Introduction

The sustainable aviation fuel (SAF) market is gaining momentum as the aviation industry strives to reduce its environmental impact. With the goal of achieving net zero carbon emissions by 2050, SAF is emerging as a pivotal solution in this eco-conscious renaissance. Unlike other proposed alternatives such as hydrogen or electric batteries, SAF doesn't require extensive aircraft or engine redesign, making it a practical choice for the industry.

The market for SAF is projected to grow significantly by 2027, driven by the increasing demand for greener aviation fuel alternatives, government regulations, and the growing awareness among airlines of SAF's advantages. Companies like Alder Fuels and BP plc are leading the way in producing renewable jet fuels that meet stringent sustainability standards. However, despite its potential, SAF currently represents only 0.1% of all flights, indicating immense room for growth.

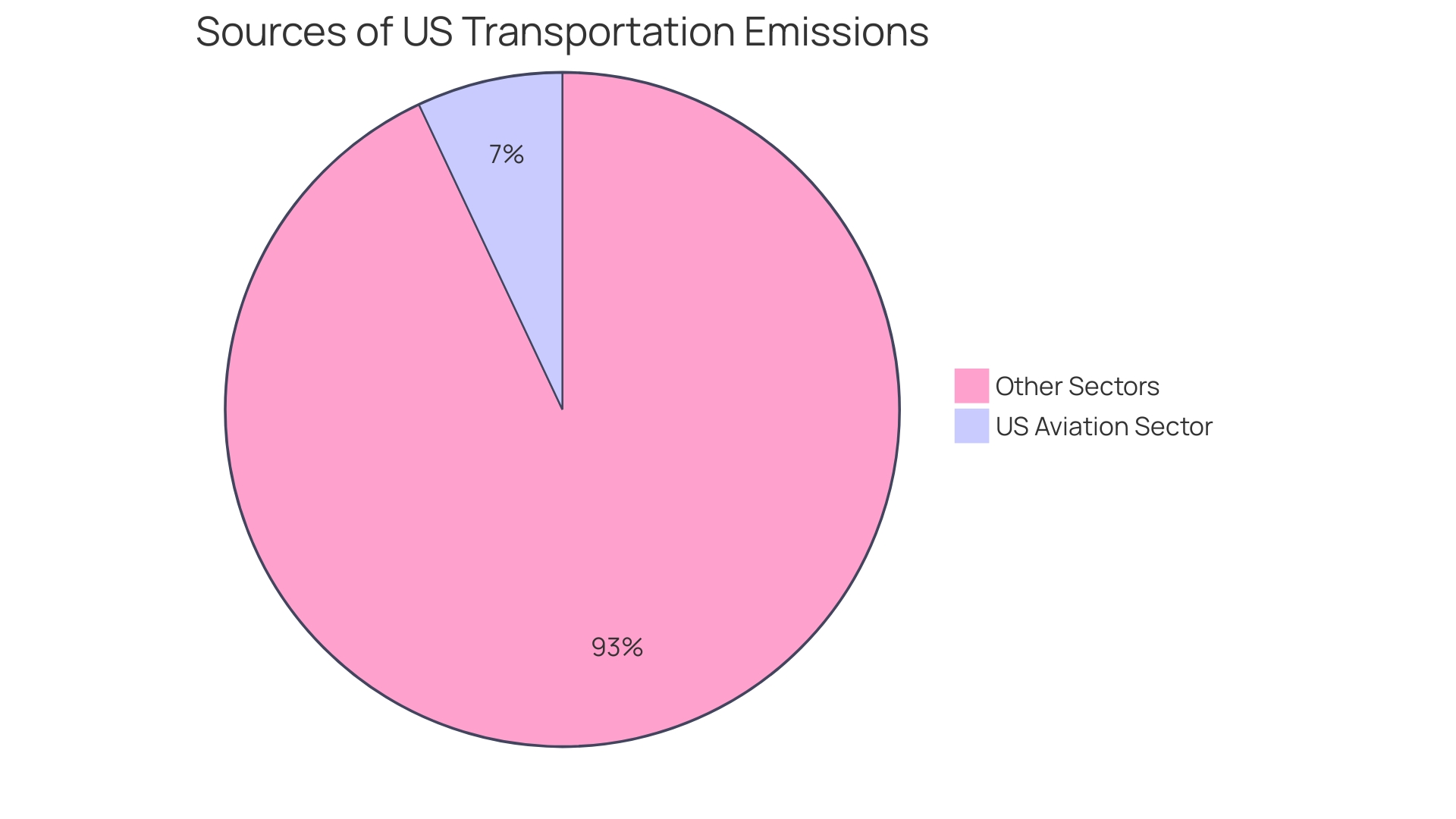

The adoption of SAF is not just an interim solution but the most viable option for the aviation industry's mid-century environmental goals. As the third-largest source of transportation emissions in the U.S., the aviation sector urgently needs a sustainable overhaul, and SAF offers a pathway to achieve that. The article explores key drivers for market growth, regulatory support, technological advancements, segmentation by fuel and aircraft type, regional market analysis, the competitive landscape, and challenges and opportunities in the SAF market.

The industry's collective efforts, technological innovation, and collaborations hold the key to a greener future in aviation.

Market Size and Growth Projections

As the air travel sector moves forward with its dedication to achieve net zero carbon emissions by 2050, sustainable aviation biofuel (SAF) stands as a crucial component in this environmentally conscious revival. Presently, SAF is a beacon of progress, particularly as it does not necessitate the development of new aircraft or engines, unlike other proposed solutions like hydrogen or electric batteries which may require extensive redesign and infrastructure changes. The present course of Saf's market expansion is proof of its potential, with a projection indicating a notable rise in market size by 2027, driven by a compound annual growth rate (CAGR) that showcases the sector's dynamism. This expansion is driven by the escalating demand for greener alternatives to aviation fuel, the tightening grip of government regulations aimed at reducing carbon emissions, and the heightened cognizance of airlines regarding the advantages of Sustainable Aviation Fuels (SAFs).

At the forefront of this movement, companies like Alder Fuels are utilizing patented technologies to pioneer the creation of sustainable jet propellants that adhere to strict industry standards for environmental friendliness. These high-performance, low-emission SAF solutions are carving a pathway for the industry to minimize the carbon footprint of air travel. Similarly, energy conglomerate BP plc is extending its portfolio to encompass diverse energy products including SAF, as part of its broader strategy to transition towards a low-carbon future.

Despite the promise of SAF, its current utilization remains a mere 0.1% of all flights, highlighting the nascent stage of its market penetration and the immense scope for growth. The inflection point for Saf's broader adoption hinges on its ability to scale up to meet the demands of long-haul flights, which will require significant volumes of fuel. The sector's growth momentum is further fueled by dynamic market trends and a competitive landscape that spurs continuous innovation and offers of high-quality, environmentally benign solutions aligned with the sustainability objectives of the aviation field.

With the U.S. air travel sector representing the third-largest source of transportation emissions in the country and projections indicating an uptick in emissions due to growing air travel and freight demands, the urgency for a sustainable overhaul is clear. Given that commercial aircraft often remain operational for two to three decades, relying solely on advancements in aircraft design or electrification would likely fall short of the decarbonization timeline. Thus, SAF emerges not just as an interim solution, but as the most viable option for the industry's mid-century environmental goals, setting a precedent for the sector's sustainable transformation.

Key Drivers for Market Growth

The sustainable air travel fuel (SAF) market is gaining momentum, propelled by the air travel sector's commitment to curtail its environmental impact. With commercial flying identified as a significant contributor to human-induced climate change, accounting for 3.5% of energy balance alterations in the Earth's atmosphere, the shift toward SAF is not just a trend but a necessity. The emissions from air travel alone have surged since the 1980s, now threatening to consume a quarter of the CO2 budget needed to keep global warming under 1.5°C by 2050.

As a reaction to these ecological obstacles, the sector is shifting from traditional jet substances to SAF solutions. These alternative fuels are designed to be compatible with existing aircraft engines, offering the potential to decrease the sector's carbon footprint without additional planet-warming gases. Companies like Aemetis Inc. and Alder Fuels are at the forefront, leveraging patented technologies to produce high-performance SAF that complies with rigorous standards.

Promisingly, government policies are supporting this shift through incentives, emphasizing the significance of cooperation between policymakers and the airline sector. The Science Based Targets initiative (SBTi) exemplifies such collaboration, fostering corporate commitment to scientifically grounded emission reduction targets. Moreover, the introduction of sustainable solutions extends beyond environmental benefits, as demonstrated by ATR's turboprop technology, which significantly reduces consumption of energy source and CO2 emissions compared to regional jets, thereby also opening new routes and fostering global connectivity.

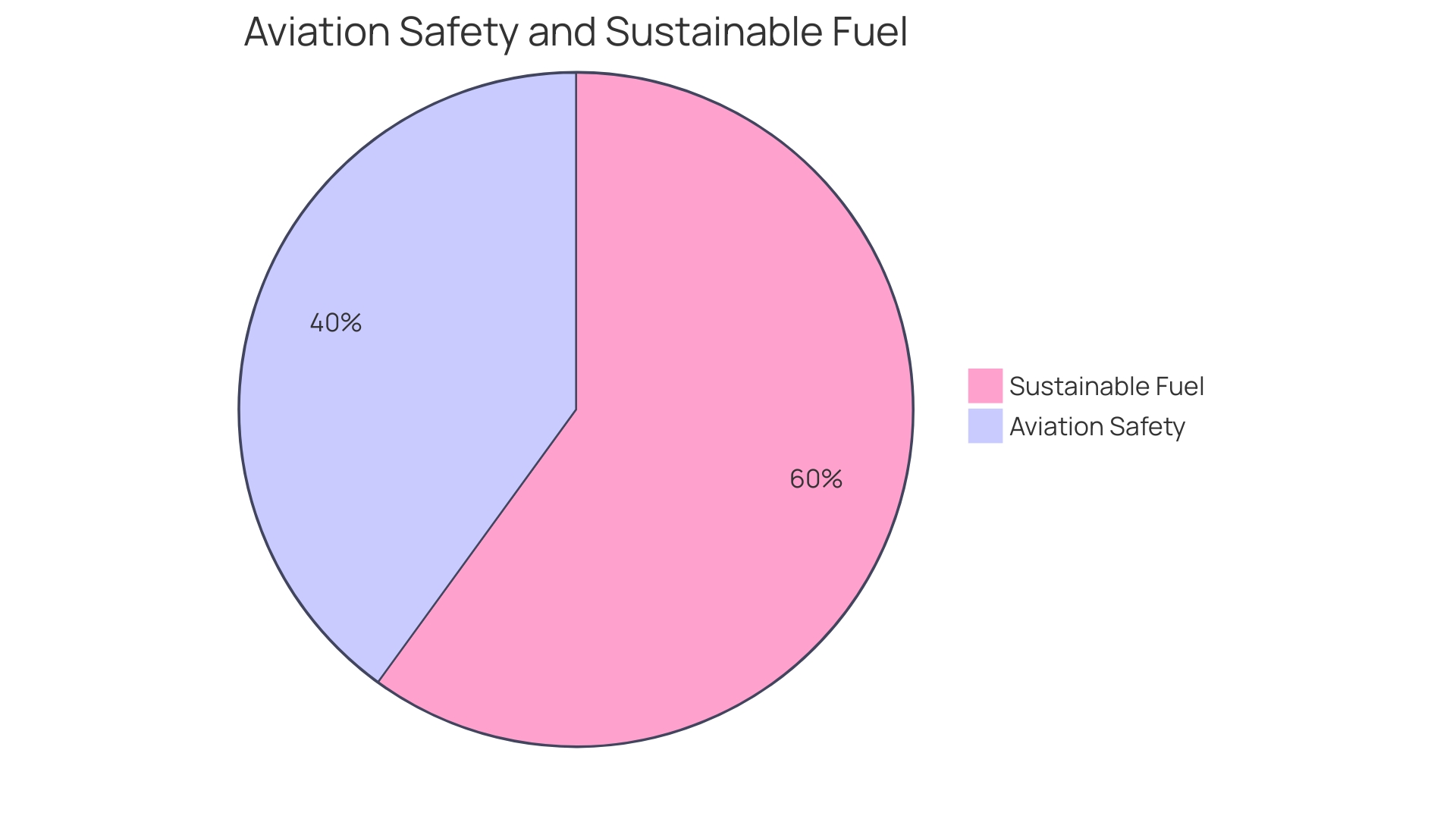

With the dual challenges of reducing climate impact and fulfilling the growing need for air travel, the implementation of SAF is a strategic move for the air travel sector. As dynamic market trends push companies to innovate, the focus on producing cost-effective, energy-efficient SAF is paramount. This shift is supported by a deepening safety culture within the sector, which now includes sustainability as a critical component of its infrastructure.

Regulatory Support and Environmental Concerns

The development of the sustainable SAF market is greatly impacted by regulatory frameworks and the urgent requirement to tackle environmental concerns. Governments and regulatory authorities globally are enacting policies to bolster SAF usage. Significantly, the International Civil Aviation Organization (ICAO) is dedicated to achieving carbon-neutral growth in the air transport industry starting in 2020, a pledge that has spurred the implementation of requirements and encouragements for SAF adoption by different countries. The need to reduce carbon emissions and mitigate the climate impact of air travel is driving airlines towards sustainable alternatives.

In the quest to achieve net-zero carbon emissions by 2050, the aviation industry faces a formidable challenge. For instance, Delta Air Lines has established an ambitious plan to substitute 10% of their annual 4 billion gallons of jet energy with SAF by 2030. Furthermore, the airline is actively decreasing its energy consumption by a minimum of 10 million gallons per year until 2030. SAF, derived from renewable waste and residue materials, such as used cooking oils and animal fats, offers a viable, sustainable substitute to conventional jet fuel.

However, misconceptions about SAF persist, underscoring the importance of education in fostering its adoption. According to Amelia DeLuca, Delta's Chief Sustainability Officer, it is essential to communicate to consumers the wider importance of SAF—beyond entertaining stories like its French fry-like aroma—emphasizing its contribution to the sector's transition towards net-zero emissions.

Advancement in SAF manufacturing and its integration into the current air travel infrastructure are gaining momentum, with pioneers like Alder Fuels and energy giants such as BP investing in high-performance, low-emission SAF solutions. As production scales up globally, similar to the renewable energy sector's growth, the efficiency improvements and cost reductions are anticipated to drive broader adoption.

Despite its potential to significantly reduce emissions from flying, Saf's journey is not without controversy. Concerns have been raised over certain SAF sources potentially leading to deforestation or competing with agricultural land use. The challenge of supply and the feasibility of deploying SAF at scale remain critical considerations within the sustainability agenda of the sector.

As the sector navigates the intricacies of decarbonization, the role of SAF is unquestionably pivotal to the strategy for a more sustainable future in air travel, with collaborations, education, and technological advancements leading the way ahead.

Technological Advancements and Innovations

The sustainable flight energy (SAF) market is undergoing a dynamic change, driven by technological advancements and the goal of achieving net-zero carbon emissions by 2050. With 90% of the aviation sector's emissions originating from jet propellant, companies like Delta Air Lines are setting ambitious goals to incorporate 10% SAF into their annual fuel usage by 2030. Innovative production pathways are harnessed, utilizing renewable waste and residue raw materials—ranging from used cooking oils to agricultural by-products and even municipal solid waste—offering a greener alternative to conventional jet fuel.

SAF's potential is not just theoretical; it's being realized through groundbreaking facilities like the LanzaJet Freedom Pines Fuels plant in Georgia, the first of its kind to convert ethanol into SAF. This groundbreaking technology is a testament to the commitment of the sector to decarbonization. Furthermore, considering that the sector related to air travel accounts for a substantial amount of worldwide emissions and only 0.1% of flights are currently powered by sustainable aviation fuel (SAF), the urgency for expansion in this field is palpable.

The transformation of the sector is also apparent in the collaborations and educational initiatives underway. Airbus's partnership with Neste and Delta's with Virgin Atlantic emphasize the shared commitment towards a sustainable future in air travel. These initiatives highlight the crucial role of SAF in achieving the sustainability goals of the sector, with the additional advantage of propellant obtained from atypical sources like human waste, as examined by the British company Firefly.

Amidst this innovation, it's essential to convey the importance of SAF to the public, dispelling myths and emphasizing its role in sustainable travel. According to Amelia DeLuca from Delta Air Lines, the focus is not solely on locating sustainable feedstocks but also on decreasing total energy usage. The route to a more environmentally friendly sector is lined with obstacles, yet the technological creativity and cooperative nature of the field indicate a hopeful voyage in the future.

Segmentation by Fuel Type and Aircraft Type

Sustainable aviation SAF has emerged as a pivotal solution for the aviation industry's journey towards net-zero carbon emissions. Given the sector's significant impact on the environment, mainly caused by the combustion of jet fuel, the demand for SAF has gained significant momentum. SAF is produced from renewable waste and residue raw materials, such as used cooking oils and animal fat waste, presenting a cleaner alternative to conventional jet propellants.

The market for SAF is diverse, encompassing various types of energy sources such as biojet, hydroprocessed esters and fatty acids (HEFA), and Fischer-Tropsch (FT) synthetic paraffinic kerosene (SPK). Biojet, in particular, has witnessed an increase in acceptance because of its smooth integration with existing aircraft engines and its reduced carbon emissions. Amelia DeLuca, Chief Sustainability Officer at Delta Air Lines, emphasizes the importance of SAF by highlighting Delta's dedication to substituting 10% of their annual jet consumption with SAF by 2030. This initiative is part of a broader strategy to reduce their overall fuel usage and contribute to the industry's decarbonization efforts.

In the realm of aircraft categories, commercial flying prevails in the SAF market, driven by a growing number of airlines focusing on sustainability. Military and general aviation also incorporate SAF, but the commercial sector's sheer volume of flights has made it the primary driver of demand.

Innovative partnerships and technologies are crucial to advancing SAF adoption. For instance, Delta's collaboration with various stakeholders aims to educate consumers on Saf's benefits and debunk common misconceptions, such as the humorous notion that SAF might smell like French fries due to its origins from cooking oil. These collaborative efforts are essential for fostering a well-informed public that supports the sector's sustainable transition.

The development of the SAF market is also characterized by dynamic trends and global efforts propelling competition, urging sector players to innovate and offer high-quality, eco-friendly solutions. Enterprises such as Aemetis Inc. and Alder Fuels are leading the way in this trend, utilizing patented technologies to generate sustainable jet propellants that comply with strict sector norms, thus diminishing the carbon impact of air travel.

The way to a sustainable airline industry is intricate and necessitates a diverse approach, encompassing enhancements in energy technology, customer enlightenment, industry cooperation, and pioneering market solutions. As the field of air travel continues to evolve, the role of SAF stands out as a crucial component in attaining the sector's ambitious environmental objectives.

Regional Market Analysis

The scenery of the sustainable fuel market for flying is constantly changing, with different areas around the world adopting and integrating fuel for flying at different speeds. In North America, the market is burgeoning, buoyed by the presence of leading airlines and a robust regulatory framework that encourages the use of SAF. Europe's market is similarly expanding, propelled by strict environmental policies and the airlines' increasing commitment to curbing carbon emissions.

The Asia Pacific region is on the cusp of significant expansion, with China and India's soaring air travel demands acting as a catalyst. Reports emphasize the crucial role of collaboration between stakeholders across the air travel, energy sectors, and public sector in these regions, highlighting financial and policy strategies that can facilitate an environment ripe for SAF scaling.

Technological advancements and strategic global production hubs are also under the spotlight, pinpointing the constraints in cost and supply that currently challenge the market. These insights point to a concerted effort required to overcome barriers and satisfy the growing SAF demand.

In contrast, regions like Latin America and the Middle East, though smaller in SAF market share, are demonstrating potential for growth. Innovative companies like Alder Fuels are leading the way in the SAF sector with their patented technologies aimed at reducing the carbon footprint of air travel, while global energy companies such as BP plc are diversifying their portfolios to include low-emission SAF solutions.

The dynamic market trends and the global push towards sustainable air travel solutions are intensifying competition, urging players to innovate and offer high-quality, environmentally friendly solutions. This is in accordance with the broader sustainability goals of the sector and the international commitment to achieving net-zero carbon emissions by 2050, as established at the 41st Assembly of the International Civil Aviation Organization (ICAO).

Competitive Landscape and Key Players

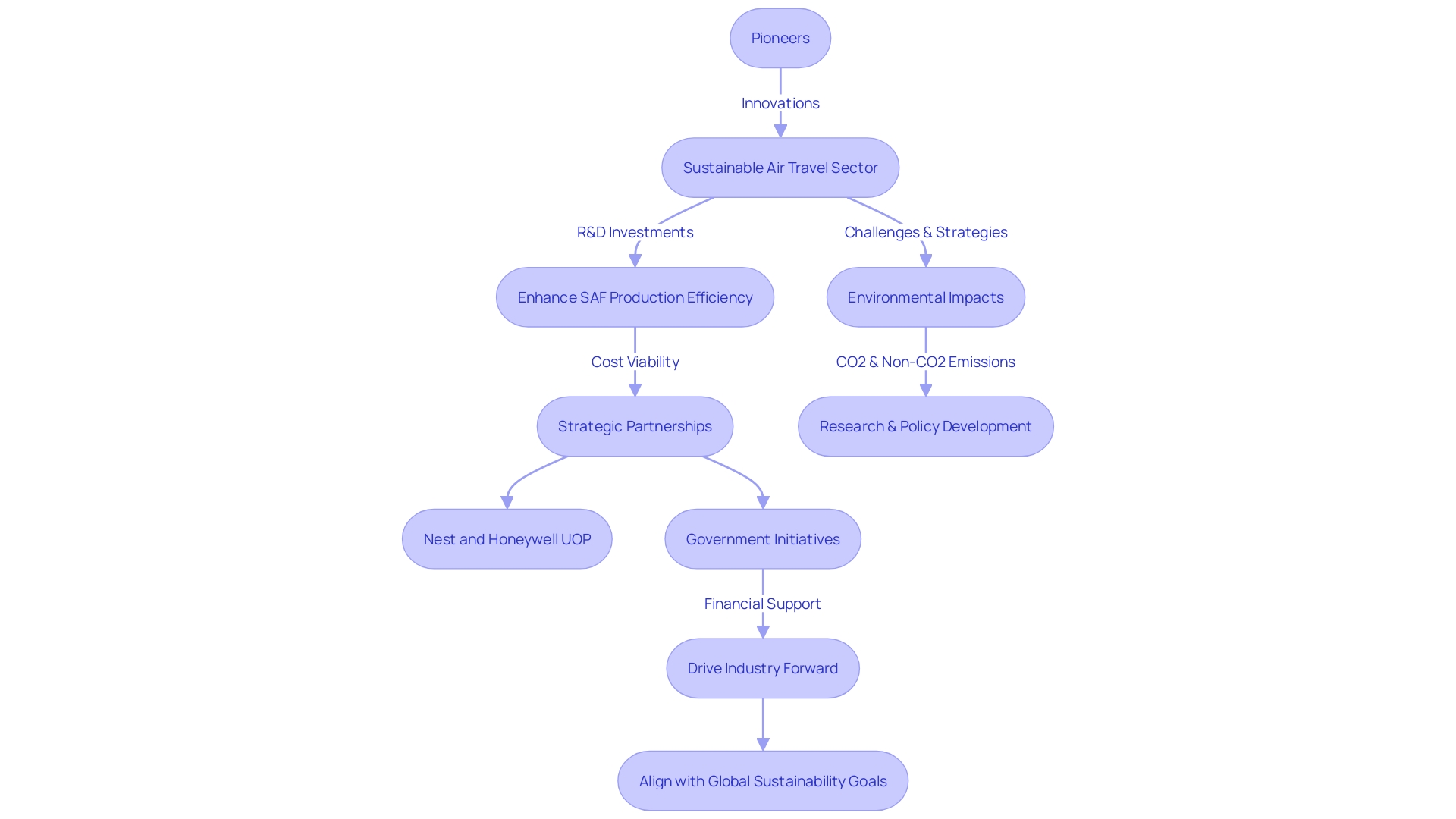

In the swiftly progressing sustainable air travel sector, a group of pioneers are driving innovations to satisfy the increasing environmentally aware travel needs of the world. Companies like Southwest Airlines and Gevo are at the forefront, investing heavily in research and development to enhance SAF production efficiency and cost viability. Their efforts are supplemented by strategic partnerships and collaborations, with entities such as Nest and Honeywell UOP aligning with airlines and fuel suppliers to expand their operational footprint in the market. Furthermore, the backing from government initiatives is crucial, providing the necessary financial support to enhance production capabilities, facilitating a stable supply chain in response to the growing demand for sustainable flight solutions. These collaborative efforts by important market participants aim to not only drive the industry forward but also align with global sustainability goals, thereby contributing to a cleaner air travel impact.

Challenges and Opportunities in the SAF Market

Sustainable Fuel (SAF) represents both a challenge and a beacon of hope for the sector, currently grappling with the imperative to reduce its carbon footprint. The high costs of SAF production, primarily due to expensive feedstocks and complex manufacturing processes, stand as a significant hurdle. This is in stark contrast to traditional jet propellant, which benefits from a well-established supply chain. Nevertheless, as technological advances and economies of scale come to fruition, we anticipate a downward trend in these costs.

In the realm of SAF, a notable accomplishment is the pioneering transatlantic flight executed by Virgin Atlantic, utilizing a Boeing 787 powered by a blend of SAF derived from waste fats, including tallow. This historic flight, a first of its kind, symbolizes a substantial stride towards net-zero aviation emissions. However, the constraints of energy supply and the early phase of this technology highlight the necessity for extensive acceptance and infrastructural investment.

In a classroom setting, the examination of SAF's lifecycle impacts by biology students at Waubonsee Community College underscores the educational importance of this fuel. It reveals the diverse approach needed to understand and tackle the environmental impact of air travel.

Furthermore, the establishment of the LanzaJet Freedom Pines Fuels plant in Georgia signifies a major achievement in the field of sustainable flight, signaling the beginning of the world's first ethanol-to-SAF production facility. This venture stands testament to the innovative spirit that propels the industry towards a greener future.

Encouragingly, only about 10% of the global population utilizes air travel, suggesting an untapped market poised for growth. With the contribution of approximately 4% to global carbon emissions, the sector is at a crucial moment to embrace SAF and mitigate its environmental impact significantly. The International Energy Agency highlights the urgency, noting that air travel contributes to 2% of global greenhouse gas emissions, a percentage expected to increase as demand for flying grows.

To expedite this transition, businesses, governments, and innovators must collaborate, fostering technological breakthroughs and robust market signals. The Sustainable Flight Innovation Challenge, initiated by UpLink and the First Movers Coalition, showcases this collaborative spirit by highlighting 16 innovators ready to revolutionize the airline sector.

The road ahead for SAF is undeniably challenging, yet the collective will and innovative prowess within the sector promise a future where aviation not only coexists with our environmental aspirations but actively champions them.

Conclusion

In conclusion, the sustainable aviation fuel (SAF) market is rapidly growing as the aviation industry strives to reduce its environmental impact and achieve net zero carbon emissions by 2050. SAF offers a practical and viable solution without requiring extensive aircraft or engine redesign. The market is projected to expand significantly by 2027, driven by increasing demand for greener aviation fuel alternatives, government regulations, and growing awareness among airlines of SAF's advantages.

Companies like Alder Fuels and BP plc are leading the way in producing renewable jet fuels that meet sustainability standards. However, SAF currently represents only 0.1% of all flights, indicating immense room for growth. SAF is not just an interim solution; it is the most viable option for the aviation industry's mid-century environmental goals.

Key drivers for market growth include the aviation sector's commitment to reducing its environmental impact, government policies and incentives, and the need to address climate change caused by aviation emissions. Technological advancements and innovations in SAF production are propelling the market forward, with companies utilizing renewable waste and residue materials to create greener alternatives to conventional jet fuels.

Regulatory support and environmental concerns play a crucial role in shaping the SAF market. Governments and regulatory authorities are enacting policies to promote SAF usage, and companies are educating consumers about SAF's broader significance in the industry's move towards net-zero emissions. Collaboration between stakeholders is essential for scaling up production and addressing supply and feasibility challenges.

The SAF market is segmented by fuel type and aircraft type, with biojet fuel being a popular choice due to its compatibility with existing engines and lower carbon emissions. Commercial aviation is the primary driver of SAF demand, but military and general aviation sectors are also incorporating SAF. Partnerships, collaborations, and technological advancements are crucial for advancing SAF adoption and meeting sustainability targets.

In conclusion, the SAF market holds immense potential for the aviation industry's sustainable transformation. The industry's collective efforts, technological innovation, and collaborations are key to achieving a greener future in aviation. Embracing SAF will significantly reduce the aviation sector's carbon footprint and contribute to global sustainability goals.

Discover how Universal Fuel Technologies can help you implement SAF in your operations.