Introduction

The aviation industry is making significant efforts to reduce its carbon footprint, with a particular focus on the production of sustainable aviation fuel (SAF). However, the economic viability of SAF production relies on various factors, including feedstock selection, production costs, and market demand.

This article delves into the economics of SAF production, exploring different pathways and electricity requirements, as well as the challenges and opportunities in the renewable energy sector. It also discusses the role of power purchase agreements (PPAs) and the integration of battery storage in advancing the economic feasibility of renewable energy.

The article highlights the importance of understanding electricity costs in different locations and analyzes the economic challenges associated with aviation electrification. Additionally, it explores the utilization of CO2 in SAF production and the policy and funding considerations necessary for scaling up SAF production. This technical and analytical article provides insights into the economic dynamics of the renewable fuels industry and offers a comprehensive overview of the various factors impacting SAF production.

Economics of Sustainable Aviation Fuel (SAF) Production

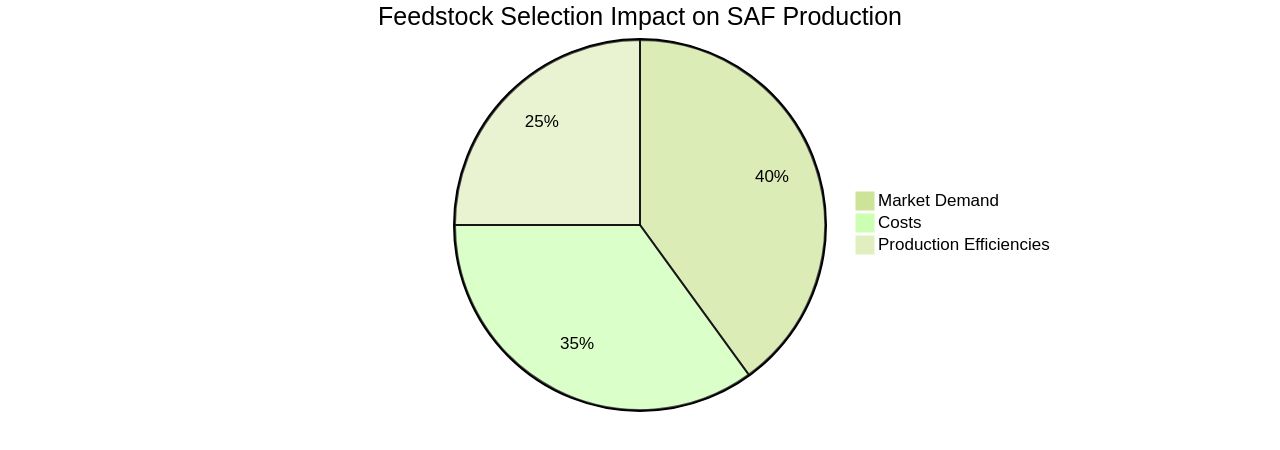

The selection of feedstocks plays a pivotal role in the financial dynamics of sustainable aviation fuel (SAF) production, with renewable naphtha standing out for its lower carbon footprint. Its economic feasibility is influenced by a range of factors, including feedstock costs, production efficiencies, and market demand.

Using Aspen Process Economic Analyzer software, projections for capital costs and operational expenses in fuel production stand at $71 million and $303 million/year, respectively, yielding a gross profit of $60.5 million/year. The net present value (NPV) is estimated at $235 million with a payback period of 1.7 years, emphasizing the sensitivity of NPV to product pricing.

Researchers at Uppsala University are exploring synthetic SAF production via a photobiological-photochemical approach using genetically modified cyanobacteria, which convert atmospheric CO2 into isoprene using sunlight. However, this innovation faces scalability challenges.

The refining industry has found that retrofitting existing facilities to produce renewable diesel (RD) and SAF is more cost-effective than constructing new ones, though this is economically viable for only a select few refineries due to the complexities involved. The power-to-liquid (PtL) process can potentially reduce CO2 emissions by 89 to 94%, yet high production costs and market uncertainties hinder private investment.

Government support and incentives are crucial for the economic viability of such ventures. Sweden's planned annual SAF output of 80,000 tons represents a significant fraction of its current and future SAF needs, despite the energy-intensive nature of the production process and the necessity for sustainable sourcing.

To address these challenges, Unifuel.tech offers Flexiforming technology, allowing operators to manage their decarbonization process flexibly. This solution can be integrated into idle hydrotreaters or reformers, thus reducing capital investments and carbon intensity. Unifuel. Tech pledges to provide responses to inquiries within a day, collecting data about feeds, target products, and existing infrastructure to determine the best application of Flexiforming. For further information, the company's contact details are available on their website, subject to their terms of use. Proportion of Feedstock Selection Impact on Financial Aspects of Sustainable Aviation Fuel (SAF) Production

SAF Production Pathways and Electricity Requirements

The transition to Sustainable Aviation Fuels (SAFs) has become a focal point in the aviation industry's efforts to reduce its carbon footprint. With the sector accounting for a significant portion of global CO2 emissions, the adoption of Safe is seen as a pivotal step towards achieving Net-Zero 2050 targets. One promising pathway is the use of renewable naphtha in the Hydroprocessed Esters and Fatty Acids (HEFA) process, which necessitates considerable energy for operations such as hydrotreatment and hydrocracking.

Technologies like Unifuel.tech's flexiforming process are innovating in this space, enabling the conversion of renewable naphtha in underutilized assets, thus minimizing capital costs and carbon intensity. This method allows operators to calibrate their decarbonization trajectory, directly impacting net emission reductions. Meanwhile, the power-to-liquid (PtL) method, though in its early stages, offers the potential for significant CO2 emission savings.

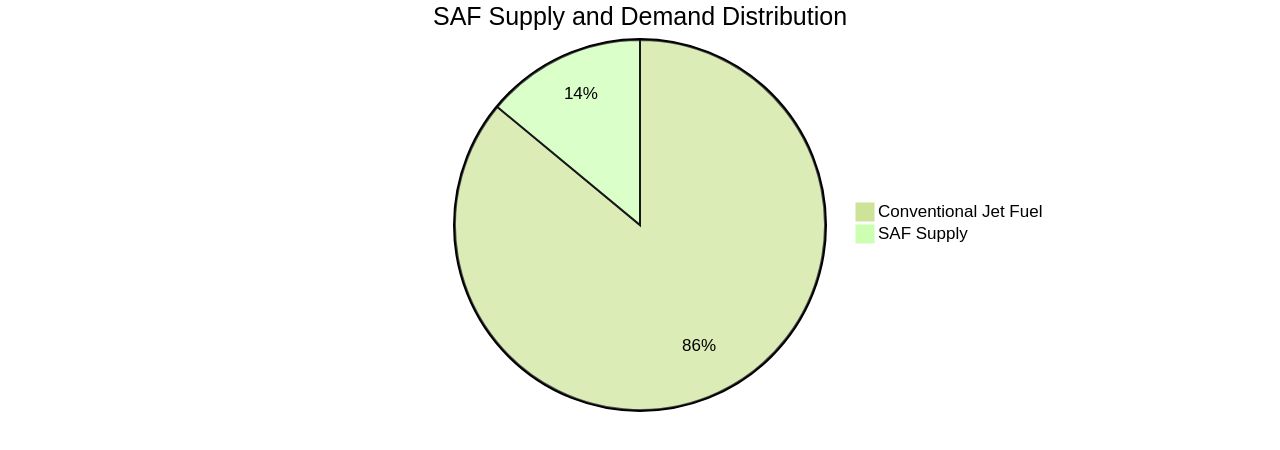

Sweden's current SAF production, standing at 80,000 tons per annum, fulfills just 5% of its jet fuel requirements. However, projections indicate that by 2030, this figure could rise to 20%. Despite Safe being more costly than traditional fuels—2 to 5 times higher in production costs—early adopters in the market may find profitable opportunities as the industry strives to close the demand gap for Safe.

Moreover, advancements such as the production of bio-based aromatics are expanding the potential for higher SAF blends, even up to 100%, as demonstrated by airlines like United and Virgin Atlantic. The ReFuelEU aviation regulation, mandating a progressive increase in SAF blending, exemplifies the regulatory push towards these greener fuels. However, the challenges of affordability, sustainability, and feedstock competition remain critical issues that need to be addressed to scale production economically and meet the burgeoning global demand.

Retail Electricity Costs for SAF Production

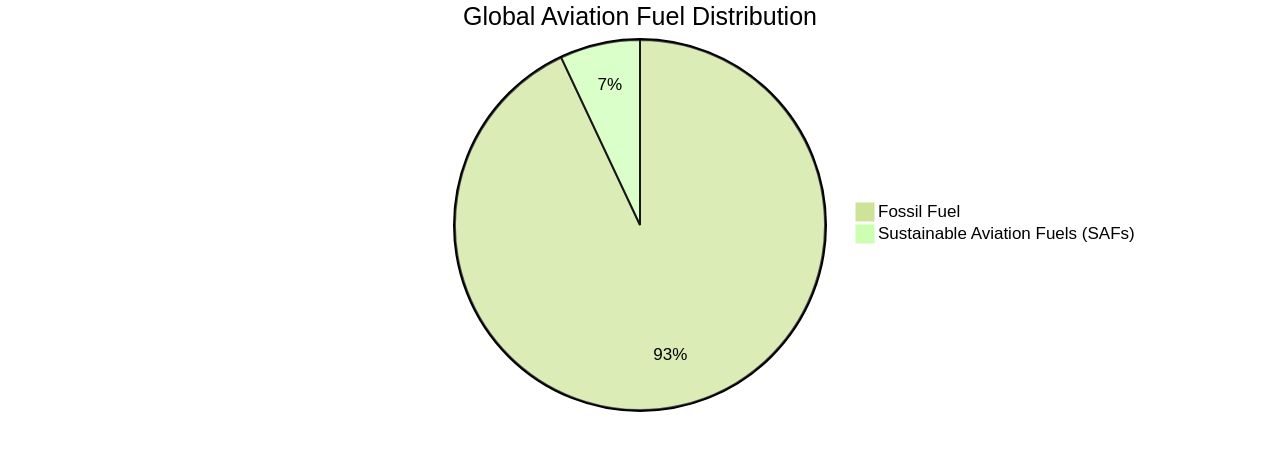

Understanding the economics of Sustainable Aviation Fuel (SAF) is paramount for its successful integration into aviation fuel markets. Currently, SAF is at least three to four times more costly than conventional jet fuel, constituting only a minuscule fraction of the millions of tons of kerosene consumed by commercial airlines.

Despite its higher cost, Saf's potential to reduce carbon emissions is significant, with the Power-to-Liquids (PtL) process enabling CO2 savings of 89 to 94%. Yet, the development and deployment of PtL technology face challenges, particularly in terms of large-scale production readiness and the sufficiency of supply to meet the growing demand for greener fuels.

The aviation industry's commitment to carbon neutrality by 2050 amplifies the urgency to overcome these obstacles. With aviation accounting for about 2% of global energy-related CO2 emissions, the transition to SAF is a critical step towards achieving this goal.

However, the economic viability of SAF is constrained by the limited supply of green electricity required for its production. This green electricity is often more beneficially used to replace high-emission power sources like coal or gas plants, rather than to manufacture e-fuels.

In the Swedish context, the planned annual SAF output of 80,000 tons represents a significant step, covering approximately 5% of the country's current jet fuel demand and 20% of its SAF requirement by 2030. Innovative solutions like Unifuel.tech's Flexiforming technology are addressing these economic and supply challenges. Flexiforming allows for a customizable rate of decarbonization and can be implemented using existing infrastructure, such as an idle hydrotreater or reformer. This integration not only reduces capital expenditures but also lowers carbon intensity, making it a strategic asset in scaling up SAF production. As we navigate the complexities of scaling up SAF production, it is essential to consider the six identified roadblocks, which include the industry's international scope and the intensive capital expenditures required. Collaborative efforts and the adoption of technologies like Flexiforming are crucial to advancing the economic viability of SAF and achieving the aviation industry's sustainability objectives.

Power Purchase Agreements (PPAs) for Renewable Energy and Battery Storage

Power Purchase Agreements (PPAs) are crucial mechanisms within the renewable energy sector, offering a stable, long-term procurement of electricity at fixed prices, often spanning 5 to 20 years. These contracts not only provide a predictable revenue stream for energy project developers, crucial for securing financing for the construction and operation of facilities, but also enable buyers to lock in low, stable electricity rates, advancing their sustainability goals. Municipalities are increasingly recognizing the strategic value of PPAs to promote local renewable energy initiatives.

Germany, now Europe's second-largest PPA market after Spain, exemplifies the growing reliance on these agreements to bolster renewable energy's share in electricity generation. The European Commission, in response to the 2022 energy crisis, has advocated for PPAs, encouraging Member States to introduce de-risking measures such as state-backed or private guarantee schemes. A noteworthy development in the PPA landscape is the integration of battery storage, which significantly improves the economic feasibility of renewable energy.

With the electric vehicle sector propelling an 80% reduction in battery costs, storage technology is now a competitive option for managing the variable output from wind and solar farms, alleviating grid congestion, and safeguarding against power outages during peak demand. In a landmark move, Solar Holler's agreement with Wayne County Schools in West Virginia, facilitated by a favorable shift in state policy and the Inflation Reduction Act, showcases the potential savings PPAs can offer—anticipated at $6.5 million over 25 years. This agreement, the largest of its kind in Appalachia, highlights the transformative impact of PPAs in driving renewable energy adoption and economic sustainability.

Financial PPAs from Dedicated Renewable Plants

Power Purchase Agreements (PPAs) with dedicated renewable power plants are shaping the Sustainable Aviation Fuel (SAF) industry's economic landscape. By securing competitive electricity rates and favorable terms through PPAs, SAF producers can achieve substantial savings on the cost per gallon of fuel.

This is not only beneficial for the bottom line but also bolsters the economic viability of SAF in the competitive fuel market. With PPAs, the volatility of market prices is mitigated, ensuring a steady and sustainable electricity supply crucial for SAF production operations.

Despite the higher costs and the emerging state of the technology, SAF plays a pivotal role in the aviation sector's decarbonization efforts. The International Civil Aviation Organization's target of net-zero carbon emissions by 2050 underscores the urgency of addressing these challenges.

The PtL (Power-to-Liquid) process, while still in its infancy, promises remarkable CO2 emission reductions between 89 to 94%. However, hurdles such as scaling up production and managing costs remain.

The global commitment to sustainable aviation is evident in the construction of new SAF production facilities, like the pilot plant in Montreal and the planned facility in Sweden. These projects are testaments to the industry's resolve to overcome supply and cost challenges.

Innovations like [[[Unifuel.tech's flexiforming technology](https://fuelcellsworks.com/news/lhyfe-and-saf-international-group-sign-a-memorandum-of-understanding-to-produce-e-saf-from-green-and-renewable-hydrogen-to-decarbonise-the-aviation-industry/)](https://fuelcellsworks.com/news/lhyfe-and-saf-international-group-sign-a-memorandum-of-understanding-to-produce-e-saf-from-green-and-renewable-hydrogen-to-decarbonise-the-aviation-industry/)](https://fuelcellsworks.com/news/lhyfe-and-saf-international-group-sign-a-memorandum-of-understanding-to-produce-e-saf-from-green-and-renewable-hydrogen-to-decarbonise-the-aviation-industry/) offer a unique opportunity to accelerate SAF production. This technology allows operators to tailor their decarbonization trajectory and can be integrated into existing infrastructure, presenting a cost-effective solution to reduce carbon intensity. Flexiforming can be deployed in an idle hydrotreater or reformer, reducing both capital expenditure and carbon intensity. With a commitment to rapid response times and the ability to optimize the application of flex forming technology based on specific operational data, Unifuel.tech enhances the economic viability of SAF. A case in point is Kallista Energy, which operates multiple renewable energy farms and is developing a network of high-power charging stations for electric vehicles, showcasing the integration of renewable energy solutions into various sectors. Another example is the joint project near Forsmark, Sweden, which aims to produce electrofuel for aviation using fossil-free electricity, water, and recycled carbon dioxide. These initiatives highlight the industry's efforts to establish a more sustainable and economically viable SAF supply chain.

Real-Time Pricing (RTP) from Wholesale Power Market

Sustainable Aviation Fuels (SAFs) are poised to play a critical role in the decarbonization of the aviation sector, which currently accounts for 2-3% of global CO2 emissions. The U.S. aviation sector, being the third-largest source of domestic transportation emissions, is under scrutiny to reduce its carbon footprint.

As the industry grapples with the challenge of decarbonizing long-haul flights, Safe have emerged as a viable solution. The integration of Safe into the fuel mix is essential to meet the International Civil Aviation Organization's ambitious target of net-zero carbon emissions by 2050.

However, achieving this requires overcoming significant barriers, including the scale of production and the capital-intensive nature of the industry. With most relevant SAF production technologies ready, the primary hurdle remains the insufficient supply to meet the burgeoning demand.

Recent reports suggest that the global energy system's volatility underscores the urgency for alternative fuels like SAFs, derived from various renewable feedstocks. These include biomass, waste, natural oils, fats, and other carbon sources, which are key to reducing greenhouse gas emissions.

Despite the technical readiness, the current SAF production falls short, with less than 0.1% of global aviation fuel coming from SAFs. The planned annual output of 80,000 tons in Sweden, which represents about 5% of the nation's jet fuel demand, underscores the potential and the need for scaling up production.

The economic considerations are manifold, with environmental taxes playing a pivotal role in driving sustainable practices. According to Eurostat's definition, the tax base—rather than the motive or name—determines whether a tax is considered environmental. This definition facilitates cross-country comparative studies and encourages the adoption of environmentally friendly fuels. However, experts like Virgin's Weiss caution that significant investment and regulatory certainty, alongside price support mechanisms, are essential to scale SAF production. The industry's call for oil companies to prioritize supplying Safe is echoed by 86% of stakeholders, emphasizing the need for a concerted effort to foster innovation and collaboration in SAF usage globally. Unifuel.tech's flexiforming technology offers a new avenue for operators to accelerate SAF production by retrofitting existing infrastructure, thus reducing the capital expenditure typically associated with scaling up new technologies. This solution could be a game-changer in the push towards increasing SAF supply to meet demand.

Electricity Cost Comparison for SAF Production Locations

The economic viability of Sustainable Aviation Fuel (SAF) production hinges on a meticulous assessment of electricity costs in diverse locales. This scrutiny must account for local electricity tariffs, renewable energy adoption, and regional incentives, which collectively can substantially sway Saf's cost per gallon.

Through this lens, the Levelized Cost of Energy (LCOE) emerges as a pivotal gauge, reflecting the interplay of escalating energy costs against investment, alongside operational, maintenance, and fuel expenses. Enhanced energy output, capacity factor improvements, and extended project longevity inversely affect LCOE, underscoring its importance in integrating energy resources into the grid efficiently.

Indeed, Aspen Process Economic Analyzer software underscores the financial implications of SAF production, revealing capital costs of $71 million and operating costs of $303 million annually, with a gross profit of $60.5 million per year and a net present value (NPV) of $235 million. The payback period for such an investment is estimated at 1.7 years, with product price fluctuations being the most significant factor affecting NPV.

Moreover, the SAF industry, though nascent with limited producers, is pivotal for the aviation sector's decarbonization, as it offers a potential CO2 emission reduction of 89 to 94% through the Power-to-Liquids (PtL) process. Furthermore, the existing demand for natural gas and diesel, alongside the necessity for defossilization strategies in the energy sector, positions SNG as a crucial alternative. The integration of SNG into existing gas-fired power plants can maintain peak load coverage while advancing decarbonization efforts. This integration strategy, combined with the potential of converting economically challenged refineries to renewable fuels production, presents a transformative opportunity for the industry. With Saf's planned annual output poised to meet a significant portion of Sweden's jet fuel demand by 2030, the sustainable aviation sector is at the cusp of a major shift, driven by the collective effort of stakeholders and the evolution of new business models within the SAF value chain.

Economic Challenges of Aviation Electrification

The imperative to mitigate the aviation industry's carbon footprint is gaining momentum, with sustainable aviation fuel (SAF) emerging as a pivotal solution. Saf's immediate impact on CO2 emissions reduction is increasingly recognized by industry leaders, as Airbus commits to making their aircraft 100% SAF-capable by the year 2030.

With the sector's ambition to achieve net-zero emissions by 2050, the development of SAF is not just an environmental imperative but a strategic necessity. However, the technological evolution toward greener skies does not stop there.

Electric aviation is carving its niche in the industry, with advancements in battery technology and infrastructure marking the early stages of a transformative journey. The recent FAA endorsement of an electric aviation training program and the successful test flights of Eviation's nine-seater electric plane indicate a trend toward short-haul electric flights.

This is particularly relevant considering that the majority of the U.S. and European populations are within close proximity to regional airports, enhancing the viability of electric aviation for shorter routes. Nevertheless, the economic and technological hurdles ahead are significant.

It will take considerable investment in infrastructure and fleet renewal to transition to electric and hydrogen-powered aircraft. Moreover, the scale-up of these technologies to make a substantial dent in aviation emissions is projected to take decades. The challenge is further underscored by the fact that aviation's share of global carbon emissions is poised for a steep increase. Therefore, a multifaceted approach that prioritizes immediate measures, such as SAF, alongside the pursuit of long-term solutions like electrification and hydrogen, is crucial. The industry's journey toward sustainability is complex, but the collaboration across sectors and borders, as seen in Airbus's partnership with Emirates and initiatives like the 'Hydrogen Hub at Airports,' points to a future where aviation's environmental impact is significantly reduced.

CO2 Utilization for SAF Production

Integrating carbon utilization into Sustainable Aviation Fuel (SAF) production represents a promising avenue for enhancing its economic dynamics. By capturing and repurposing CO2 from industrial emissions or directly from the atmosphere, we can tap into new revenue streams and significantly reduce emissions. Technologies such as carbon capture and utilization (CCU) are pivotal in this process, but their deployment hinges on the availability of CO2 sources, technology costs, and market demand for low-carbon fuels.

While the Power-to-Liquids (PtL) process is still nascent, it offers the potential to slash CO2 emissions by up to 94%. Despite SAF's critical role in the aviation industry's net-zero ambitions by 2050, its supply is lagging behind demand. This shortfall is exacerbated by the limited economic viability of SAF feedstocks and competition from other sectors for biofuel resources.

In this context, Unifuel.tech's Flexiforming technology emerges as a transformative solution. By retrofitting existing refinery infrastructure, such as idle hydrotreaters or reformers, Flexiforming can reduce both capital expenditures and carbon intensity. Unifuel.Tech's tailored approach to Flexiforming leverages the specific characteristics of feedstocks, targeted products, and existing facilities to optimize its application, allowing operators to choose their speed of decarbonization.

The company's commitment to rapid response, guaranteeing communication within 24 hours, underscores their dedication to customer service and technical support. Nonetheless, the path to large-scale SAF production is complex and necessitates a collaborative industry-wide effort. It's not just about a single technology or company; overcoming the six main roadblocks identified for SAF production requires a concerted push.

As we face supply constraints, with SAF being three to four times costlier than conventional jet fuel and accounting for a mere fraction of today's kerosene consumption, every contribution counts. For instance, passenger contributions at airports like Amsterdam's Schiphol are used to purchase additional SAF, although it's not yet feasible to allocate it directly to individual flights due to logistical challenges. With Sweden's planned SAF output set to meet only a fraction of its jet fuel demand by 2030, and current policy trajectories predicting a significant supply-demand gap by 2050, the urgency for scalable solutions is evident.

Policy and Funding for SAF Production

As the aviation sector confronts the challenge of reducing its carbon footprint, Sustainable Aviation Fuel (SAF) emerges as a critical component in the pursuit of decarbonization. Despite Saf's burgeoning role, its economic viability is contingent upon a matrix of factors, including government support and regulatory compliance.

For example, in Australia, the Sustainable Aviation Fuel Roadmap delineates the country's advantageous position to cultivate a domestic SAF industry. It underscores the necessity for certification processes, such as lifecycle greenhouse gas assessments, to ensure adherence to international standards, a prerequisite for global market penetration of Australian-produced SAF.

In Canada, the establishment of a collaborative platform for the SAF value chain is driving innovation and scaling up SAF utilization. This initiative exemplifies the importance of synergistic efforts among stakeholders to catalyze progress in SAF production and usage.

Meanwhile, in regions like the Great Lakes and the Rocky Mountains in the United States, policy levers are being explored to unlock SAF's potential, signaling a transformative period for local industries and environmental objectives. However, the industry also grapples with challenges such as supply chain constraints and the nascent state of SAF technology.

With the International Civil Aviation Organization targeting net-zero carbon emissions by 2050, the demand for SAF is expected to outstrip supply. This underscores the urgency for policies that not only incentivize SAF production but also ensure its sustainability and affordability. The ReFuelEU Aviation initiative and the 'Fit for 55' package are examples of such efforts, aimed at reducing greenhouse gas emissions and achieving climate neutrality within the European Union. In conclusion, the path to a sustainable and economically viable SAF production landscape hinges on an integrated approach involving government policies, financial incentives, and international collaboration. As stakeholders navigate the complexities of this evolving market, the focus remains on developing SAF in a manner that aligns with global environmental goals and energy security needs.

Conclusion

In conclusion, the economics of sustainable aviation fuel (SAF) production rely on factors such as feedstock selection, production costs, and market demand. Renewable naphtha shows promise for its lower carbon footprint and economic feasibility.

Power purchase agreements (PPAs) and battery storage integration enhance the viability of renewable energy. Understanding electricity costs in different locations is crucial for successful SAF integration.

Flexiforming technology offers customizable decarbonization trajectories and reduces capital expenditure. However, scalability challenges and competition from other sectors remain.

Aviation electrification faces significant economic and technological hurdles, but SAF remains a vital solution for immediate CO2 emissions reduction. Collaboration is key to achieving sustainability goals.

Integrating carbon utilization into SAF production presents an opportunity to enhance economic dynamics and reduce emissions. Policy support and funding are critical for the economic viability of SAF production. Government initiatives, collaborative platforms, and regulatory compliance drive innovation. In conclusion, understanding the economics of SAF production is essential for successful integration into the aviation industry. Collaboration among stakeholders, policy support, innovative technologies like Flexiforming, and advancements in renewable energy storage are key to achieving sustainable and economically viable SAF production at scale.