated on relatively unchanged fuel for the past 70 years.

Education plays a significant role in driving the adoption of Safe. Dispelling myths—like Safe smelling like French fries due to their cooking oil origins—and fostering an understanding of Safe' broader significance are vital. Neste's initiatives, from their Neste Impact solution to their partnership with Airbus, exemplify the concerted push towards enlightening consumers and enhancing sustainability.

In essence, the aviation sector is on the cusp of a transformation, with SAFs at the helm of this change. By leveraging advancements in fuel blending technologies and engine designs, the industry not only strides towards a greener future but also paves the way for market players to gain a competitive edge in this evolving landscape.

Technological Advancements and Sustainable Aviation Fuels

The jet fuel market is undergoing a significant transformation driven by technological innovations in engine design and the emergence of sustainable aviation fuels (SAF). Engine manufacturers are at the forefront, developing engines that not only enhance fuel efficiency but also minimize environmental impact. This progress is crucial as the aviation industry endeavors to meet stringent emissions regulations and reduce the environmental footprint of air travel.

Sustainable aviation fuels are emerging as a promising solution to these environmental challenges. These biofuels can either be blended with conventional jet fuel or utilized independently. They are created from renewable raw materials such as used cooking oil, agricultural residues, and even municipal waste, offering a substantial reduction in carbon emissions compared to traditional fossil fuels.

Interest in SAF has been boosted by its ability to integrate seamlessly with existing engine technology and aviation infrastructure, demonstrating comparable safety and reliability as conventional jet fuel. This compatibility is vital for ensuring the safety and efficiency of air travel, which remains a top priority in the industry.

Public and private sectors are increasing investments to scale up SAF production, evidenced by groundbreaking initiatives like the world's first ethanol-to-SAF production plant by LanzaJet in Georgia. Partnerships, such as the collaboration between Airbus and Neste, are also pivotal in driving the industry toward a net-zero future.

With growing awareness and education, consumers are becoming more cognizant of Saf's role in sustainable travel. Misconceptions are being addressed, and the wider significance of SAF is gaining recognition. As aviation companies such as Virgin Atlantic, Delta, and United set ambitious carbon neutrality goals, the adoption of SAF is seen as the most viable path forward.

Innovative approaches to SAF production are also being explored, such as using human waste as a feedstock, a method developed by British firm Firefly. This highlights the diverse potential sources for SAF, which could lead to a more sustainable aviation sector.

The aviation industry's commitment to reducing its carbon footprint is further reflected in the efforts of companies like Jetex, which aligns with IATA's goal to achieve net-zero emissions by 2050 through emission elimination, carbon offsetting, and capture technologies.

As the industry progresses, the adoption of SAF, bolstered by technological advances in engine efficiency and environmental performance, will be pivotal in shaping the future of aviation fuel and ensuring the sector's sustainability.

Regional Market Analysis

The landscape of the jet fuel market is a dynamic one, shaped by a mosaic of regional economic conditions, the ebb and flow of air travel demand, and the intricate tapestry of government policies. North America and Europe stand as the titans of this industry, their dominance underpinned by established aviation sectors and an insatiable appetite for air travel. The Asia Pacific region is emerging as a burgeoning frontier, its jet fuel market buoyed by the winds of rapid economic progression and the ascendancy of cost-effective carriers.

Concurrently, Latin America, the Middle East, and Africa are burgeoning markets, their potential ignited by an explosion in air travel and a blossoming of infrastructure development. Industry research underscores the growth trajectory of these emerging markets, reflecting a global shift towards innovative energy solutions, such as those provided by Alder Fuels and BP, who are at the forefront of sustainable aviation fuels (SAF). Their commitment to high-performance, low-emission SAF solutions is carving out a new epoch for a more sustainable aviation industry.

Groundbreaking alliances, like the ones taking shape in Germany, are testament to the sector's dedication to decarbonization. Ambitious projects aiming to establish production capacities for sustainable aviation fuels based on green hydrogen exemplify the concerted efforts to usher in climate-neutral aviation by the mid-21st century. Such initiatives not only promise a reduction in CO2 emissions but also herald economic growth and technological advancements.

Amidst this transformation, the words of the World Bank resonate, detailing a commodity landscape in flux, with oil prices experiencing an 11 percent uptick. This volatility mirrors the intricate dance between energy prices and economic sectors, where energy costs can nibble away anywhere from 10 to 30 percent of total costs, depending on the industry and region. The manufacturing and service sectors, for instance, see energy expenses as a significant portion of their overheads.

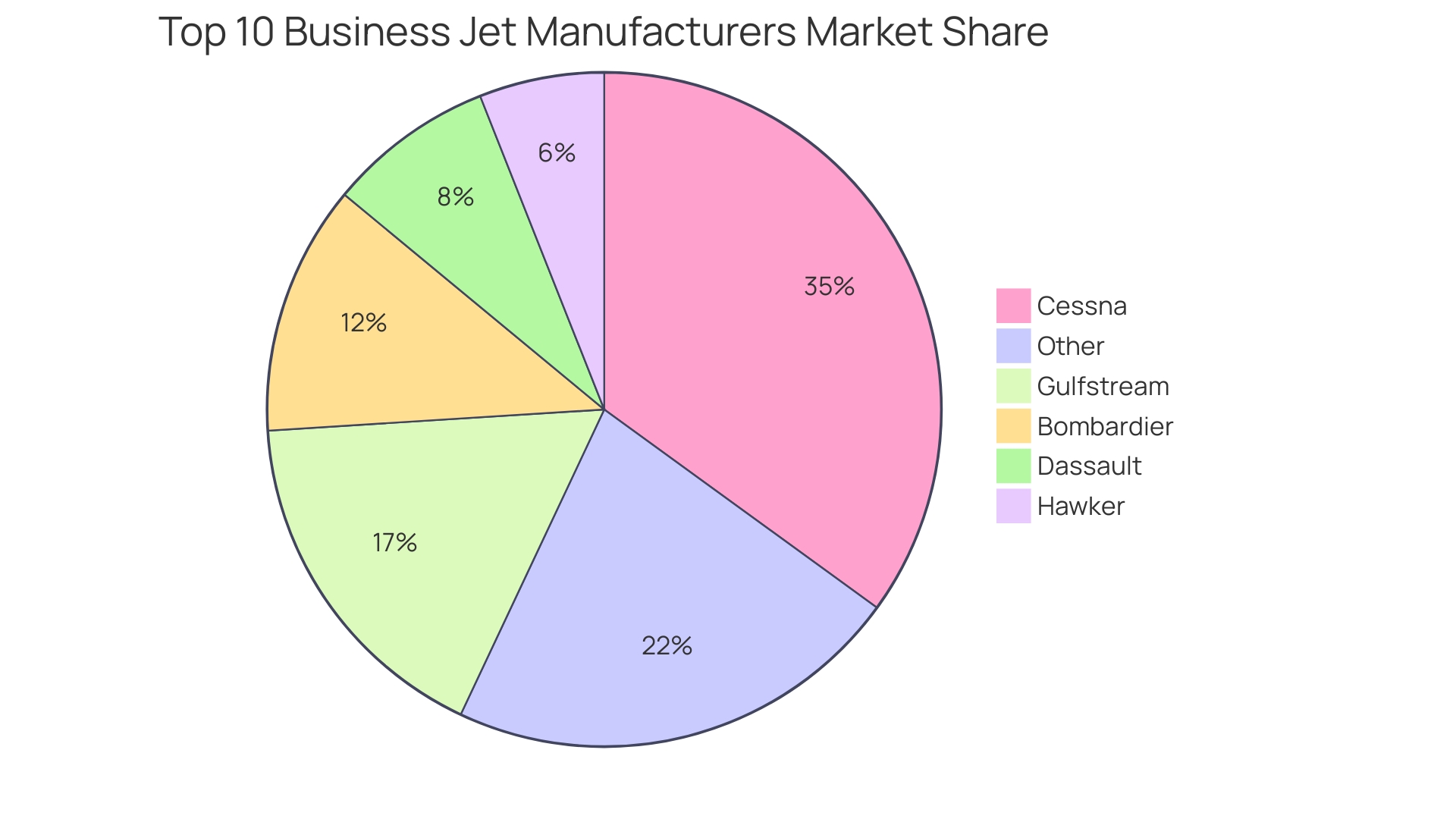

The U.S. business jet market, a microcosm of this broader narrative, features fierce competition among industry stalwarts like Cessna, Gulfstream, and Bombardier. With Cessna at the helm, holding a commanding 35% market share, these titans of the skies exemplify the fusion of innovation and luxury that characterizes this sector. Meanwhile, the Cirrus Vision Jet disrupts the status quo with its single-engine design, rewriting the rules of the very light jet class and making private air travel more attainable.

In sum, the global jet fuel market is a testament to the relentless pursuit of progress and sustainability, as evidenced by the surging demand for Safe and the strategic partnerships forming to secure a greener future for aviation.

Major Players in the Jet Fuel Market

Within the aviation industry, significant advancements are being made to transition towards sustainable aviation fuel (SAF), a pivotal component in the journey to net-zero carbon emissions by 2050. Major airlines such as Delta are at the forefront, aiming to substitute 10% of their conventional jet fuel consumption with SAF by 2030, while simultaneously reducing their total fuel usage by millions of gallons annually. This alternative to conventional jet fuel is derived from renewable waste materials—such as used cooking oils, not crude oil—making it a drop-in solution that doesn't require any modifications to existing aircraft engines or fuel infrastructure.

The industry's commitment to this transition is evidenced by collaborative efforts, exemplified by the partnership between Airbus and Neste, which underscores the commitment to decarbonize aviation. In addition, companies like Jetex are aligning their strategies with the International Air Transport Association's (IATA) goal to achieve net-zero emissions by 2050, focusing on reducing carbon emissions, recycling, and adopting green technologies across their operations.

Innovative approaches are essential to overcoming the challenges of integrating SAF into the market. As stated by Amelia DeLuca, Chief Sustainability Officer at Delta Air Lines, "With around 90% of the industry’s carbon emissions coming from jet fuel, focusing on the fuel we use and how we use it is essential to reaching net zero." Meanwhile, Virgin Atlantic continues to champion innovation, with its founder emphasizing the importance of challenging the status quo to benefit the planet.

Understanding SAF and its role in sustainable travel is crucial, and education plays a key role in debunking misconceptions. As highlighted by Neste, it's not just about the novelty of fuels that might smell like French fries, but about grasping the broader significance of SAF in achieving net-zero emissions.

Fuel suppliers and oil companies are not only competing but also investing in R&D to enhance fuel efficiency and develop sustainable alternatives, with a focus on public and private investments to accelerate SAF production and usage. This is a testament to the industry's dedication to sustainability and the collective effort to address climate change, ensuring a healthier planet for future generations.

Impact of Government Regulations and Initiatives

The jet fuel market is under transformation, driven by rigorous environmental regulations and a strong shift towards sustainability. Governments around the world are actively setting ambitious emission reduction targets and introducing policies to encourage the adoption of sustainable aviation fuels (SAF). This transition is not merely regulatory compliance but a fundamental change in the aviation fuel paradigm.

As the third largest source of transportation emissions in the United States, the aviation sector is grappling with the challenge of decarbonization, especially considering the longevity of commercial aircraft, which can operate for two to three decades. Traditional strategies like improving aircraft design and efficiency are necessary, yet they may not suffice for timely sector-wide decarbonization. Therefore, SAF emerges as the most promising alternative, capable of integrating with current technologies and infrastructure.

Public and private sectors are investing to scale up SAF production, recognizing it as a critical and energy-dense renewable fuel, necessary for meeting climate goals. Saf's compatibility with existing jet engines and its proven safety record are pivotal to its adoption. However, the task is daunting; ensuring that SAF is sustainable involves meticulous documentation and verification, particularly to confirm permanent carbon storage.

The urgency for a transition to SAF is underscored by recent regulatory developments, such as the European Union's 'Fit for 55' package, including the ReFuelEU Aviation initiative. This policy framework is set to reduce net greenhouse gas emissions by at least 55% by 2030 and achieve climate neutrality by 2050. The provisional political agreement reached on 25 April 2023, operational from 2024, marks a significant step in creating a level playing field for sustainable air transport.

Furthermore, concerns for human health, specifically the vulnerability of children to neurotoxicants like lead in aviation fuel, add to the impetus for cleaner fuel alternatives. The U.S. Environmental Protection Agency's focus on children's health emphasizes the need for fuels that do not compromise future generations' intellectual and developmental potential.

In conclusion, the jet fuel market is at a pivotal juncture. The combined forces of government initiatives, health considerations, and the undeniable urgency of climate action are propelling the industry towards SAF. As regulations tighten and market dynamics evolve, the aviation sector's ability to innovate and adapt will determine its resilience and sustainability.

Future Outlook and Trends

Innovations in sustainable aviation fuels (SAF) and advanced blending technologies are transforming the future of the jet fuel market. As environmental regulations tighten and the industry commits to lowering carbon footprints, SAFs are becoming increasingly adopted, with Neste's pioneering efforts leading to credible emission reductions. Partnering with Airbus, Neste is making strides in decarbonizing aviation, ensuring all raw materials for SAF are sustainably sourced and meet stringent sustainability standards.

Technological advancements play a significant role, with companies like Alder Fuels and BP venturing into renewable jet fuels that comply with industry standards while focusing on performance and lower emissions. Virgin Atlantic's recent milestone flight symbolizes the industry-wide push towards net zero carbon emissions, a feat achieved through strategic partnerships like the Joint Venture with Air France-KLM and Delta Air Lines, which also offer expansive route networks and competitive fares.

Europe's biofuel market, with major economies such as France, UK, Germany, and Poland, is the fastest-growing region. Ethanol, biodiesel, and renewable diesel drive the market, supported by EU policies that promote biofuel use. Despite these advancements, the industry must navigate challenges such as fluctuating crude oil prices and geopolitical uncertainties. Continuous innovation and strategic planning will be crucial for stakeholders to manage these complexities and sustain market growth.

Conclusion

The jet fuel market is undergoing a transformative shift towards sustainability, driven by green technologies and the adoption of sustainable aviation fuel (SAF). Companies like Jetex are leading efforts to reduce carbon emissions and align with net zero carbon goals. The market is projected to experience significant growth, fueled by economic development, low-cost carriers, and international tourism.

Challenges include volatile crude oil prices, environmental concerns, and stringent regulations. To overcome these, there is a strong focus on advancing SAF production and integration while ensuring safety and reliability. Initiatives like emission reduction strategies and carbon capture technologies aim to achieve net-zero emissions.

Opportunities lie in adopting SAFs, which substantially reduce carbon emissions and can be derived from diverse renewable raw materials. Education and partnerships are crucial for scaling up production and ensuring compatibility with existing jet engines.

Technological advancements in engine design and SAF are transforming the market. SAF, derived from renewable raw materials, demonstrates safety and reliability comparable to conventional jet fuel, reducing the environmental footprint of air travel.

North America and Europe dominate the market, with Asia Pacific emerging as a promising frontier. Latin America, the Middle East, and Africa show potential, driven by increased air travel and infrastructure development. Groundbreaking alliances and projects focused on sustainable aviation fuel production demonstrate the sector's commitment to decarbonization.

Major players like Delta and Virgin Atlantic are leading the transition to SAF. Government regulations and initiatives promote SAF adoption and set ambitious emission reduction targets.

Looking ahead, continued advancements in SAF and blending technologies will shape the market. Innovation, partnerships, and sustainability compliance are key to achieving credible emission reductions. Despite challenges like fluctuating oil prices, the industry's ability to adapt and collaborate will sustain growth.

In conclusion, the jet fuel market is shifting towards sustainability through green technologies and SAF adoption. The industry's resilience and sustainability depend on innovation and adaptation to evolving market dynamics and regulations.