Introduction

The aviation industry faces a pressing challenge in reducing its carbon emissions and achieving sustainability goals. Sustainable Aviation Fuel (SAF) has emerged as a key solution, offering a substantial reduction in greenhouse gas emissions compared to traditional jet fuels.

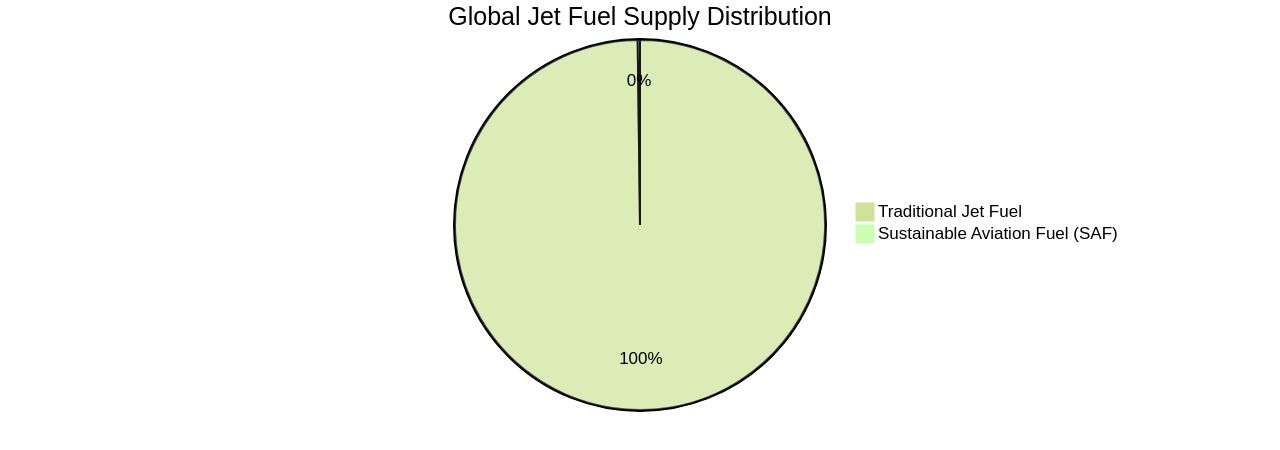

However, the global market share of SAF remains below 0.2%, highlighting the need for expansion to meet net-zero targets. This article explores the current state of SAF production, technological advancements, feedstock sustainability, and challenges in scaling production. With a focus on the renewable fuels industry, this article provides technical insights and analysis for readers with a deep understanding of the subject matter.

Understanding Sustainable Aviation Fuels (SAF)

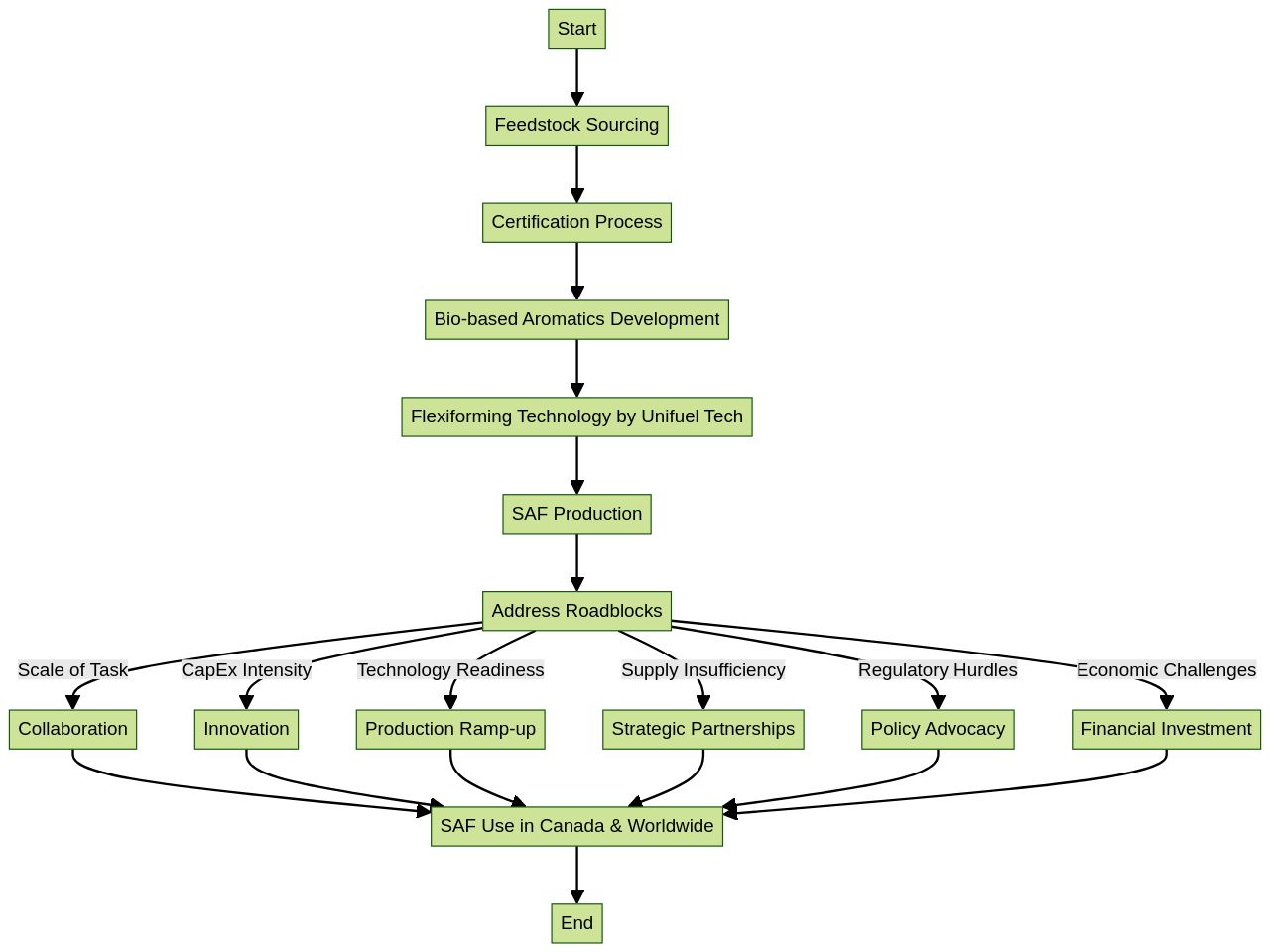

Sustainable Aviation Fuel (SAF) has surfaced as a pivotal strategy for abating emissions in aviation, leveraging renewable feedstocks such as agricultural residues, waste oils, and energy crops. As a 'drop-in' solution, SAF necessitates minimal modifications to the current aviation infrastructure.

However, Saf's global market share remains below 0.2% as of 2022, underscoring the urgency for expansion to meet the aviation sector's net-zero targets. With transportation accounting for nearly a quarter of global carbon emissions in 2021, the pivot to SAF is critical for climate goals.

Nonetheless, SAF production is nascent, and costs remain 3 to 4 times higher than conventional jet fuel. Technological strides, including the development of bio-based aromatics, have enabled the use of higher SAF concentrations, with successful demonstrations by airlines such as United and Virgin Atlantic.

Yet, global recognition of SAF hinges on adherence to international standards and renewable energy-powered production facilities to maximize emissions reductions. The challenge of scaling SAF supply persists, particularly due to the limited availability of fats, oils, and greases, the primary sources for current SAF production.

Diversification of feedstocks and technological advancements are imperative to fulfill the International Civil Aviation Organization's ambition for carbon-neutral aviation by 2050. In this dynamic context, Australia emerges as a potential key player, capable of contributing both feedstocks and SAF production, bolstered by its burgeoning hydrogen economy.

While new processes have facilitated the utilization of 100% SAF, the industry is contending with a demand-supply imbalance, affordability concerns, and feedstock competition. A multi-fuel future, with a mix of bio-SAF and synthetic kerosene, appears feasible for the industry by 2050, provided that substantial innovation, policy incentives, and infrastructure development are pursued. Global uptake of SAF is on the rise, with notable increases in Europe, the UK, and the USA. However, the scarcity of SAF and the environmental impact of biomass harvesting necessitate significant investment and regulatory support to scale production. Virgin's Weiss emphasizes the need for government-backed price support mechanisms to stimulate investment. The competition for biofuels could exacerbate global food security concerns, highlighting the urgency for innovation in cost reduction and fuel availability, particularly for e-fuels still in early development stages.

SAF as a Decarbonization Pathway

Sustainable Aviation Fuel (SAF) offers a substantial reduction in the carbon footprint of the aviation industry, with the potential to cut lifecycle greenhouse gas emissions by up to 80% compared to traditional jet fuels. Yet, Saf's market penetration remains low, accounting for less than 0.2% of the global jet fuel supply.

Its 'drop-in' capability allows for a smooth transition into the current infrastructure, avoiding the need for significant modifications to aircraft or fueling systems. Despite these advantages, the production and uptake of SAF face considerable challenges.

The cost of SAF is significantly higher than conventional jet fuels, and the economic viability of various SAF feedstocks is a concern, especially given the competition for biofuel feedstocks from other sectors. These challenges, including supply limitations, heightened costs, and the necessity for infrastructural adjustments, create barriers to the large-scale adoption of SAF.

Addressing these issues requires robust investment, international collaboration, and supportive government policies to ensure regulatory certainty and establish price-stabilizing mechanisms. In response to these challenges, Unifuel.tech by Universal Fuel Technologies introduces Flexiforming, a technology that enables operators to tailor their decarbonization trajectory. Flexiforming can be utilized in dormant hydrotreaters or reformers, presenting an opportunity to repurpose existing assets while diminishing both capital expenditure and carbon intensity. This innovation aligns with the urgent need for solutions that facilitate the integration of SAF by providing a cost-effective, scalable approach to feedstock optimization. Unifuel.tech's commitment to rapid customer service, responding to queries within 24 hours, and their ability to customize applications based on specific operational parameters, underscores their pivotal role in accelerating the transition to a carbon-neutral aviation sector by 2050.

Recommended SAF Pathways

The quest for Sustainable Aviation Fuel (SAF) is intensifying as the aviation sector grapples with its carbon footprint, representing approximately 2% of global emissions. While electric and hydrogen-powered aircraft remain on the distant horizon, SAF emerges as the immediate, viable alternative. Derived from a spectrum of feedstocks—biomass, waste, natural oils, fats, and even hydrogen—SAF is pivotal for the industry's goal to become carbon neutral by 2050.

Yet, the urgency of this transition is hampered by the nascent state of production technologies and the scarcity of feedstocks, posing a formidable challenge to meeting ambitious adoption targets. As SAF production pathways such as the Fischer-Tropsch and Hydroprocessed Esters and Fatty Acids process mature, the industry is keenly exploring the Alcohol-to-Jet (AtJ) process. The imminent commissioning of LanzaJet's Freedom Pines Fuels facility marks a significant milestone, being the world's first commercial AtJ facility.

Despite this progress, the overarching issue remains: demand outstrips supply, with SAF accounting for less than 0.1% of global aviation fuel. Virgin Atlantic's strides towards sustainability, aiming for the first 100% SAF transatlantic flight in 2023, underscore the sector's commitment. However, the path to scaling SAF is fraught with challenges—affordability, sustainability, and feedstock competition.

The Power-to-Liquids (PtL) process, albeit promising with potential CO2 emission savings of 89 to 94%, is yet to overcome hurdles of large-scale application. To catalyze Saf's growth, robust investment and government-backed regulatory frameworks are imperative, as underscored by Virgin’s Weiss. Collective efforts are essential to foster innovation, expand production, and ultimately reshape aviation into an industry that harmonizes economic aspirations with environmental imperatives.

SAF Feedstock Sustainability Guidelines

Sustainable aviation fuel (SAF) is rapidly becoming integral to achieving carbon-neutral aviation, with production intricacies closely regulated to mitigate environmental and socio-economic impacts. The demand for SAF is climbing, especially in regions like Europe, the UK, and the USA, but production limitations loom, threatening to leave this demand unsatisfied.

In this complex scenario, affordability and sustainable feedstock sourcing are paramount, amidst stiff competition and the need for cost-effective production techniques. Australia is emerging as a key contributor to the global biofuel feedstock supply, enhancing feedstock diversity and advancing its hydrogen economy to support various SAF production methods.

To meet the International Civil Aviation Organization's 2050 net-zero carbon emissions goal, Australia is focusing on robust certification and lifecycle greenhouse gas assessments to meet international standards. A significant innovation is the development of bio-based aromatics for aviation fuel, enabling higher SAF blends and powering trans-Atlantic flights entirely on SAF, signifying a shift toward environmental responsibility.

In this context, technologies like Flexiforming by Unifuel. Tech represent a pivotal advancement, offering operators the flexibility to adjust their decarbonization pace. Deployable in existing hydrotreaters or reformers, Flexiforming reduces both capital expenditure and carbon intensity, aligning with the industry's sustainability objectives. Operators can engage with Unifuel. Tech for application insights, with a commitment to a prompt response, further emphasizing the necessity for collaborative innovation to scale SAF globally.

Identifying the Most Sustainable Feedstocks

The synthesis of Sustainable Aviation Fuel (SAF) hinges on astutely chosen feedstocks, which must not only be sustainable but also align with the energy-intensive demands of aviation. The selection criteria for these feedstocks are multifaceted, with a strong focus on high energy yield and adherence to stringent sustainability benchmarks. One of the paramount considerations is the selection of feedstocks that do not encroach upon food supply chains or necessitate extensive land use.

The strategic positioning of cultivation regions can significantly curtail transportation and infrastructure outlays, thus streamlining the overall efficiency of SAF production. The use of indigenous feedstock sources is key to fostering both cost-effectiveness and sustainability. Biomass, for example, can be converted into SAF through the creation of hydrocarbon molecules, which are the foundational elements of traditional fossil fuels.

This transformation, however, must be powered by renewable energy to truly make a dent in net emissions reductions. This necessitates a holistic understanding of the various trade-offs and supplementary benefits of different feedstocks, while spurring innovation to curtail costs and broaden availability. The aviation sector's commitment to achieving carbon neutrality by 2050 underscores the critical nature of judicious feedstock sourcing for SAF scalability and implementation.

In the current climate, where global energy systems are fraught with volatility, the aviation industry faces a pressing need for emission reduction solutions. With the electrification of aircraft and the adoption of alternative fuels like green hydrogen not yet viable, particularly for long-haul flights, SAF emerges as the industry's linchpin for emission mitigation. The diverse array of feedstocks—including biomass, waste materials, natural oils, fats, other carbon sources, and hydrogen—forms the backbone of SAF.

Yet, the global uptake of SAF, notably in Europe, the UK, and the USA, is outpacing production, leading to supply shortages and raising concerns about affordability, sustainability, and the competition for feedstocks. Australia, with its existing feedstock production capabilities and burgeoning hydrogen economy, is well-positioned to become a pivotal player in the SAF market. To ensure compliance with international standards and foster global market access for Australian-produced SAF, it is imperative to establish certification processes, including life cycle greenhouse gas assessments.

This underscores the importance of strategic feedstock growth and localized processing facilities to mitigate associated costs and infrastructure demands. Hydrocarbons, the cornerstone of fossil fuels, can be sustainably replicated by processing biomass, provided these facilities operate on renewable energy. The path forward involves overcoming key obstacles to augment SAF production, notably the scale of the task in such a globally interconnected and capital-intensive industry.

Assessing Practical Availability of Feedstocks

In the pursuit of sustainable aviation fuel (SAF) production at scale, one must engage in a meticulous evaluation of feedstock options. This involves not just a nod to sustainability but a rigorous analysis of availability, scalability, and the logistics involved in feedstock procurement. With the aviation industry's commitment to reducing emissions and the absence of near-term electrification solutions for long-haul flights, the role of SAF becomes pivotal.

Yet, the current global production of SAF is insufficient to meet the soaring demands, particularly in regions like Europe, the UK, and the USA. The challenge extends to maintaining a balance between affordability and sustainability while navigating the competition for feedstocks and achieving economically efficient production scales. Australia emerges as a potential powerhouse in this regard, already exporting significant quantities of biofuel feedstocks and poised to expand its portfolio.

The country's burgeoning hydrogen economy could also provide the necessary clean hydrogen for various SAF production pathways. Innovations are imperative, as indicated by the Joint BioEnergy Institute's (JBEI) study into high-yielding biomass crops like Miscanthus, sorghum, and switchgrass, which exhibit potential for conversion into high-performance jet fuel. Moreover, the exploration of novel methods like protein production from coal signals a shift towards diverse and economically viable feedstock sources.

Considering the International Civil Aviation Organization's target for net zero carbon emissions by 2050, and the successful testing of 100% SAF by airlines, the importance of advancing SAF technology and feedstock selection is underscored. The scenario development framework, employing tools like the Analytic Hierarchy Process (AHP), facilitates the strategic selection of optimal feedstocks. This technical approach, alongside the understanding of Saf's role in a circular energy economy, is crucial for industry stakeholders aiming to navigate the complex landscape of SAF production and contribute effectively to the global decarbonization efforts.

Technological Pathways for SAF Production

Sustainable Aviation Fuel (SAF) stands as a pivotal solution for the aviation sector's pressing emissions predicament. With the viability of electric or other alternative fuel-powered long-haul flights still in the distant future, SAF produced from a variety of feedstocks including biomass, waste, natural oils, and hydrogen is the current frontrunner.

The critical nature of this development is emphasized by aviation's 2% contribution to global carbon emissions, a percentage expected to increase with the rising demand for air travel. Despite the urgency, Safe account for less than 0.2% of the global jet fuel supply, contrasting sharply with the industry's goal of achieving carbon neutrality by 2050.

Milestones in the transition to SAF, such as Virgin Atlantic's initiative for a 100% SAF-powered transatlantic flight by 2023, highlight the fuel's capability as a direct substitute for current fleet requirements. However, the challenge remains to scale production to satisfy escalating demand, especially since most Safe are produced from scarce resources like fats, oils, and greases.

Addressing this challenge, Unifuel.tech's flexiforming technology is a notable breakthrough, offering operators the flexibility to set their decarbonization pace. By utilizing dormant hydrotreaters or reformers, this technology mitigates capital expenditures and carbon output.

Unifuel.tech, under the ownership of Universal Fuel Technologies, engages promptly with stakeholders, responding to queries within 24 hours and gathering specific data on feeds, target products, and existing infrastructure to optimize the application of flexiforming. The significance of SAF is also underlined by a comprehensive report from Carbon Direct and Apple, which outlines the variety of fuel types, carbon intensities, and cost implications, providing a blueprint for amplifying production and curtailing greenhouse gas emissions. Although the global aviation fuel market faces growth prospects fueled by heightened demand for bio-jet fuel, the substantial costs of aircraft fuels remain a formidable challenge. Yet, regional trends, such as the projected surge in visitors to Saudi Arabia by 2030 and a substantial increase in North American airline traffic, signal a promising horizon for SAF market growth. In the midst of these intricacies, collaborative initiatives like the one in Canada are being forged to stimulate SAF innovation and production, demonstrating a unified effort to align supply with the intensifying global demand.

Challenges of SAF Production and Technology Maturity

The quest for sustainable aviation fuel (SAF) is a complex endeavor, facing not just technological growth pains but also the need for scalability. Advancements are ongoing to improve efficiency and reduce costs, crucial for mainstreaming SAF as a key player in aviation decarbonization. The intricate nature of the aviation industry, with its international scope and substantial capital requirements, demands a concerted effort among all stakeholders.

Collaboration and innovation are essential to form new business models within the SAF supply chain. The current gap between demand and supply, although challenging, also offers lucrative opportunities for timely market entrants. The Power-to-Liquid (PtL) process, pivotal in SAF production, is still evolving, with large-scale production presenting its own set of challenges.

Nevertheless, most technologies, Direct Air Capture being an exception, are nearing readiness, with a clear understanding of the cost structures. Despite this, the supply of SAF lags behind demand. While alternatives like hydrogen are being explored, SAF remains the most feasible option for immediate aviation decarbonization, serving as a drop-in fuel that requires no modifications to aircraft, airports, or fueling infrastructures.

Recent breakthroughs, such as the development of bio-based aromatics, have made it possible to increase SAF blending rates, even achieving 100% SAF flights in test cases. This innovation circumvents the need for costly and disruptive changes to the existing aviation infrastructure. As we forge ahead, international collaboration and pragmatic policies will be key to ensuring a sustainable transition to SAF, ultimately leading to a reduction in greenhouse gas emissions and a more sustainable future for aviation.

Managing SAF Production Costs

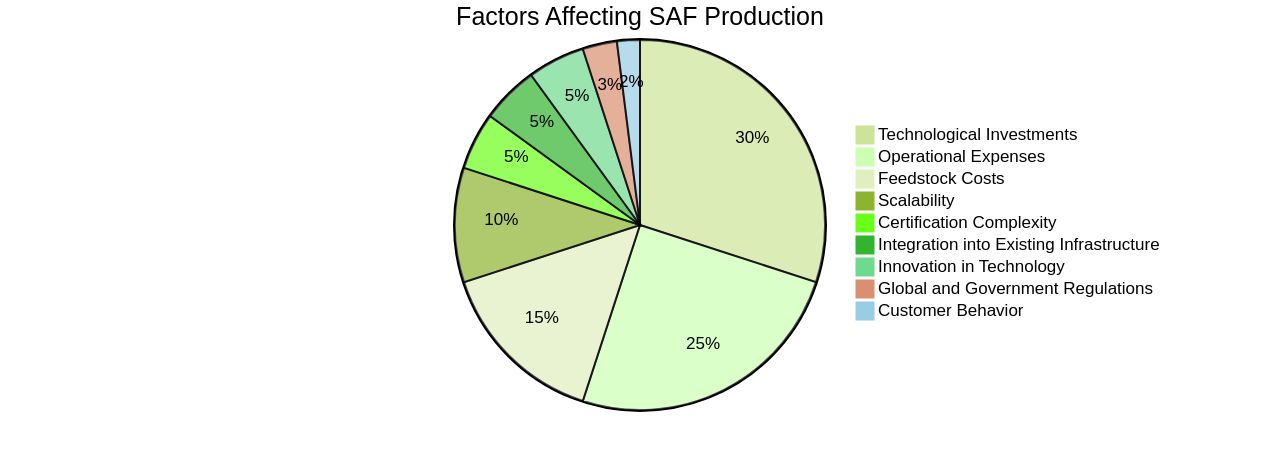

Sustainable Aviation Fuel (SAF) is pivotal for the aviation sector's shift towards a low-carbon future, yet its production is fraught with economic and technical challenges. Feedstock costs, technological investments, and operational expenses are critical factors that dictate Saf's commercial feasibility.

While HEFA technology has emerged as a cost-effective pathway for SAF, its scalability is essential to meet the burgeoning demand, which, as it stands, is a mere 0.2% of global jet fuel supply. The Power-to-Liquid (PtL) process, promising an impressive 89 to 94% reduction in CO2 emissions, is still embryonic and faces significant barriers to large-scale deployment.

These include establishing international standards and the complexity of certifying new SAF varieties. The integration of SAF into the existing fuel infrastructure is seamless, a 'drop-in' solution that avoids the overhaul of global aircraft fleets and fueling infrastructure.

The burgeoning demand for SAF, with 86% of travelers prioritizing its supply to airlines, is tempered by its cost—currently three to four times higher than conventional jet fuel. Innovation in technology, such as the Flex forming process developed by Universal Fuel Technologies, offers a strategic pivot.

This technology affords operators the flexibility to adjust their decarbonization pace and can be integrated into existing infrastructure, thus reducing capital outlays and carbon intensity. Flexiforming can be applied using idle hydrotreaters or reformers, and Universal Fuel Technologies, the company behind Unifuel.tech, provides a swift response to inquiries within 24 hours, ensuring a tailored application that aligns with the operator's specific needs. Global and government regulations, as well as customer behavior, are identified as influential yet uncertain drivers of SAF production. Collaborative efforts across the SAF value chain are crucial to overcome these uncertainties and foster innovation, production, and usage. As the industry strives to align with the 2050 emission targets, the recent milestone of a commercial Transatlantic flight powered by 100% SAF underscores the potential of full-scale SAF adoption and the imperative to surmount the current production and cost impediments.

SAF Cost Breakdown by Technological Pathway

The imperative for the aviation industry to reduce its carbon footprint has led to a surge in the demand for sustainable aviation fuel (SAF). The production of SAF, however, is fraught with financial and technical challenges. It hinges on the delicate interplay of feedstock availability, technological innovation, and scale of production.

For instance, Power-to-Liquids (PtL) processes promise significant CO2 emission savings ranging from 89 to 94%. Yet, the nascent state of PtL technology poses challenges for large-scale deployment, not least because of the need for continuous green electricity supply, which competes with other energy demands. Moreover, the current SAF production is a capital-intensive venture, requiring strategic partnerships and industry-wide collaboration.

The Australian SAF Roadmap exemplifies such an initiative, aiming to stimulate the SAF sector through innovative approaches. The roadmap underscores the necessity for a nuanced understanding of the co-benefits and trade-offs inherent in different feedstocks. One of the most promising technological advancements is Unifuel.tech's flexiforming technology, which allows plant operators to tailor their production processes to the prevailing market conditions, thereby optimizing costs and reducing carbon intensity.

The ability to integrate this technology into existing infrastructure, such as idle hydrotreaters or reformers, further minimizes capital expenditures. This adaptability is crucial, as evidenced by Unifuel.tech's rapid response to operators' needs within 24 hours, ensuring that the flexiforming application is fine-tuned to the specificities of the feeds, target products, and facility configurations. Despite these advancements, Saf's penetration into the aviation fuel market remains marginal, accounting for less than 0.1%.

The challenge is compounded by the competition for agricultural resources, which are already under strain from overuse, raising concerns about ecosystem and biodiversity impacts. This underscores the urgency for regulatory frameworks and investment to scale SAF production to meet the aviation industry's ambitious emission targets. With the right support, SAF can not only fulfill its environmental promise but also offer a viable economic opportunity for producers entering the market.

Conclusion

In conclusion, Sustainable Aviation Fuel (SAF) is a crucial solution for reducing carbon emissions in the aviation industry. Despite its potential to cut greenhouse gas emissions by up to 80%, SAF's global market share remains below 0.2%.

Scaling up production and overcoming challenges such as high costs and limited feedstock availability are essential to meet net-zero targets. Technological advancements, including bio-based aromatics and Flexiforming, offer promising solutions to increase SAF concentrations and optimize production processes.

Collaboration among industry stakeholders, government support, and investment are imperative to drive innovation, expand production capacity, and establish regulatory frameworks. Australia's diverse feedstock sources and burgeoning hydrogen economy position it as a key player in the SAF market.

Strategic feedstock growth and localized processing facilities are crucial for maximizing efficiency and mitigating costs. Adherence to international standards and robust certification processes are necessary for global market access.

The aviation sector must prioritize the selection of sustainable feedstocks that do not compete with food supply chains or require extensive land use. By leveraging SAF as a drop-in fuel that requires minimal modifications to existing infrastructure, the industry can achieve immediate emission reductions. With continued advancements in technology, collaboration, and supportive policies, the aviation industry can successfully transition to SAF and contribute significantly to global decarbonization efforts. It is imperative to invest in SAF production, address affordability concerns, diversify feedstocks, and foster innovation. By embracing SAF as a viable alternative fuel for aviation, the industry can make substantial progress towards achieving its carbon neutrality goals by 2050. The time is now for all stakeholders to come together and drive the expansion of SAF production worldwide.