Introduction

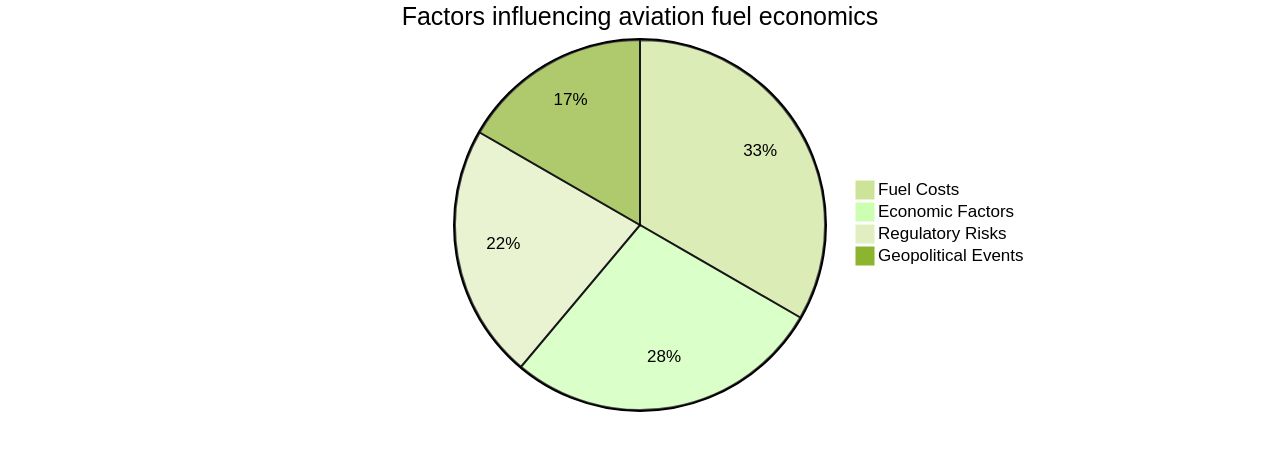

The aviation industry is heavily influenced by the economics of airplane fuel. With the price volatility of this commodity and its significant impact on operational costs, it is crucial to examine the factors affecting its market dynamics.

From fuel conservation to regulatory risks and geopolitical events, there are various economic factors that shape the industry's viability. Additionally, the pursuit of sustainable alternatives, like Unifuel.tech's Flexiforming technology, plays a vital role in the industry's future. In this article, we will explore the economics of airplane fuel and discuss the factors affecting its cost, trends in fuel prices, and the impact of fuel costs on airlines.

Understanding the Economics of Airplane Fuel

The aviation industry, central to worldwide connectivity and trade, is heavily influenced by aviation fuel economics. The price volatility of this commodity and its significant influence on operational costs necessitate a vigilant examination of the factors affecting its market dynamics.

Fuel consumption in aviation exacts a high cost not only to airlines but also to society due to its climate-change externalities. However, these costs can be mitigated through strategic operational changes for fuel conservation, which can significantly reduce emissions and enhance the industry's sustainability.

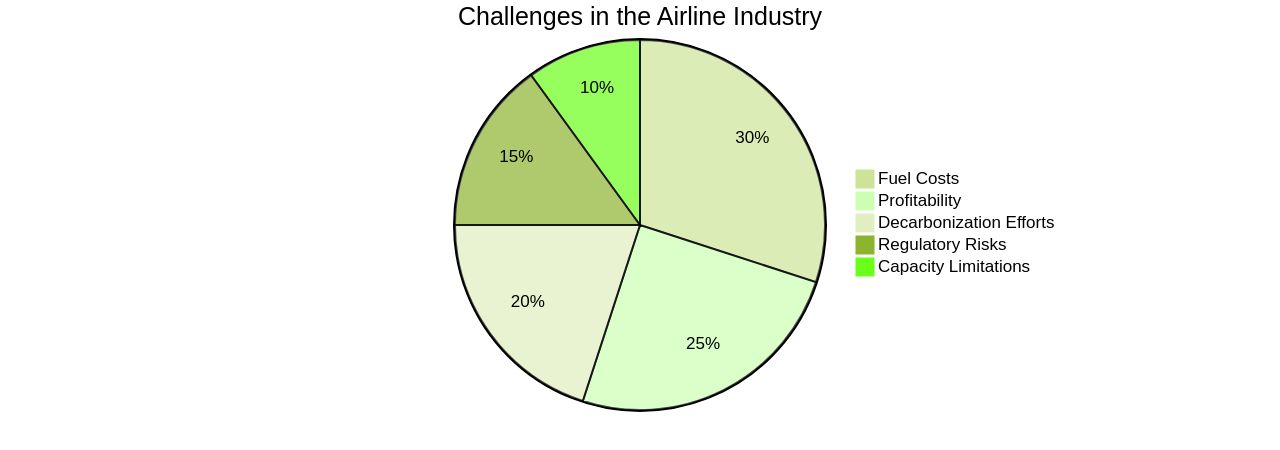

Beyond fuel costs, airlines face regulatory risks, including increasing compliance costs and additional expenses related to passenger rights, environmental initiatives, and accessibility requirements. The uneven recovery speed from the pandemic across various regions highlights the industry's financial vulnerability.

Economic factors such as inflation, unemployment rates, and travel demand also influence the industry's economic viability. Additionally, geopolitical events can disrupt operations and inflate fuel prices, leading to global impacts on airlines.

Higher fuel costs can result in increased fares, putting a strain on consumers. Major airlines have already experienced escalating fuel costs, which, combined with high inflation, can pressure consumers.

This situation has led to industry warnings about potential impacts on airline profits and travel demand. The industry's path to decarbonization, including levies on airfares to fund sustainable fuel initiatives, will also contribute to rising travel costs. However, this is a necessary step towards a more sustainable aviation industry. In this context, solutions like Unifuel.tech's Flexiforming technology can play a crucial role. Flexiforming allows operators to choose their decarbonization speed and can be deployed in an idle hydrotreater or reformer, reducing both capital expenditure and carbon intensity. Therefore, the effective management of aviation fuel costs and the pursuit of sustainable alternatives like Flexiforming are vital for the industry's future.

Factors Affecting the Cost of Airplane Fuel

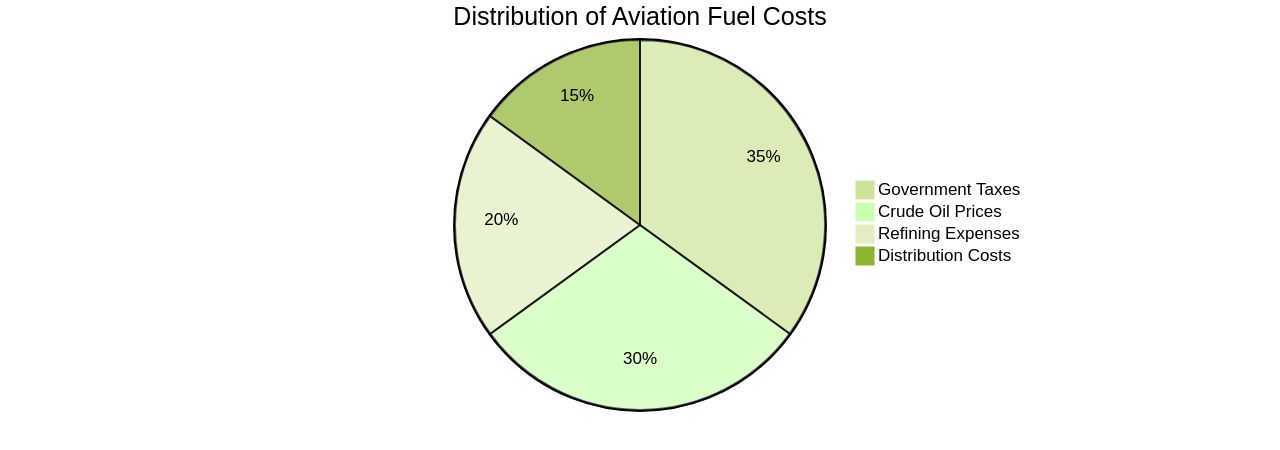

Aviation fuel costs are dictated by an array of variables, with the chief determinant being the price of crude oil, the primary raw material for fuel production. The escalating demands of burgeoning economies like China, India, and Latin America significantly sway oil prices.

Further, the discovery and exploitation of new oil reserves have become strenuous, thereby constraining supply and profoundly influencing global economic progression. This situation is exacerbated by the rising oil prices, with the West Texas Intermediate Crude, a standard for US oil prices, indicating a potential resurgence to $100 per barrel.

This upsurge, along with the challenges in fuel reserve management, presents substantial hurdles for airlines. Other contributing factors to the final fuel price include refining expenses, distribution costs, and government taxes.

Airlines are tasked with navigating this intricate terrain to optimize their operations, curtail costs, and lessen emissions. Interestingly, despite the rising oil prices, the demand for motor fuels in the US has not seen a significant increase from the last year. However, this trend is set to change as the demand for gasoline has started to ascend. As such, airlines need to remain alert and adapt to the fluctuating market dynamics to preserve their financial viability and sustainability.

Trends in Airplane Fuel Prices

The aviation sector's susceptibility to fuel market fluctuations, driven by geopolitical issues, natural disasters, and supply-demand alterations, necessitates the use of detailed historical trend analysis and vigilant market surveillance. In this context, models like the capital stock model provide valuable insights into capital stock utilization and composition, fostering emission reductions via fuel-efficient operations.

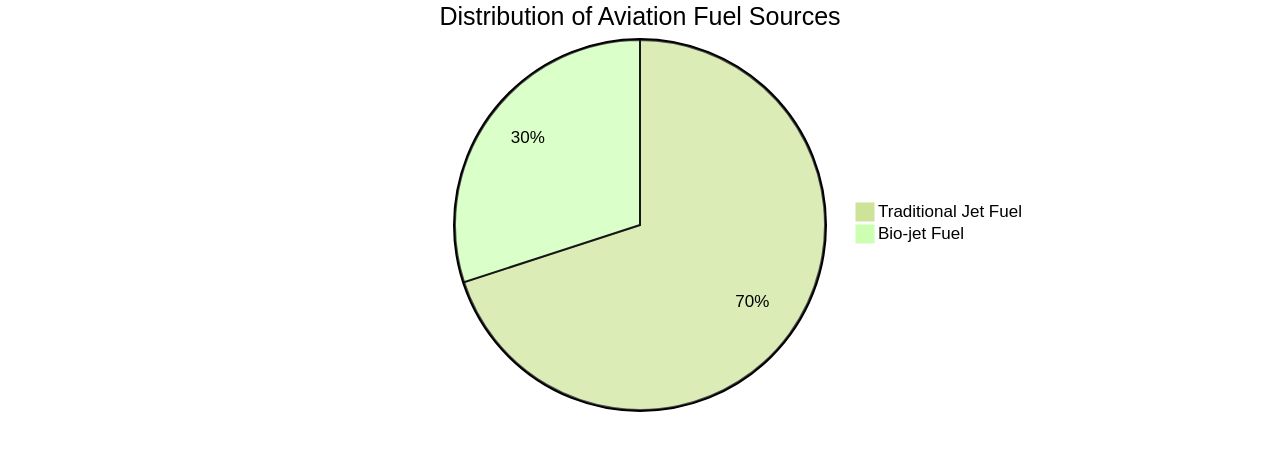

The increased Aviation Turbine Fuel (ATF) prices have compelled airlines such as IndiGo to implement a fuel surcharge, underscoring ATF's considerable role in operational costs. Simultaneously, the global aviation fuel market is projected to expand, fueled by the growing demand for bio-jet fuel.

Nevertheless, the high costs associated with aircraft fuels may hinder market growth. Further complicating matters, the recent oil price hike has triggered a rise in jet fuel prices, leading airlines to reevaluate their fuel hedging strategies and potentially increase flight prices.

Despite these challenges, passenger numbers in the global airline industry are nearing pre-pandemic levels, indicative of the potential of sustainable aviation fuels to herald a cleaner, greener aviation era. In this scenario, Unifuel.tech's Flexiforming technology emerges as a potential game-changer. This technology, which can be deployed in an idle hydrotreater or reformer, allows operators to choose their decarbonization speed, reducing both capital expenditure and carbon intensity. Unifuel.tech promises to provide an optimal application for Flexiforming based on the operator's feeds, target products, and existing facilities, with a response promised within 24 hours.

The Impact of Fuel Costs on Airlines

The airline industry navigates a complex landscape of operational and financial challenges, significantly influenced by the volatile nature of fuel costs. A key strategic consideration for airlines is the balance between absorbing increased fuel costs and transferring these costs onto customers, which could impact demand and overall profitability.

Research from the University of California, Irvine, highlights the potential for airlines to adjust their capital stock, specifically their fleet of durable aircraft, in response to changes in fuel prices, which could offer a pathway towards reduced emissions. However, a surge in oil prices, as witnessed by major airlines such as United, Delta, and American, could lead to an increase in passenger fares.

In response to rising Aviation Turbine Fuel (ATF) prices, Indian airline IndiGo has introduced a fuel charge on its domestic and international routes. Regulatory risks and the varying pace of post-pandemic recovery across regions also factor into airlines' financial performance and strategic decision-making.

The industry's goal of achieving net-zero emissions by 2050 may be challenged by the slow rate of fleet renewal and the current limitations of green aircraft technologies. In line with the industry's decarbonization efforts, the Singapore government is considering a levy on air fares to fund sustainable aviation fuel, suggesting that passengers may bear some of the cost of environmental initiatives.

Despite these challenges, the International Air Transport Association (IATA) projects strengthened profitability for airlines in 2023, which is expected to stabilize in 2024. However, net profitability globally is forecast to be below the cost of capital in both years, indicating significant regional variations in financial performance. On the regulatory front, airlines could face rising compliance costs and additional costs related to passenger rights regimes, regional environmental initiatives, and accessibility requirements. These factors, coupled with the direct impact of unforeseen maintenance issues and delays in aircraft and parts delivery, have limited capacity expansion and fleet renewal. The development of refineries that can produce chemicals, materials, and synthetic fuels from biomass, recycled plastic, carbon dioxide, and hydrogen instead of crude oil presents a sustainable method for reducing greenhouse gas emissions. This approach, powered by renewable energy, could potentially offer a more environmentally friendly way to power vehicles.

Conclusion

In conclusion, the economics of airplane fuel are crucial for the viability and sustainability of the aviation industry. Fuel price volatility, driven by factors such as crude oil prices, geopolitical events, and regulatory risks, significantly impacts operational costs. Strategic fuel conservation measures can mitigate costs and enhance sustainability.

Factors affecting fuel costs include crude oil prices, refining expenses, distribution costs, and government taxes. Challenges in discovering and exploiting new oil reserves constrain supply and influence global economic progression. Rising oil prices pose hurdles for airlines, requiring them to optimize operations and adapt to market dynamics.

Trends in fuel prices are influenced by geopolitical issues, natural disasters, and supply-demand changes. Historical trend analysis and market surveillance are necessary to navigate fluctuations successfully. Increased Aviation Turbine Fuel (ATF) prices have led to surcharges by airlines, underscoring ATF's role in operational costs.

The demand for bio-jet fuel presents opportunities for market expansion but may be hindered by high costs. Fuel costs impact airlines' operational and financial challenges. Balancing increased costs or transferring them to customers affects demand and profitability.

Adjusting capital stock in response to changing fuel prices offers a pathway towards reduced emissions. However, surges in oil prices can lead to increased passenger fares. The pursuit of sustainable alternatives like Unifuel.tech's Flexiforming technology is essential for the industry's future.

Flexiforming allows operators to choose decarbonization speed while reducing capital expenditure and carbon intensity. Addressing economic factors impacting fuel prices and embracing innovative solutions will be crucial for the aviation industry's success. Effective management of fuel costs through strategic measures will enable the industry to navigate volatility while moving towards a more sustainable future.