Introduction

The aviation industry is heavily influenced by the cost of fuel, with direct implications for airline profitability and competitiveness. As air travel demand surges and sustainability initiatives take center stage, airlines are focusing on enhancing financial robustness and optimizing resources. However, fuel prices have been subject to volatility, prompting airlines to reassess their fuel hedging strategies and consider fare adjustments.

Alongside rising fuel costs, labor negotiations and increasing passenger numbers add further complexity to the financial landscape. In this article, we explore the significance of fuel costs in the aviation industry, the current cost of airplane fuel, the impact of fuel prices on airline expenses, historical trends in fuel prices and airline costs, factors influencing fuel prices and airline economics, how fuel prices affect airline ticket prices, strategies airlines use to mitigate high fuel costs, the long-term implications of high fuel prices for airlines, and the future of aviation fuel, including alternatives and innovations. By delving into these topics, we gain a deeper understanding of the challenges and opportunities that arise from fuel costs in the aviation sector.

Significance of Fuel Costs in the Aviation Industry

Airplane fuel expenses are a pivotal factor in the aviation sector, with direct implications for the bottom line of airlines. It is one of the most substantial operational costs, influencing both profitability and market competitiveness. The recent data from the International Air Transport Association (IATA) reveals an optimistic outlook, with expected aggregate net profits of $30.5 billion in 2024, despite previous severe losses due to the pandemic.

As air travel demand surges to an anticipated five billion passengers in 2024, airlines are focusing on enhancing profitability and financial robustness to support customer needs and sustainability initiatives aimed at achieving net-zero carbon emissions by 2050.

Fuel prices have been subject to volatility, as evidenced by the rise in jet fuel costs averaging $3.42 a gallon at major U.S. airports, marking a 38% increase from two months prior, as reported by Airlines for America. These fluctuations have prompted airlines to reassess their fuel hedging strategies and consider fare adjustments. The financial resilience of airlines is further tested by labor negotiations, with American Airlines recognizing a significant expense due to new pilot contracts featuring substantial pay raises.

Amid these challenges, airlines have seen a resurgence in passenger numbers, returning to near pre-pandemic figures, and are capitalizing on the robust demand for air cargo, which is integral to the massive $8.3 trillion trade delivered globally by air. Total air cargo volumes are projected to reach 62 million tons in 2024, underscoring the sector's critical role in global commerce and the aspirations of economies worldwide.

In light of these dynamics, centralized budgeting and resource allocation have become essential for airlines to optimize their financial resources effectively. By adopting a centralized approach, organizations can eliminate redundancies and allocate resources strategically, thereby ensuring better coordination and informed decisions aligned with overarching growth objectives. Additionally, implementing robust performance evaluation systems for different divisions enables airlines to identify and address inefficiencies, reallocating resources to more productive areas and enhancing overall financial outcomes.

Current Cost of Airplane Fuel

Airlines in 2023 face a complex landscape when it comes to fuel costs, with a myriad of factors influencing the price per gallon of aviation fuel. Volatility in the price of crude oil, geopolitical tensions, and the intricacies of supply and demand have all shown their capacity to sway cost structures in the aviation industry. Notably, jet fuel prices have seen a significant uptick, with S&P Global Commodity Insights highlighting a jump from $97.78 a barrel in early July to a higher average in the beginning of August, underlining the impact of oil price shifts and refinery disruptions.

Airlines have been deploying strategies aimed at improving operational efficiency, as evidenced by the recent Thanksgiving travel surge at Washington Dulles International Airport where every minute saved in operations can lead to substantial cost savings. With the holiday season testing these new methods, airlines are keenly aware of the financial implications of fuel costs on their bottom lines. Major U.S. carriers have already felt the sting of jet fuel price increases, with some locations seeing a 30% rise to $3.18 a gallon in early September, leading to concerns over squeezed revenues and potential fare hikes.

The pursuit of sustainability also plays a crucial role in the future of airline operations. Airbus, for instance, is advancing towards making its fleet 100% Sustainable Aviation Fuel (SAF)-capable by 2030, a move that could significantly alter the economics of fuel consumption. This initiative, coupled with Emirates' recent SAF demonstration flight powered by Engine Alliance, showcases the industry's commitment to reducing its carbon footprint.

Against this backdrop of rising costs and sustainability goals, airlines are experiencing a resurgence in travel demand, nearly reaching pre-pandemic passenger levels, which could offer some cushion against financial pressures. Nonetheless, airline executives like those at Delta Air Lines assert that despite domestic demand softening, travel remains a top priority for consumers, with robust bookings to prove it. As the industry navigates through these challenges, the delicate balance between managing fuel expenses and optimizing pricing strategies will continue to be paramount for airline profitability.

Impact of Fuel Prices on Airline Expenses

The aviation industry is perpetually at the mercy of volatile fuel prices, which can significantly affect airlines' bottom lines. For instance, U.S. jet fuel prices have surged by an astonishing 38% in just two months, with major airports reporting an average of $3.42 per gallon. This sharp increase is attributed to various global factors, such as oil price hikes and refinery disruptions, leading airlines to reassess their fuel hedging strategies and possibly raise airfares to pass on the additional costs to consumers.

Despite this, Delta Air Lines reports robust booking strength across its network, signaling sustained travel interest. However, the financial impact of rising fuel costs is tangible, with American Airlines adjusting its third-quarter earnings forecast to 20-30 cents per share, down from a previous high of 95 cents. This revision acknowledges the fuel price crunch and a costly new pilot labor agreement that entails a significant $230 million expense.

Adding to the complexity, labor unions are securing better pay and benefits, further pressuring airline finances.

The current scenario underscores the importance of strategic financial management within the airline industry, as it grapples with the dual challenge of satisfying increased passenger demand and managing escalating operational expenses due to fuel price volatility. As airlines navigate this dynamic landscape, the interplay between fuel costs and airline expenses remains a critical factor in shaping their profitability and operational strategies.

Historical Trends in Fuel Prices and Airline Costs

When analyzing the intricacies of airline fuel costs, it's crucial to consider the profound impact of oil price fluctuations on the aviation sector. The historical interplay between oil prices and airline operating expenses has been a dominant factor in determining airline profitability. For instance, West Texas Intermediate Crude (WTIC), a benchmark for U.S. oil prices, significantly influences the cost of jet fuel, with prices surging in response to production cuts or geopolitical tensions.

Jet fuel at major U.S. airports soared to an average of $3.42 per gallon, a substantial 38% increase within two months, highlighting the volatility airlines must navigate.

Amidst these price dynamics, airlines have experienced a dichotomy in 2023: despite the high cost of living affecting various sectors, airfares in the U.S. have hit a 15-year low, signaling a complex economic landscape. This surprising trend in ticket pricing, with fares nearly a quarter less than pre-pandemic levels, stands in contrast to other industries where consumer prices continue to climb.

The airline industry's performance can be tracked via indices like the NYSE Arca Airline Index (XAL), which measures the health of the sector through the share prices of airline companies. Nevertheless, the industry's susceptibility to cost pressures extends beyond fuel. Labor negotiations, such as the recent pilot labor deal that mandated a 21% immediate pay raise with a cumulative 46% increase over four years, also contribute to the financial landscape airlines must manage.

Similar labor movements across various industries, from package delivery services to the entertainment sector, reflect a broader push for improved compensation and benefits, underscoring the importance of strategic financial planning.

Record earnings in the airline industry for the year 2023, spurred by robust demand and high fares, illustrate the sector's resilience and capacity for adaptation. Airlines have leveraged various strategies, including capacity adjustments and fare structuring, to mitigate the impact of cost pressures and maintain profitability. With the global economy forecast to expand by 2.9% in 2023, the demand for oil—and consequently, jet fuel—is expected to rise, making the ability to anticipate and react to these market forces all the more critical for airlines looking to soar above the turbulence of fuel cost variability.

Factors Influencing Fuel Prices and Airline Economics

Airplane fuel costs are a critical concern for the airline industry, influenced by a myriad of factors that intertwine to create a complex market. The price of West Texas Intermediate Crude (WTIC), a benchmark for oil prices in the United States, has a direct impact on jet fuel prices. Significant production cuts by major oil-producing countries, such as the one million barrels per day cut announced by Saudi Arabia and the additional cuts by OPEC+ nations totaling almost three million barrels, reverberate through the market.

These cuts are material when considering the scale of global oil consumption—the US alone consumes around 20 million barrels per day, and the top ten oil-consuming nations account for over 73% of global production.

Refinery capacities and disruptions also play into fuel pricing. Recent refinery issues have led to a spike in jet fuel costs, as reported by the International Air Transport Association (IATA) and S&P Global Commodity Insights, which showed an average price increase from $97.78 to $ in just one month. This has prompted airlines to re-evaluate their fuel hedging strategies and potentially increase flight prices to offset the higher costs.

The effects of these dynamics are felt across the airline industry, with U.S. airlines at major airports reporting a 38% increase in jet fuel costs over two months.

The global demand for aviation fuel, driven by factors like the 2.9% projected real GDP growth for 2023, further complicates the pricing landscape. An increase in passenger numbers nearing pre-pandemic levels adds to the demand pressure. However, with the high price of jet fuel, airlines are experiencing a squeeze on their revenues, especially outside the peak summer season.

As early as September, jet fuel in major U.S. cities was 30% more expensive than two months prior, at $3.18 a gallon.

Geopolitical events also have their say in the equation. The extension of oil output cuts by Saudi Arabia and Russia through the end of 2023, as noted by the International Energy Agency, indicates a potential market deficit for the remaining year. This could lead to higher gasoline prices amid efforts to recover the economy and tackle inflation issues.

With WTI crude prices on the rise, the cost of air travel could escalate, affecting both airlines and consumers.

In summary, the cost of airplane fuel in 2023 is subject to a complex set of influences, including crude oil prices, refinery operations, global demand, and geopolitical events. Airlines must navigate this landscape with precision to manage their fuel procurement and pricing strategies effectively.

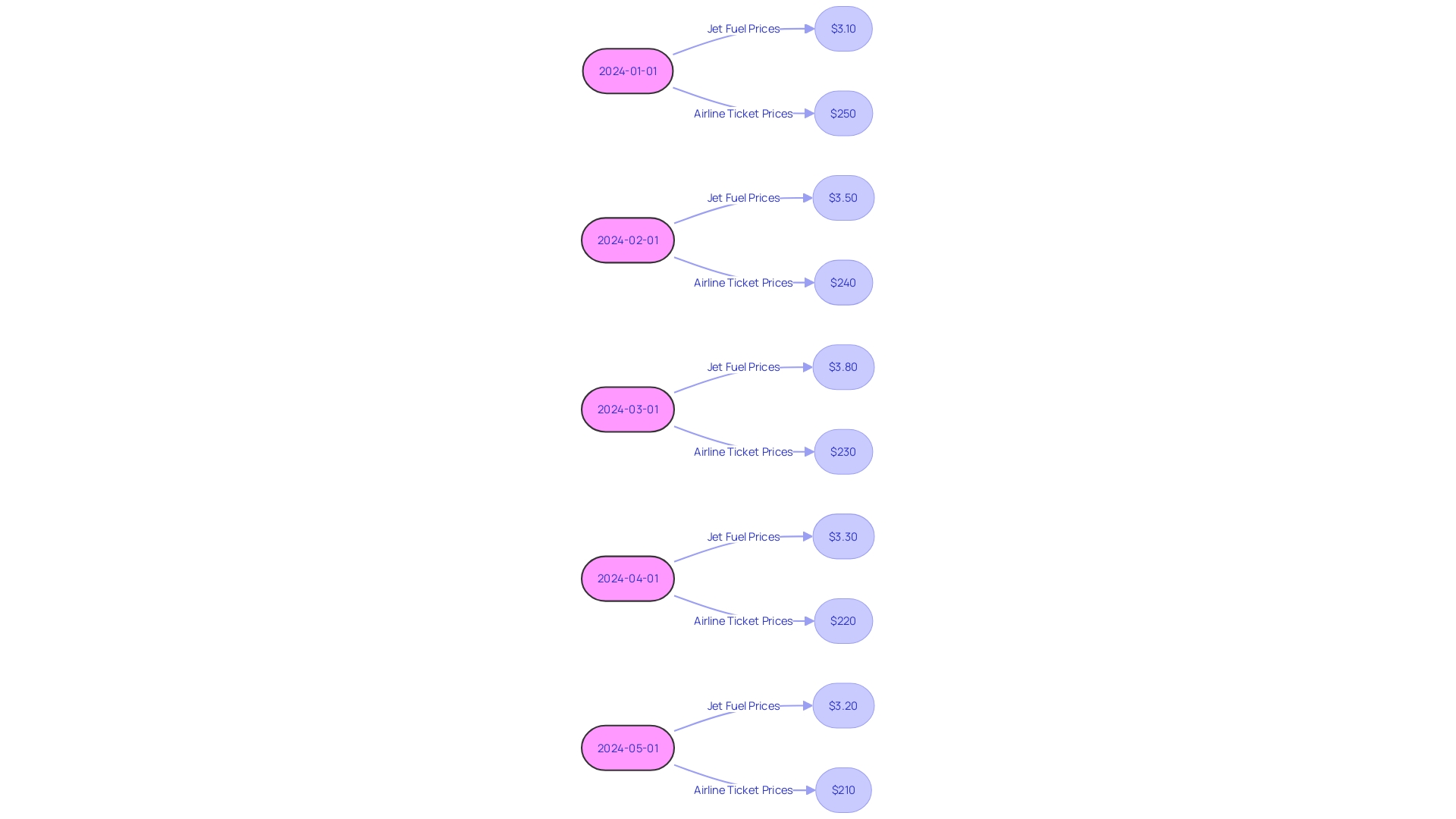

How Fuel Prices Affect Airline Ticket Prices

The interplay between fuel prices and airline ticket costs is a critical factor in the airline industry's pricing strategy. As analysts from American Express Global Business Travel have observed, while average ticket prices globally are expected to maintain a steady trajectory, the U.S. market is witnessing a divergence in the trends for domestic and international airfares. Hayley Berg, an economist from the booking platform Hopper, projects a decrease in domestic airfare costs, with average fares dropping by 8 percent from the previous year to about $276 for a round trip in February.

This decline is attributed to the increased number of seats available on flights and a reduction in jet fuel expenses. In fact, she suggests that January marks the onset of a period of lower travel costs extending until the fall.

The airline industry's sensitivity to oil price fluctuations is evident from the recent moves in the market. For instance, after production cuts announced by OPEC+ nations, including a significant cut by the Saudis and Russia, oil prices have trended upwards. This is set against a backdrop of a consumption rate of 20 million barrels per day by the United States alone, which is a significant share of the global oil output of 93 million barrels per day in 2021.

As the global economy grows with a forecasted real GDP increase of 2.9% for 2023, the demand for oil continues to rise.

Moreover, the airline industry is undergoing a transformation with increased competition, as noted by travel expert Katy Nastro, who cites competition as the primary driver behind the current affordability of flights. With average airfare in the U.S. being nearly a quarter less than pre-pandemic levels, the industry is experiencing its lowest prices since 2009. Despite this trend, the aviation sector remains vigilant, monitoring the dynamic fuel market that can significantly influence ticket pricing and airline operations.

Strategies Airlines Use to Mitigate High Fuel Costs

Airlines today face the complex challenge of balancing soaring fuel costs with the need to maintain profitability and environmental commitments. With U.S. jet fuel prices escalating by 38% over a two-month period, reaching an average of $3.42 per gallon, carriers are deploying a variety of tactics to mitigate these financial pressures. One approach is the strategic use of fuel hedging, which can provide a buffer against market volatility.

Additionally, investing in fuel-efficient aircraft has become a priority, exemplified by Airbus's ambition to make all its aircraft 100% Sustainable Aviation Fuel (SAF)-capable by 2030. This goal aligns with the broader industry's focus on sustainability, as airlines like Delta Air Lines maintain robust travel demand despite economic headwinds.

The optimization of flight routes and the adoption of fuel-saving operational practices further contribute to airlines' efforts to enhance fuel efficiency. Case in point, Delta's resilience in the face of industry challenges showcases the potential for airlines to sustain financial health even with fluctuating fuel prices. The company's proactive stance is further supported by Airbus's partnership with Emirates to advance the use of SAF, demonstrating a shared dedication to sustainable aviation.

In the face of potential revenue squeezes due to high fuel costs, airlines are also examining their pricing strategies. While the International Air Transport Association (IATA) reports a slight recovery in passenger numbers nearing pre-pandemic levels, the industry remains vigilant about the impact of elevated jet fuel prices on travel costs. The pursuit of alternative fuels, such as bioenergy crops like miscanthus giganteus, underscores the sector's commitment to reducing its carbon footprint and achieving net-zero emissions.

These concerted efforts by airlines to navigate the intricacies of fuel management and environmental responsibility reflect a broader industry imperative: to ensure safe, efficient, and sustainable air travel for the future.

Long-term Implications of High Fuel Prices for Airlines

The aviation industry's fiscal landscape is under significant pressure from the unyielding ascent of fuel costs, a trend that is reshaping the strategic calculus for airlines. With jet fuel prices surging to an average of $3.42 per gallon at major U.S. airports, representing a steep 38% rise over a two-month span, airlines are pressed to reassess their financial and operational models. This uptick reflects broader market forces, including refinery disruptions and oil price escalations.

The impact on airlines is multifaceted: from reconsidering fuel hedging strategies to potentially inflating ticket prices, carriers are grappling with a delicate balance between cost absorption and consumer pricing.

While the summer season witnessed a buoyant uptick in passenger numbers, rivaling pre-pandemic statistics, the impending leaner travel months paired with persistent inflation present a stark reality. Airlines are poised to confront a squeeze on revenues, as evidenced by American Airlines trimming its earnings forecast and recognizing a $230 million expense for pilot raises in a new labor deal. This scenario underscores the intricate web of factors—from operational costs to labor agreements—that airlines must navigate.

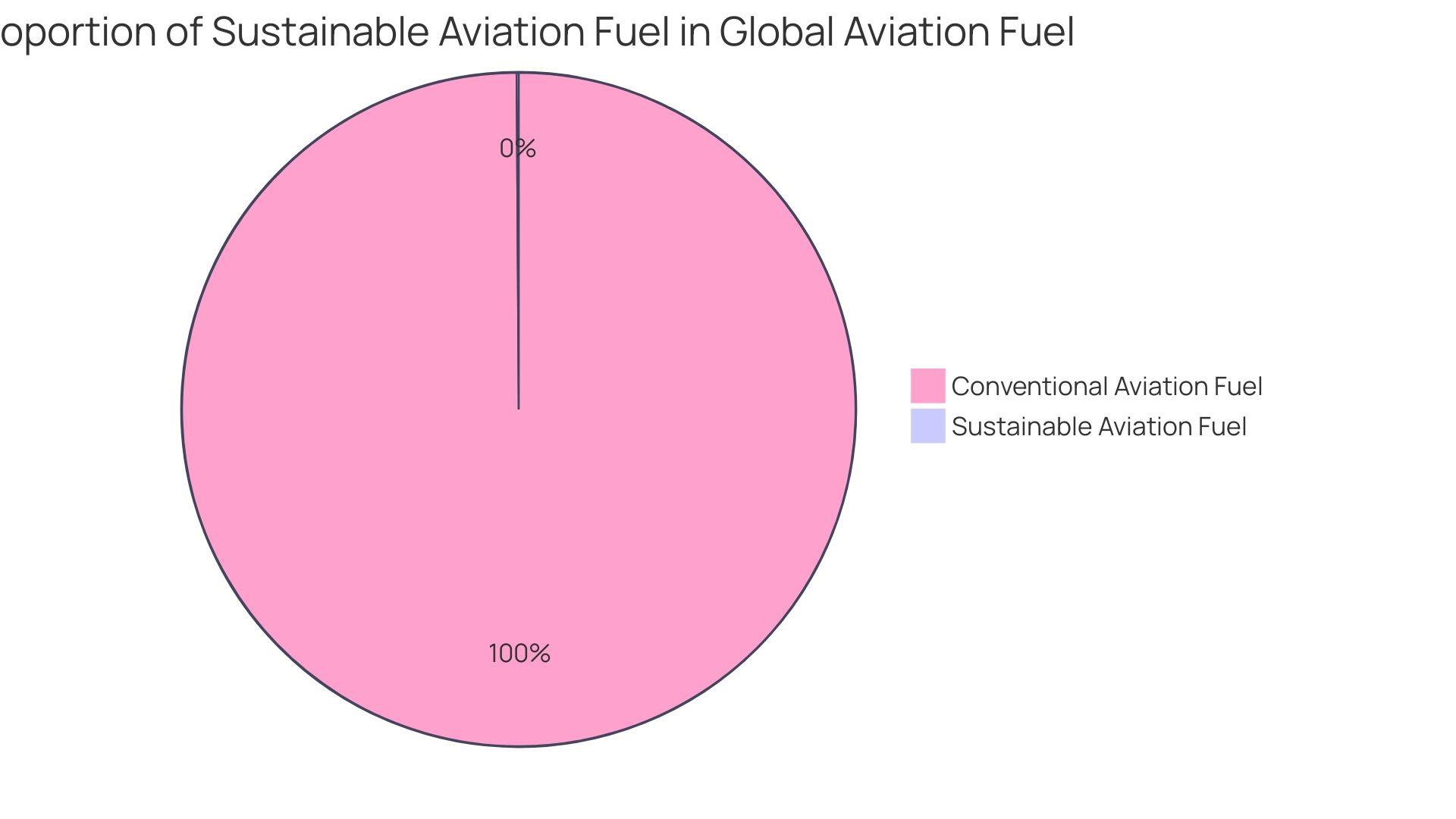

Moreover, the long-term horizon is equally challenging. The International Civil Aviation Organization's aspiration for net-zero carbon emissions by 2050 propels the sector towards sustainable aviation fuels (SAF) as a pivotal emissions abatement tool. Saf's promise is recognized in the industry through various reports, highlighting its role in reducing greenhouse gas emissions without necessitating immediate overhauls of aircraft designs or refueling infrastructure.

In light of these complex dynamics, airlines are compelled to strategically plan their fleet composition, optimize routes, and invest in SAF to create resilient business models. These measures are not merely reactive but are essential for adapting to an industry where decarbonization is as much a part of the agenda as managing the volatility of fuel prices. The path forward is clear: innovation, foresight, and adaptability are the cornerstones of sustainable growth in the ever-evolving aviation sector.

Future of Aviation Fuel: Alternatives and Innovations

As the aviation sector navigates towards a greener future, the exploration of alternative fuels is pivotal. Sustainable Aviation Fuel (SAF) is at the forefront of this transformational journey. Neste, a leading renewable product provider, underscores the importance of sustainably sourced raw materials — a principle that is deeply embedded in their production process, with a stringent adherence to sustainability audits and standards, including the Neste's Supplier Code of Conduct and Responsible Sourcing Principle.

The use of SAF is a significant step for the industry's commitment to reducing carbon emissions. The LanzaJet Freedom Pines Fuels plant in Soperton, Georgia, marks a historic milestone as the world's first facility to produce SAF from ethanol, showcasing the potential of innovative technologies in the pursuit of decarbonized aviation.

Moreover, the collaboration between Airbus and Neste exemplifies the industry's drive towards environmental responsibility, aiming to decarbonize aviation and meet sustainability targets. Virgin Atlantic's achievements in customer service excellence and expansion of its transatlantic network, in partnership with Delta Air Lines, Air France-KLM, and others, demonstrate the industry's dedication to innovation and customer satisfaction while also focusing on environmental stewardship.

Notably, sustainable fuels are not a distant dream but a present reality. The introduction of British firm Firefly's initiative to transform human waste into aviation fuel is a testament to the diverse and creative pathways that can lead to sustainable fuel production. While power-to-liquid methods offer potentially limitless fuel supplies, they require a substantial increase in renewable electricity and carbon capture.

The aviation industry's growth, with a forecasted doubling of the global airliner fleet over the next two decades, increases the urgency for sustainable solutions. The transition to SAF is critical in balancing the expansion of air travel with the imperative to achieve net-zero carbon emissions by 2050, as committed by the International Air Transport Association's member airlines. The shift to more fuel-efficient modern aircraft will contribute to this goal, but the widespread adoption of SAF will be a key driver in the industry's sustainable evolution.

In summary, the future of aviation fuel is not just about finding environmentally friendly alternatives but also about ensuring economic viability and scalability. The industry's leaders and innovators are already paving the way, demonstrating that sustainable aviation is not a mere possibility but a reality in motion.

Conclusion

The aviation industry's financial landscape is heavily influenced by fuel costs, which directly impact airline profitability and competitiveness. Volatility in fuel prices, along with factors like labor negotiations and increasing passenger numbers, create complexity in the industry. Airlines are implementing strategies such as fuel hedging, investing in fuel-efficient aircraft, and optimizing operations to mitigate high fuel costs.

Centralized budgeting and resource allocation are crucial for effective financial management.

The interplay between fuel prices and airline ticket prices is a critical factor in the industry's pricing strategy. While global ticket prices are expected to remain steady, the U.S. market shows divergent trends for domestic and international airfares. The pursuit of sustainability and the goal of achieving net-zero carbon emissions drive the exploration of alternative fuels, such as Sustainable Aviation Fuel (SAF).

Collaboration between industry leaders and innovative solutions demonstrate the industry's dedication to environmental responsibility and innovation.

In conclusion, the aviation industry faces challenges and opportunities related to fuel costs. Strategic financial management, fuel hedging, investment in fuel-efficient aircraft, and adoption of alternative fuels are crucial for airlines to mitigate high fuel costs and ensure long-term success in an ever-evolving sector.