Introduction

Delving into the viability of hydrogen energy sourced from naphtha, our comprehensive study examined the environmental and socio-economic impacts. The investigation shed light on the potential influence on greenhouse gas emissions and air quality, alongside the socio-economic benefits stemming from the production and utilization of renewable naphtha.

Notably, the study illuminated the prospect of green hydrogen generation, particularly in economically burgeoning nations such as Vietnam, which is witnessing a surge in renewable energy capacity. A workshop conducted in partnership with the UNDP and the Institute of Energy in Vietnam provided a forum for stakeholders to delve into the transformative promise of green hydrogen.

The research further underscored hydrogen's burgeoning role as a sustainable substitute for traditional fossil fuels. It's anticipated that by 2050, the global hydrogen market could account for 20% of the annual reductions in global emissions.

Moreover, the study emphasized the significance of green hydrogen in making industries like steel and chemicals more eco-friendly. The outcomes of the research indicate that regions rich in renewable resources, such as Latin America and the Caribbean, could significantly expand the green hydrogen sector, thus fostering economic growth and mitigating the risks associated with oil price fluctuations and supply interruptions. According to the International Energy Agency (IEA), the demand for hydrogen could escalate from the current 95 million tons per year to 430 million tons by 2050. The study advocates for a shift in focus from the technical feasibility of augmenting low-carbon hydrogen production to its energy efficiency and cost-effectiveness as a strategy for curtailing greenhouse gas emissions.

Environmental and Socio-Economic Analysis of Naphtha Reforming Hydrogen Energy

Delving into the viability of hydrogen energy sourced from naphtha, our comprehensive study examined the environmental and socio-economic impacts. The investigation shed light on the potential influence on greenhouse gas emissions and air quality, alongside the socio-economic benefits stemming from the production and utilization of renewable naphtha.

Notably, the study illuminated the prospect of green hydrogen generation, particularly in economically burgeoning nations such as Vietnam, which is witnessing a surge in renewable energy capacity. A workshop conducted in partnership with the UNDP and the Institute of Energy in Vietnam provided a forum for stakeholders to delve into the transformative promise of green hydrogen.

The research further underscored hydrogen's burgeoning role as a sustainable substitute for traditional fossil fuels. It's anticipated that by 2050, the global hydrogen market could account for 20% of the annual reductions in global emissions.

Moreover, the study emphasized the significance of green hydrogen in making industries like steel and chemicals more eco-friendly. The outcomes of the research indicate that regions rich in renewable resources, such as Latin America and the Caribbean, could significantly expand the green hydrogen sector, thus fostering economic growth and mitigating the risks associated with oil price fluctuations and supply interruptions. According to the International Energy Agency (IEA), the demand for hydrogen could escalate from the current 95 million tons per year to 430 million tons by 2050. The study advocates for a shift in focus from the technical feasibility of augmenting low-carbon hydrogen production to its energy efficiency and cost-effectiveness as a strategy for curtailing greenhouse gas emissions.

Materials and Methods

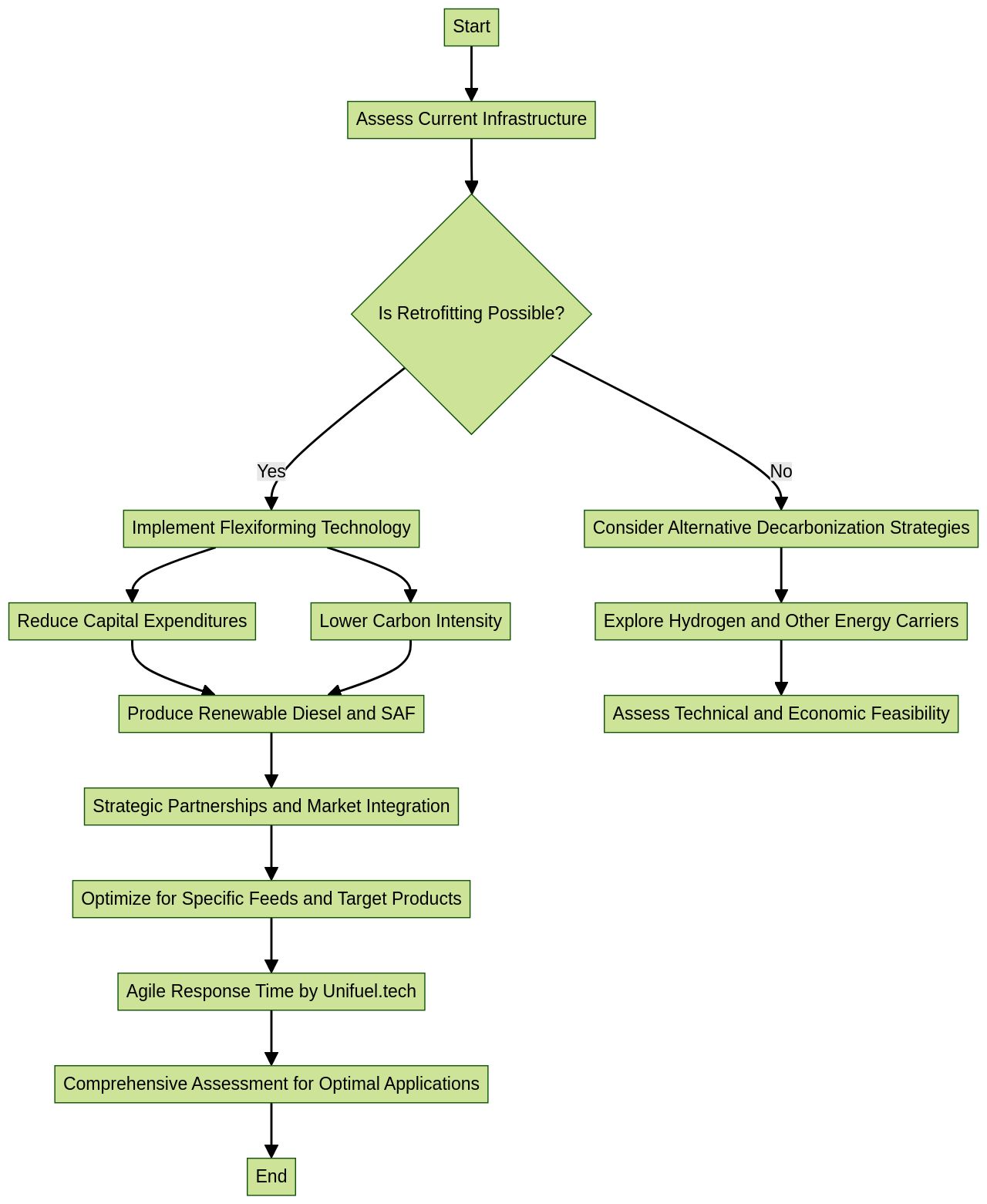

The economic viability of renewable naphtha is further enhanced by the integration of Flexiforming technology, a solution provided by Unifuel.tech. This innovation offers plant operators the flexibility to tailor their decarbonization pace, which is particularly advantageous in the context of fluctuating market conditions and the need for strategic raw material cost management. By retrofitting idle hydrotreaters or reformers with Flexiforming, operators can significantly reduce both capital expenditures and carbon intensity, contributing to the financial robustness of renewable naphtha production ventures.

Moreover, Unifuel.tech's agile response time, promising inquiries addressed within 24 hours, and their comprehensive assessment of optimal applications for Flexiforming based on the operator's specific feeds, target products, and existing infrastructure, underscore the value of strategic partnerships and technological adaptability. This is aligned with the industry's shift towards converting existing refineries to produce renewable diesel and sustainable aviation fuel, as the Flexiforming technology can be a cost-effective and environmentally responsible approach to such transitions. For detailed information and potential collaboration, stakeholders can reach out to Unifuel.tech, a subsidiary of Universal Fuel Technologies, with the assurance that all interactions are governed by the company's terms of use.

Assumptions of the Hydrogen Energy System

The burgeoning hydrogen economy has cast a spotlight on renewable naphtha, a derivative with significant potential for revenue generation. Renewable naphtha's ability to act as a storage medium for renewable energy sources bolsters grid stability and supports long-term energy solutions.

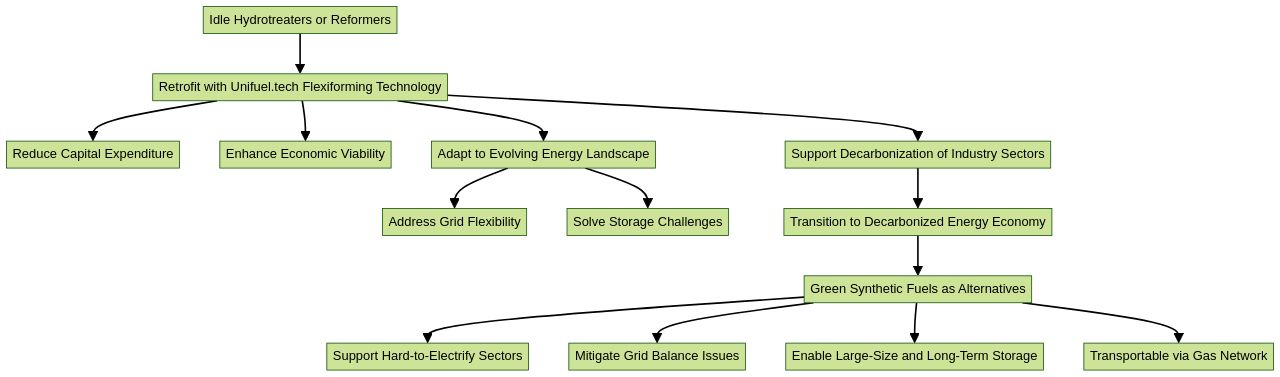

While challenges such as the high costs of fuel cells and underdeveloped hydrogen infrastructure persist, innovative technologies are emerging to streamline the integration of renewable naphtha into the energy market. One such innovation is the flexiforming technology provided by Universal Fuel Technologies, operating under the brand Unifuel.tech.

Flexiforming allows plant operators to retrofit idle hydrotreaters or reformers, thereby leveraging existing assets to reduce both capital expenditure and carbon intensity. This technology aligns with the dynamic needs of the hydrogen market, offering a scalable solution for the monetization of renewable naphtha that can adapt to the operator's chosen pace of decarbonization.

The financial implications of incorporating flexiforming are notable, considering the sensitivity of net present value (NPV) to product pricing in the market. By optimizing the use of current facilities and targeting suitable products, Unifuel.tech's approach could potentially enhance the economic viability of renewable naphtha projects. Their responsiveness—committing to inquiries within 24 hours—and tailored solutions based on feedstock and existing infrastructure underscore the adaptability of flexiforming technology in response to the evolving energy landscape. As regions like the Gulf Coast and Europe advance their hydrogen infrastructure and production capabilities, the integration of flexiforming could play a pivotal role in the renewable naphtha market, addressing grid flexibility and storage challenges while contributing to the decarbonization of industry sectors.

Estimated Production and Employment Costs

In the pursuit of renewable energy solutions, the production of renewable naphtha through Flexiforming technology has emerged as a promising avenue. A detailed financial analysis conducted using Aspen Process Economic Analyzer software revealed capital costs of $71M and operating costs of $303M per year, resulting in a gross profit of $60.5M annually.

The Net Present Value (NPV) of the project stands at an impressive $235M, with a rapid payback period of just 1.7 years. However, a significant challenge lies in the cost of raw materials, which make up approximately half of the total production expenses.

The reliance on sugars such as glucose, fructose, and sucrose in the upstream processes highlights the need for cheaper, renewable feedstocks to maintain economic viability. Strategic long-term purchase agreements with key end-users could offer a buffer against market volatility by securing stable purchase prices and quantities.

The global energy landscape is experiencing a surge in demand, driven by population growth and industrialization, thus necessitating the efficient production of renewable energy sources. Within this context, hydrogen, when produced sustainably, is projected to contribute significantly to emissions reductions. By 2050, green hydrogen could account for over 20% of the annual global emissions cuts. Lastly, the financial assessment must factor in the depreciation of equipment, which represents a non-negligible part of the Operating Expenditure (OPEX) over time, signifying the gradual capital loss due to wear and technological obsolescence.

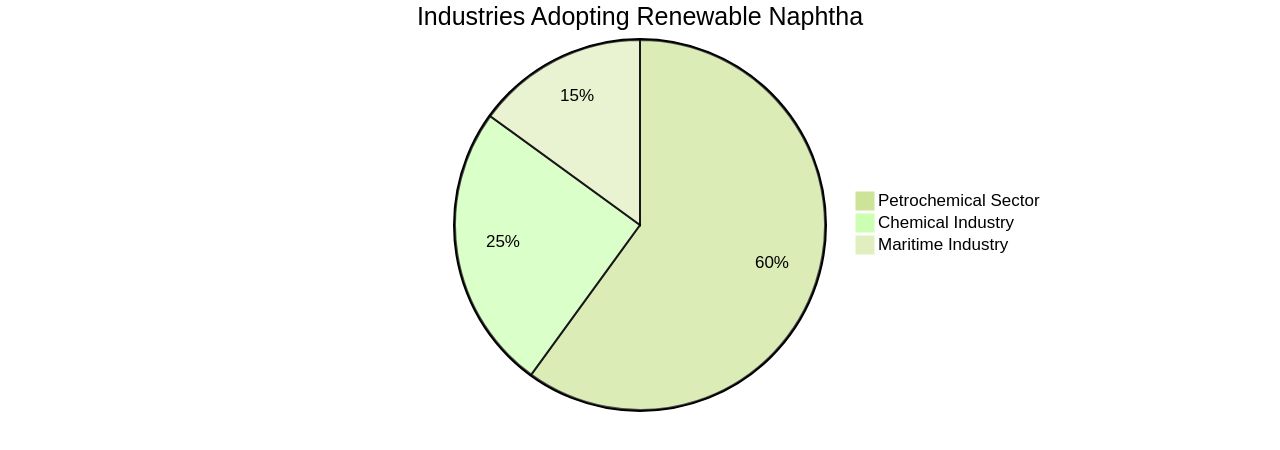

Established New Sectors

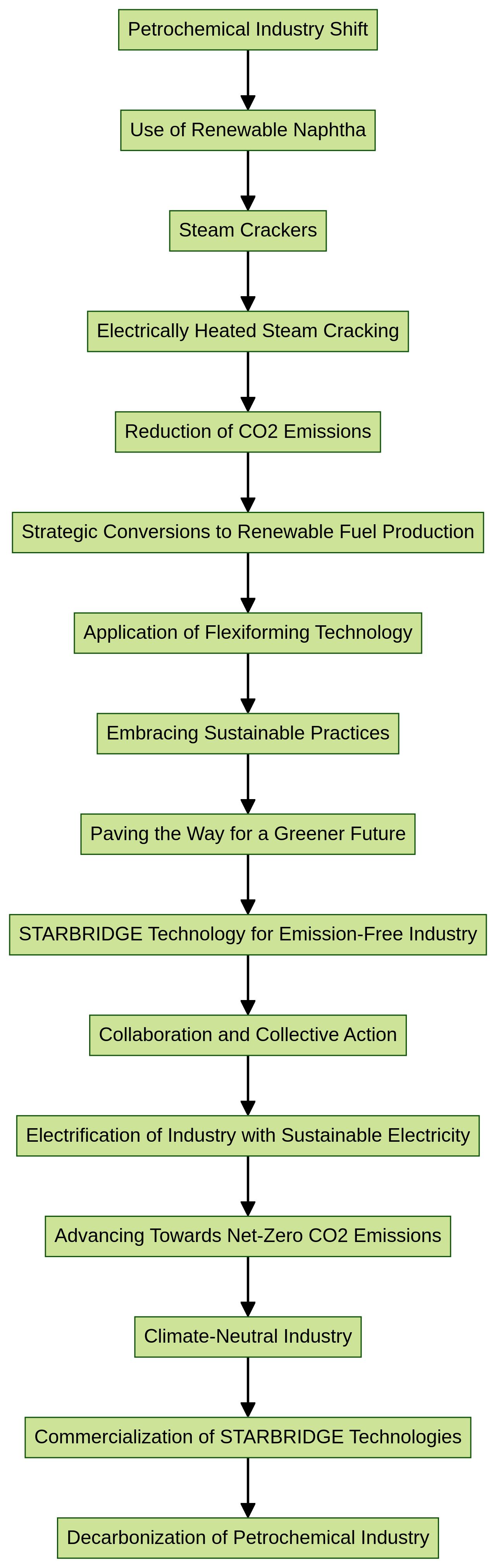

The petrochemical industry, a major consumer of crude oil, is on the cusp of a transformative shift towards sustainability, leveraging renewable naphtha as a key player. A notable development in this arena is the use of renewable naphtha in steam crackers, which traditionally operate at around 850 degrees Celsius using conventional fuels.

The advent of electrically heated steam cracking—spearheaded by a joint venture including BASF, SABIC, and Linde—has proven that these high temperatures can be achieved using green electricity. This innovation is poised to reduce CO2 emissions in one of the industry's most energy-intensive processes by a staggering 90%, showcasing a significant stride towards eco-friendly petrochemical production.

In the context of refining, experience has illuminated that augmenting the capacity of existing facilities is often more economical than constructing new ones. The U.S. refining landscape reflects this, with an uptick in capacity against a backdrop of fewer operational refineries, emphasizing the importance of strategic conversions to renewable fuel production.

Here, Unifuel.tech's Flexiforming technology has emerged as a pivotal tool, allowing plant operators to retrofit idle hydrotreaters or reformers. This technology not only facilitates a cost-effective approach to reducing both capital expenditures and carbon intensity but also empowers operators with the flexibility to set their decarbonization pace, a critical factor in today's dynamic energy landscape.

Unifuel. Tech ensures that the transition is seamless, providing optimal application of Flexiforming tailored to the operator's specific feeds, target products, and existing infrastructure. Their commitment to responsive customer service, with inquiries addressed within 24 hours, complements their robust technology offering. The versatility of renewable naphtha aligns with the global investment trend towards renewable energy, with major economies like the United States, China, and India at the forefront. As the petrochemical sector accounts for a growing share of global oil demand—predicted to rise to 55% by 2050—renewable naphtha stands as a testament to the industry's potential to embrace sustainable practices, paving the way for a greener future.

Results and Discussion

With the renewable naphtha market poised for significant growth, Unifuel.tech's Flexiforming technology emerges as a transformative solution for plant operators aiming to monetize this resource. By integrating Flexiforming into idle hydrotreaters or reformers, operators can leverage existing infrastructure to facilitate a more cost-effective and flexible transition to renewable energy production.

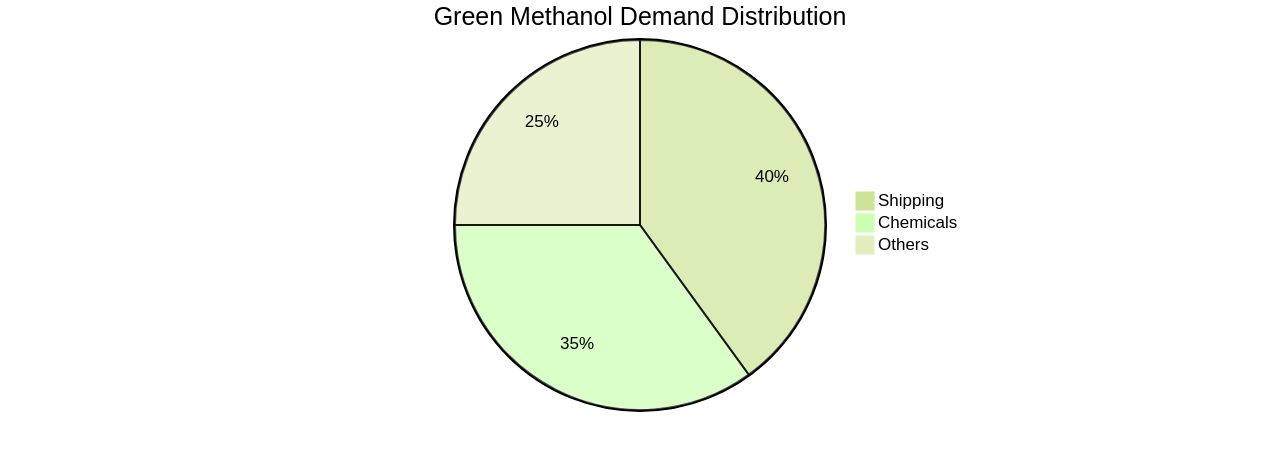

This aligns perfectly with the increasing imperative to decarbonize and positions Flexiforming as an essential tool in the conversion of renewable naphtha to green methanol. The demand for green methanol is expected to rise sharply, with estimates suggesting a potential increase to 300 million tons annually by 2050.

This upsurge is primarily to displace fossil methanol in industries such as shipping and chemicals, where pioneering companies are scaling up green methanol production. For instance, Moller – Maersk's commitment to green methanol underscores the industry's shift towards sustainable practices.

Despite Trinidad and Tobago's methanol trade experiencing a reduction in capacity, it demonstrated robust economic performance with exports valued at $1.39 billion in 2019. The combination of market dynamics, supportive policies, and technological advancements like Unifuel.tech's Flexiforming underscores the significant economic opportunities presented by the monetization of renewable naphtha. This strategy plays a pivotal role in climate change mitigation and propelling a more sustainable economy. Unifuel. Tech not only offers a path to decarbonization at the operator's preferred pace but also ensures a rapid response within 24 hours to inquiries, assisting operators in identifying the most optimal application of Flexiforming based on their specific feeds, target products, and facility infrastructure.

Life Cycle Effects

Universal Fuel Technologies is at the forefront of renewable naphtha production, employing their proprietary flexiforming technology to enhance the monetization of this sustainable fuel. This technology provides plant operators with the flexibility to tailor their decarbonization efforts, fitting effortlessly into existing infrastructure like idle hydrotreaters or reformers. By adopting flexiforming, capital expenditures are curbed and carbon intensity is reduced, optimizing the value derived from renewable naphtha.

A detailed economic analysis indicates that renewable naphtha production is financially viable, projecting a significant gross profit margin. The analysis takes into account capital and operating expenses, yielding a net present value (NPV) that demonstrates the economic promise of the technology, with a notably quick payback period. Sensitivity analyses highlight the influence of product pricing on NPV, further solidifying the case for its adoption.

The environmental advantages of renewable naphtha are confirmed by a life cycle assessment, which shows a substantial reduction in post-consumer impact, aligning with industry trends towards sustainability. Noteworthy collaborations within the industry aim to further decarbonize petrochemical processes, contributing to the global shift towards renewable energy sources. As renewable naphtha continues to gain momentum, it is set to play a crucial role in meeting the increasing energy demand while addressing climate change imperatives, supported by strategic partnerships and long-term agreements.

Sectoral Effects

Renewable naphtha is catalyzing a transformative shift in industries historically tethered to fossil-based resources, marking a pivotal step towards a sustainable economic framework. Evonik's pioneering efforts in producing renewable biosurfactants from naphtha exemplify the innovative potential within this realm.

Their success, mirrored in robust financial outcomes, underscores the dual benefits of environmental stewardship and economic viability. The petrochemical sector, a cornerstone of oil refinement for over a century, is poised for a seismic shift as it integrates renewable naphtha.

By 2030, strategic enhancements in energy efficiency, coupled with the deployment of green energy solutions, are projected to slash emissions by a third. Concurrently, the adoption of advanced recycling technologies could further trim emissions by 5%, ushering in a new era of circularity in the chemical industry.

As refineries contemplate a future shaped by renewable naphtha, Unifuel. Tech introduces flexiforming, a solution allowing operators to tailor their decarbonization pace.

Flexiforming can be utilized in existing idle hydrotreaters or reformers, thus minimizing capital expenditures and reducing carbon intensity. By assessing the operator's feedstock, desired products, and existing infrastructure, Unifuel. Tech facilitates the identification of the most suitable flexiforming application. This innovation not only addresses the challenge of energy intensity in processing renewable naphtha but also capitalizes on existing refinery assets. The maritime industry, with its substantial market valuation of USD 46 billion in 2023 for renewable naphtha, showcases the fuel's significance in reducing shipping emissions. These developments collectively herald the emergence of an eco-conscious economy, with renewable naphtha and technologies like flexiforming at its heart.

Sensitivity Analysis Using Grid Mix Scenarios

To understand the economic and environmental implications of renewable naphtha production, a comprehensive sensitivity analysis was conducted. This analysis, employing Aspen Process Economic Analyzer software, revealed that the capital and operating costs are substantial, amounting to $71 million and $303 million per year, respectively.

However, these costs are counterbalanced by a gross profit of $60.5 million per year and an encouraging Net Present Value (NPV) of $235 million, with a swift payback period of just 1.7 years. It is evident that product pricing exerts the most significant influence on the NPV, necessitating a thorough consideration of market dynamics during the planning phase.

The global energy landscape is witnessing a heightened demand for energy, precipitated by population growth and industrialization, which underscores the need for efficient renewable energy production. This scenario is further compounded by the limited availability of fossil fuels and the environmental detriments associated with their use.

In this context, the recent decision by the Dutch government to cease operations at the Groningen gas field, a significant European energy supplier, by October 1, highlights the urgent shift towards renewable energy sources. This closure, although planned, emphasizes the volatility of fossil fuel reliance and the resultant price fluctuations.

The sensitivity analysis also incorporates the Response Surface Methodology (RSM), a statistical tool that aids in optimizing complex processes by effectively exploring the design space. This method allows for a nuanced understanding of the interplay between various operational conditions and their impacts on power and hydrogen production.

For instance, it was discovered that marine algae, despite its high power output, exhibited lower system efficiency due to its moisture and ash content. On the other hand, coal, with its lower power output compared to biomasses, presents different operational challenges. Lastly, strategic long-term agreements for raw material prices and energy supply are highlighted as pivotal. They offer a buffer against the erratic nature of methanol and electricity prices, with the study's scenarios indicating the non-viability of low-temperature steam electrolysis (LSP) if methanol prices dip below €500/ton. Moreover, additional revenue streams, such as oxygen sales and guarantees for electricity supply at a cap of €30/MWh, are crucial for the commercial sustainability of Carbon Capture and Utilization (CCU) plants. These elements, along with strategic partnerships along the value chain, can significantly enhance the project's economic and environmental outcomes.

Acknowledgments

The integration of Flexiforming technology by Unifuel.tech, a Universal Fuel Technologies subsidiary, marks a significant advancement in the renewable energy sector. This innovative solution, which can be incorporated into dormant hydrotreaters or reformers, represents a strategic move towards enhancing the value of renewable naphtha.

By doing so, plant operators are afforded greater operational flexibility and the opportunity to tap into new revenue streams, without the burden of excessive capital expenditure or heightened carbon intensity. The efficacy of Flexiforming technology underscores the broader trend in the energy sector towards optimizing existing infrastructure to meet the growing demand for sustainable fuel sources.

In light of the substantial $220 billion investment in clean energy and transportation projects observed during our study, it is evident that there is a robust financial backing driving the transition to cleaner energy solutions. This level of funding reinforces the significance of renewable energy enterprises in leveraging financial capital, whether it's from family funding, subsidies, or bank loans, to achieve entrepreneurial success and propel the sector forward.

Furthermore, the case of ENGIE's HyFlexPower project at the Smurfit Kappa paper mill in France demonstrates the practical applications of renewable energy in industrial settings. By converting renewable electricity into green hydrogen, which is then stored and used to generate power when needed, this Power-to-Hydrogen-to-Power demonstrator exemplifies the potential for renewable energy to support industrial decarbonization. The pursuit of renewable energy is not just about environmental stewardship but also about economic prudence. As highlighted by the experience of the US refining industry, enhancing the capacity of existing refineries is a financially sound strategy compared to constructing new facilities. This approach aligns with the findings of our study, which suggests that the capital and operating costs associated with renewable energy projects can lead to a positive net present value and a relatively short payback period, thereby offering a compelling case for investment in clean fuel infrastructure and technology.

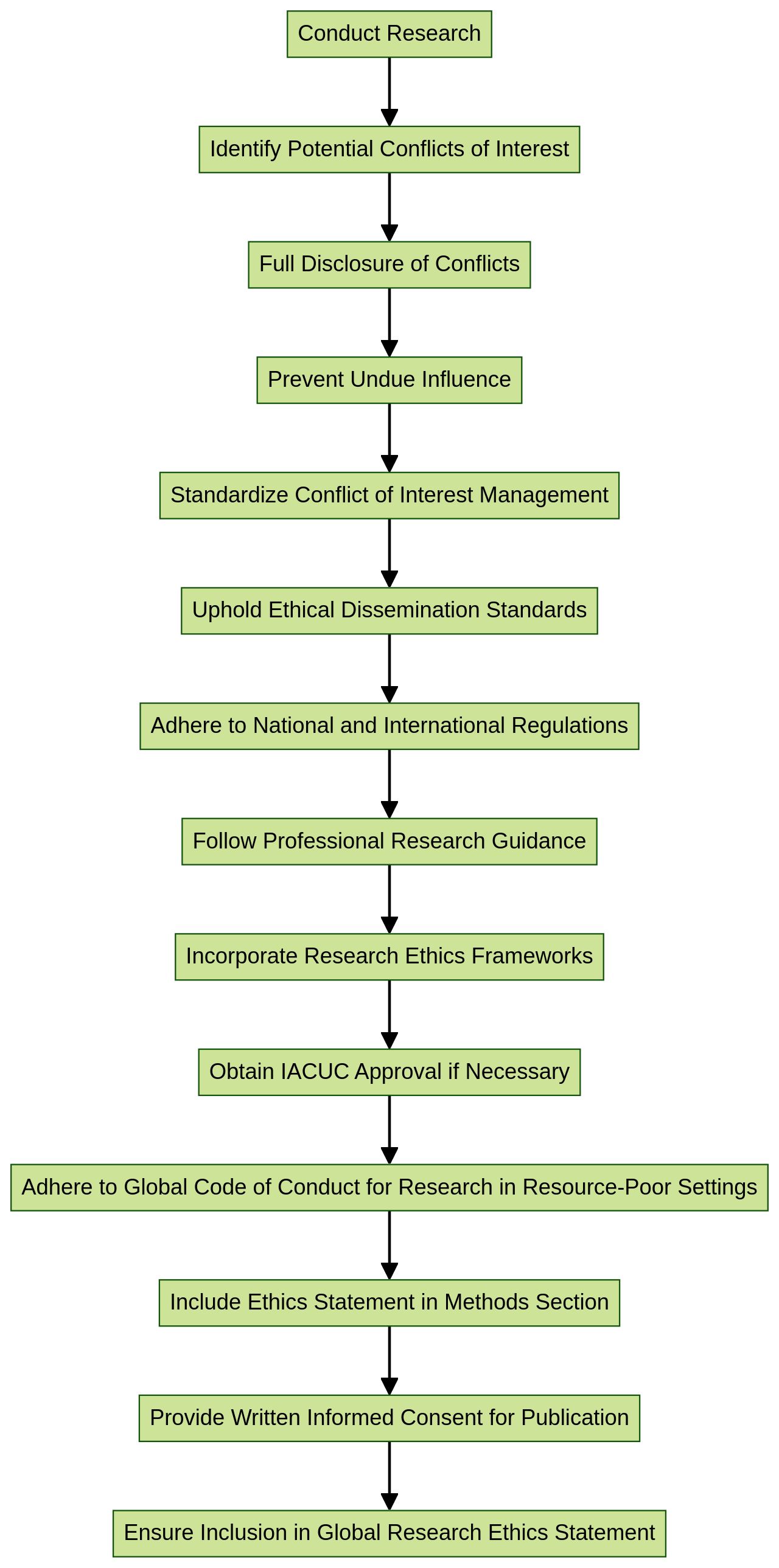

Conflicts of Interest

The integrity of scientific research is paramount, as it forms the basis for policies that impact public health and safety. Despite assertions of impartiality, concerns have been raised over potential conflicts of interest within research dissemination, particularly when firms advise both government and private sector clients.

Senator Deborah O'Neill and Clancy Moore, CEO of Transparency International, have voiced apprehensions about such conflicts potentially influencing policy outcomes. Doctors for the Environment Australia have similarly questioned the prudence of employing firms with ties to the industry they consult for.

The research community has long wrestled with the challenge of maintaining scientific integrity in the face of conflicts of interest. A National Academies of Sciences, Engineering and Medicine report highlighted the detrimental effects of funders' influence on research quality and independence.

Gary Ruskin of U.S. Right to Know emphasized the necessity for a trustworthy health evidence base, free from commercial influences.

This sentiment underscores the importance of full disclosure and the management of conflicts to prevent undue influence on research and subsequent policies. Research dissemination is essential for translating scientific findings into actionable knowledge for policymakers, practitioners, and the public.

However, studies indicate that only half of biomedical journals enforce conflict of interest disclosures, and research sponsorship is often driven by commercial rather than scientific motives. This uneven landscape of disclosure policies across disciplines points to a need for standardized, rigorous conflict of interest management. The timely and accurate communication of research findings is crucial. Open-access papers, for example, receive more media attention, potentially influencing policy. The dissemination process must be driven by ethical standards to ensure that the social value of research is maximized and that the academic record remains unblemished by bias. As such, all stakeholders, including researchers, institutions, publishers, and media, must uphold the principles of integrity in their dissemination policies and practices.

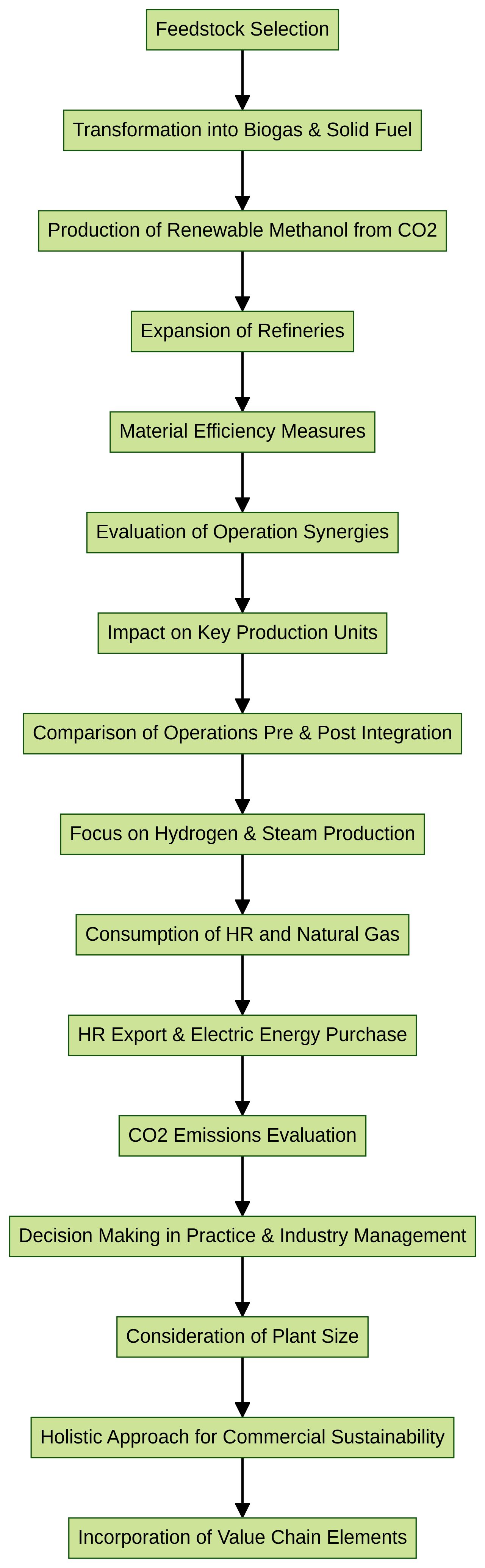

Appendix A: Final Demand by Sector and Life Cycle Stage

In the intricate landscape of renewable naphtha, strategic decisions at every stage of the life cycle are pivotal to shaping sectoral demand. Feedstock selection is a cornerstone in this process, with Thailand's Napier Pak Chong 1 grass demonstrating its potential as a high-yield, climate-resilient source for energy production.

Utilized in the IFBB method, it is transformed into valuable biogas and solid fuel, exemplifying innovation in raw material use. The production of renewable methanol from CO2 hinges on key variables such as electricity costs and the logistics of CO2 source proximity.

Iceland's scenario illustrates how low electricity costs can render methanol production economically favorable. Similarly, the chemical industry's role in clean energy transitions is underscored by the need to mitigate CO2 emissions throughout the lifecycle of chemical products, from production to end-of-life.

The expansion of existing refineries, rather than the construction of new ones, emerges as a cost-effective approach to capacity enhancement, with considerations given to the refinery scale. Market trends in the naphthalene sulfonate sector are propelled by advancements in product characteristics and regional construction demands, particularly in the Asia Pacific.

The chemical sector, as the principal industrial energy consumer, must confront its CO2 emissions against a backdrop of robust demand. Material efficiency measures, such as enhanced plastics recycling and judicious use of ammonia fertilizers, are critical to curbing chemical demand and advancing towards a Net Zero Scenario by 2030.

In this context, the chemical sector's energy consumption, half of which is used as feedstock, is a focal point for achieving greater sustainability in the face of growing product demand. Adjunct to these measures, Unifuel.tech's flexiforming technology offers a transformative approach for refinery operators. This technology can be seamlessly integrated into idle hydrotreaters or reformers, offering a scalable solution for decarbonization efforts with minimal capital expenditure. By incorporating flexiforming, operators can effectively reduce carbon intensity while enhancing the value chain of renewable naphtha. The swift response time and technical support from Unifuel. Tech facilitate a streamlined transition, ensuring that operators can navigate the complexities of renewable naphtha production with greater agility and foresight.

Appendix B: Ratio of Sectoral Contributions to Added Value

The renewable naphtha landscape is actively transforming, with various industry segments playing critical roles in the energy transition. While the electricity sector is making strides with renewables, the chemical subsector is pushing for a more sustainable approach to meet the rising demand for chemicals and plastics. Amid this shift, steam crackers are pivotal, yet they struggle with economic viability due to high fixed costs and operational inefficiencies at lower capacities.

Addressing these challenges, innovative technologies are emerging to enhance the value chain of renewable naphtha. One such advancement is the introduction of flexiforming technology by Unifuel.tech, a solution under the purview of Universal Fuel Technologies. Flexiforming presents an opportunity for plant operators to retrofit idle hydrotreaters or reformers, optimizing their use and reducing both capital expenditure and the carbon intensity of operations.

This technology offers a tailored approach to decarbonization, allowing operators to set their pace in transitioning towards greener processes. For those seeking to integrate flexiforming into their facilities, Unifuel. Tech provides a prompt response service, guaranteeing communication within 24 hours upon receiving the requisite details on feeds, target products, and existing infrastructure.

This level of customization underscores the technology's adaptability and potential to bolster economic efficiency within the sector. The integration of flexiforming aligns with global efforts, as seen in projects like the green methanol plant in Spain and Neste's drive for renewable electricity, all contributing to a substantial reduction in CO2 emissions. The industry's progress, as reported in Energy Global magazine, emphasizes the importance of such technological innovations, strategic investments, and policy support in achieving a more sustainable and economically viable future for renewable naphtha.

Conclusion

In conclusion, the study highlights the potential of hydrogen energy sourced from naphtha as a sustainable substitute for fossil fuels. Green hydrogen generation, particularly in economically burgeoning nations like Vietnam, offers a transformative solution for reducing greenhouse gas emissions and making industries more eco-friendly.

Regions rich in renewable resources, such as Latin America and the Caribbean, can significantly expand the green hydrogen sector, fostering economic growth and mitigating risks associated with oil price fluctuations. The demand for hydrogen is projected to escalate by 2050, necessitating a shift towards energy efficiency and cost-effectiveness in low-carbon production.

The integration of Flexiforming technology by Unifuel.tech enables operators to retrofit idle hydrotreaters or reformers, reducing capital expenditures and carbon intensity. Financial analysis demonstrates that renewable naphtha production is financially viable, with significant profits and positive net present value.

Addressing conflicts of interest in research dissemination is crucial for maintaining scientific integrity and informing unbiased policies effectively. By leveraging innovative technologies and fostering partnerships, we can drive industries towards greener practices while promoting economic growth and mitigating climate change. In summary, renewable naphtha has immense potential as a key player in the transition towards sustainable energy solutions. By embracing green hydrogen generation and adopting technologies like Flexiforming, we can accelerate the shift towards a more eco-friendly future while reaping economic benefits and addressing climate challenges.