Introduction

The aviation industry is continuously evolving, driven by factors such as market dynamics, pricing, geopolitical events, taxes, and regulations. In 2023, understanding these intricate elements is essential for stakeholders in the renewable fuels industry. This article provides a comprehensive analysis of the global market dynamics and pricing factors, delving into the cost components of aviation kerosene and the impact of geopolitical events on prices.

Additionally, it explores the role of taxes and regulations in shaping the economic landscape of aviation kerosene. With a deep understanding of these factors, industry professionals can navigate the renewable fuels industry with confidence and make informed decisions for a sustainable future.

Global Market Dynamics and Pricing Factors

In evaluating aviation kerosene costs in 2023, it's pivotal to consider the overarching market dynamics that dictate its pricing. Demand for air travel significantly influences the need for aviation fuel, with increased flight and passenger numbers exerting upward pressure on kerosene prices. The production of aviation fuel, chiefly derived from crude oil, also plays a vital role; disruptions in the crude oil supply chain, whether due to geopolitical tensions or natural calamities, often lead to price volatility.

Market speculation and trading activities can add another layer of complexity, with speculators and traders impacting oil market stability. Furthermore, exchange rate fluctuations, governmental policies, and environmental regulations contribute to the intricate interplay of factors shaping the aviation kerosene market.

Amidst these traditional fuels, sustainable aviation fuel (SAF) emerges as a promising alternative, with the potential to be utilized in current engines without adding to greenhouse gas emissions. The production process of SAF essentially reverses combustion, using energy to transform water and CO2 back into fuel, replenishing the oxygen in the atmosphere. This innovative approach not only addresses environmental concerns but also paves the way for a sustainable fuel lifecycle.

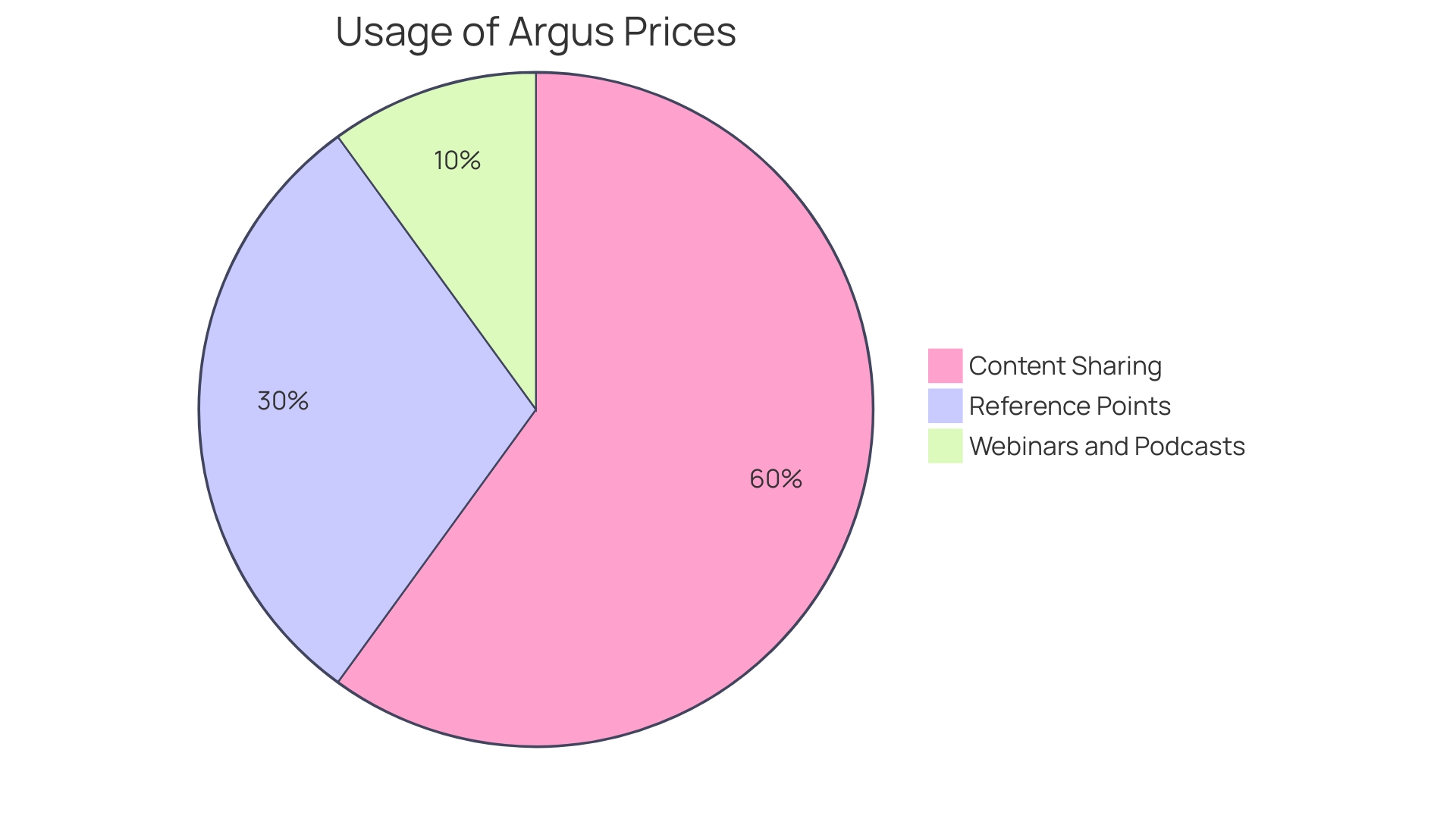

In the context of transparency and market intelligence, Argus prices are established benchmarks in the commodities sector, including aviation fuel. With over 50 years of data collection and 25,000+ price assessments globally, Argus provides insights that are instrumental for strategic planning. As the aviation industry is inherently cyclical, driven by demand and supply, insights from Argus aid in navigating the market's nuanced cycles, from anticipating growth spurts to preparing for slower periods.

The aviation industry's cyclical nature is underscored by the words of a seasoned industry expert, who suggests looking to the past to predict future trends. While the current market may seem daunting, there's an anticipation of growth, particularly in the latter half of 2024, driven by the surge in e-commerce and the need for restocking. The convergence of these factors—demand, supply, alternative fuel advancements, and market intelligence—forms the backbone of a comprehensive analysis of aviation kerosene economics in 2023.

Cost Components of Aviation Kerosene

The economic landscape of aviation kerosene is multifaceted, primarily influenced by the price of crude oil, which is a substantial factor in its overall cost. Market volatility, shaped by global supply-demand balances, geopolitical tensions, and strategic OPEC decisions, directly impacts crude oil pricing. Beyond the crude oil itself, the transformation of this raw material into aviation-grade kerosene incurs refining and processing expenses, encompassing energy consumption, labor, and routine maintenance costs.

Once refined, the kerosene must reach airports, incurring transportation and logistics expenses, which include shipping, storage, and handling. Furthermore, government taxes, varying widely by country, add another layer to the final cost. Finally, marketing and distribution efforts to promote and supply the kerosene to airlines also contribute financially.

Innovations such as Power-to-X, which encapsulates the conversion of electricity from renewable sources into storable energy forms like gas or ammonia, offer a glimpse into the potential transformation of the aviation sector. This approach not only provides an avenue for long-distance transportation of energy but also aligns with the goal of defossilizing industries that cannot fully operate on green electricity alone.

The pursuit of sustainable aviation fuels (SAF) is evidenced by the development of 'bio-crude', which mimics crude oil's chemical behavior but is derived from sustainable feedstocks. Groundbreaking facilities like LanzaJet Freedom Pines Fuels in Georgia exemplify this advancement, producing SAF from a variety of sustainable sources, projected to significantly cut greenhouse gas emissions by over 70%, while bolstering the local economy through job creation and economic activity.

The transition towards green aviation is an intricate endeavor, as traditional reliance on crude oil derivatives has spawned countless products and services integral to modern life. Yet, the urgency for more environmentally friendly alternatives is clear, particularly within an industry accountable for 2-3% of global greenhouse gas emissions. As alternative energy solutions evolve, the potential to reshape the aviation fuel market grows, promising a more sustainable trajectory for the sector.

Impact of Geopolitical Events on Prices

The aviation industry faces a complex web of factors that influence the price of aviation kerosene, a key determinant in operational costs for airlines. In 2023, geopolitical events continue to play a pivotal role in shaping the cost dynamics of this crucial fuel. Historical instances, such as the oil crisis of 1973, underscore the profound impact geopolitical tensions can have on energy markets, triggering shifts in policy and consumer behavior.

During that period, the formation of the International Energy Agency and the US Department of Energy highlighted the urgency of addressing energy reliance and efficiency.

In the present day, oil production cuts and geopolitical tensions have led to considerable fluctuations in oil prices. Notably, Saudi Arabia's production cuts and Russia's export reductions have contributed to a significant increase in oil prices, with Brent International reaching $90.04 per barrel and West Texas Intermediate settling at $86.69 per barrel. These changes, alongside the strategic maneuvers by OPEC+ countries, underscore the intricate interplay between geopolitics and energy markets.

Moreover, global oil production, consuming trends, and economic growth forecasts all factor into the equation. The interplay between supply and demand is critical, with top oil-consuming nations vying for a substantial portion of global production. As the world economy expands, projected at 2.9% for 2023, the demand for oil naturally intensifies.

Shifts in production, even by a fraction, can therefore have material impacts on market prices, affecting industries like trucking, shipping, manufacturing, and notably, aviation.

The establishment of the Organization of the Arab Petroleum Exporting Countries (OAPEC) further illustrates the historical significance of geopolitics in oil markets. OAPEC's founding principles aimed at decoupling oil affairs from politics and ensuring reasonable prices and security of supplies, demonstrating early recognition of the mutual interests of producers and consumers.

Recent market analyses reveal the sensitivity of commodity prices to geopolitical risks. The World Bank's Commodity Outlook report highlights an 11% increase in oil prices, driven by apprehensions over OPEC's strategic production decisions. This volatility extends to various sectors, with energy costs constituting a significant portion of total costs, especially in manufacturing and agriculture.

The fluctuations in energy prices hold considerable implications for these industries, with developing countries being particularly vulnerable.

Looking ahead, the stability of commodity prices remains fragile, influenced by the state of global economic growth and financial conditions. As the aviation industry navigates through these challenges, understanding the multifaceted impact of geopolitical developments on aviation kerosene prices remains essential.

Role of Taxes and Regulations in Pricing

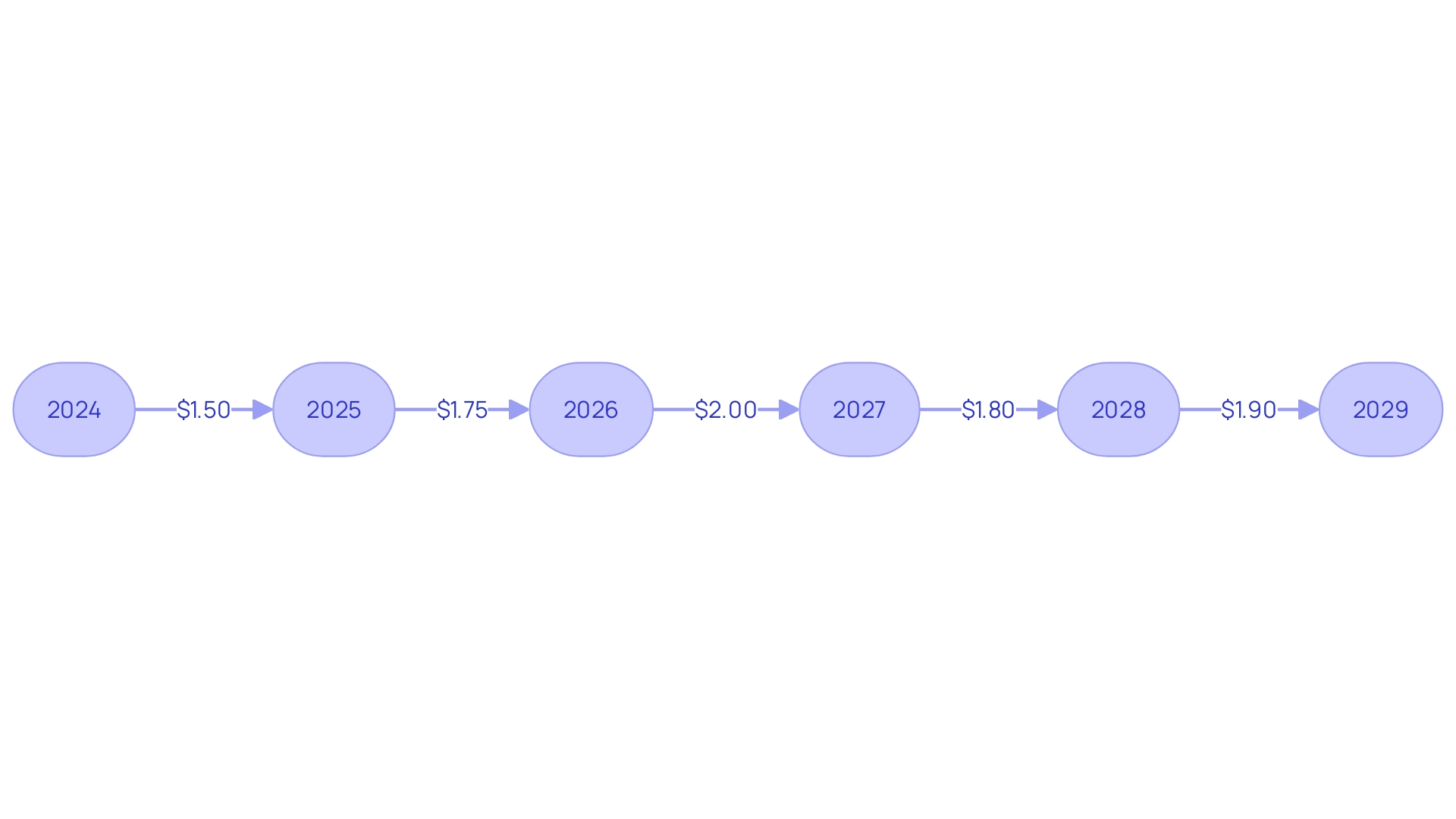

The economic landscape for aviation kerosene is heavily influenced by a complex interplay of taxes, regulations, and global market dynamics. While crude oil prices remain reasonably stable, hovering between $75-$80 per barrel with a potential modest increase come spring, aviation fuel prices are subject to additional factors that could significantly alter the cost per gallon.

In 2023, the aviation industry continues to navigate through the challenges of taxation and regulatory policies that directly impact aviation kerosene pricing. For instance, Germany's shift from a proposed kerosene tax to an increased ticket tax exemplifies the industry's sensitivity to taxation measures. This move, while placating the industry, underscores the ongoing debate about the environmental footprint of aviation, with the industry accounting for 2% of annual global energy-related emissions.

In the United States, where fuel taxes for road and rail transport are a given, aviation kerosene remains tax-exempt for international flights, a privilege rooted in the historic Chicago Convention. This exemption is not without controversy, as calls for a kerosene tax to address environmental concerns and generate revenue are growing louder. Such a shift could play a pivotal role in curbing the predicted tripling of aviation emissions by 2050.

Regulations, particularly those addressing environmental standards like carbon pricing or emissions trading, can also influence kerosene pricing. Tighter regulations often translate into higher production and distribution costs, potentially leading to increased fuel prices. Additionally, safety and quality standards, along with industry practices, impose further costs on suppliers and distributors, shaping the final price of aviation kerosene.

The Middle East, a region known for its vast oil reserves and yet impacted by geopolitical tensions and production challenges, remains a wild card in the global oil market. Conflicts and sanctions have led to countries like Iran, Libya, and Venezuela, despite their significant oil reserves, facing difficulties in exporting their produce. Such constraints have a ripple effect on the availability and pricing of aviation fuel on a global scale.

With a nuanced understanding of these factors, stakeholders in the aviation and energy sectors, as well as policymakers, are better equipped to navigate the fluctuating landscape of aviation fuel costs and develop strategies that ensure resilient and competitive operations in the face of ever-changing market dynamics.

Conclusion

In conclusion, understanding the global market dynamics and pricing factors is crucial for stakeholders in the renewable fuels industry in 2023. Factors such as demand for air travel, disruptions in the crude oil supply chain, market speculation, exchange rate fluctuations, governmental policies, and environmental regulations shape the aviation kerosene market.

Sustainable aviation fuel (SAF) offers a promising alternative, addressing environmental concerns without adding to greenhouse gas emissions. Innovations like Power-to-X and 'bio-crude' from sustainable feedstocks provide avenues for transforming the aviation sector and cutting greenhouse gas emissions.

Geopolitical events play a pivotal role in shaping aviation kerosene costs. Historical instances, like the oil crisis of 1973, highlight the impact of geopolitical tensions on energy markets. Oil production cuts, maneuvers by OPEC+ countries, and shifts in global oil consumption and economic growth forecasts affect oil prices, impacting the aviation industry.

Taxes and regulations significantly impact aviation kerosene pricing. The ongoing debate about the environmental footprint of aviation and calls for kerosene taxes demonstrate the industry's sensitivity to taxation measures. Regulations addressing environmental standards and safety and quality standards shape the final price of aviation kerosene.

By understanding these factors, stakeholders can navigate the fluctuating landscape of aviation fuel costs. With a deep understanding of global market dynamics, pricing factors, and the role of taxes and regulations, industry professionals can make informed decisions for a sustainable future in the renewable fuels industry.